Short selling involves borrowing shares to sell them at the current price with the intention of buying them back later at a lower price, profiting from a decline in the stock's value. Buying puts grants the right to sell a stock at a predetermined price before expiration, limiting risk to the premium paid while offering leveraged downside protection. Both strategies aim to capitalize on falling markets but differ in risk exposure, capital requirements, and potential losses.

Table of Comparison

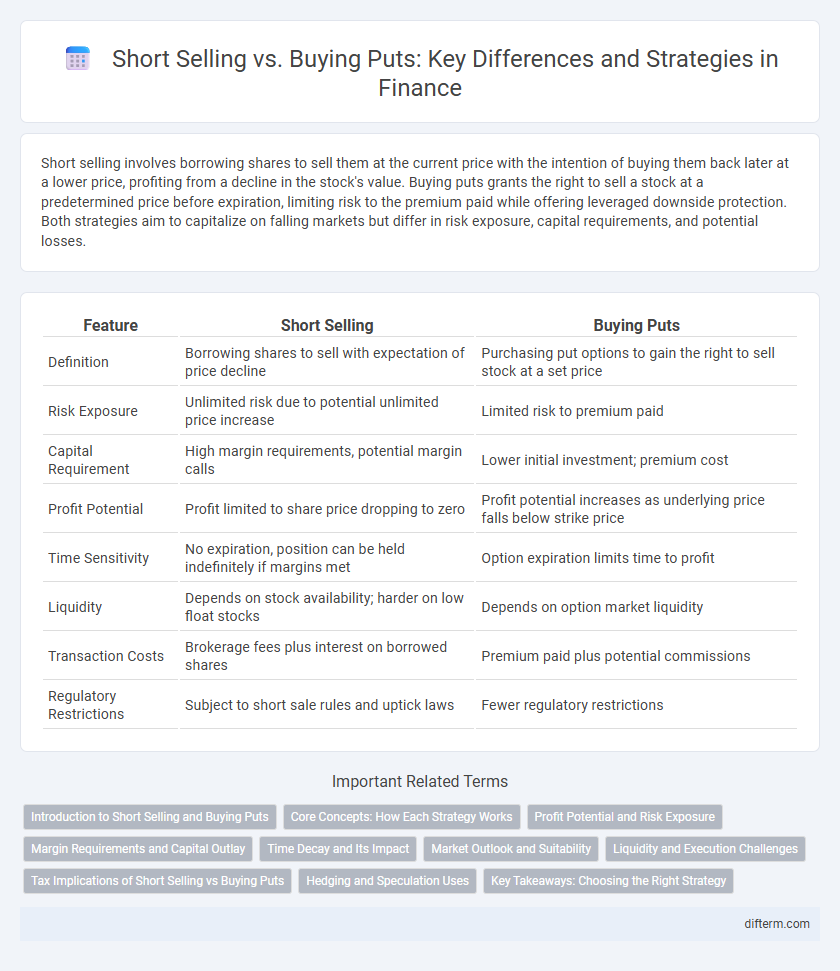

| Feature | Short Selling | Buying Puts |

|---|---|---|

| Definition | Borrowing shares to sell with expectation of price decline | Purchasing put options to gain the right to sell stock at a set price |

| Risk Exposure | Unlimited risk due to potential unlimited price increase | Limited risk to premium paid |

| Capital Requirement | High margin requirements, potential margin calls | Lower initial investment; premium cost |

| Profit Potential | Profit limited to share price dropping to zero | Profit potential increases as underlying price falls below strike price |

| Time Sensitivity | No expiration, position can be held indefinitely if margins met | Option expiration limits time to profit |

| Liquidity | Depends on stock availability; harder on low float stocks | Depends on option market liquidity |

| Transaction Costs | Brokerage fees plus interest on borrowed shares | Premium paid plus potential commissions |

| Regulatory Restrictions | Subject to short sale rules and uptick laws | Fewer regulatory restrictions |

Introduction to Short Selling and Buying Puts

Short selling involves borrowing shares to sell at the current market price, aiming to buy them back later at a lower price to profit from a decline. Buying puts grants the right to sell an asset at a predetermined strike price, offering downside protection or speculative opportunities without owning the underlying stock. Both strategies serve as tools for investors to capitalize on anticipated market downturns while managing risk exposure.

Core Concepts: How Each Strategy Works

Short selling involves borrowing shares to sell them at the current market price with the intention of buying them back later at a lower price, profiting from the decline. Buying put options grants the right, but not the obligation, to sell an asset at a predetermined strike price before expiration, limiting potential losses to the premium paid. Both strategies capitalize on price declines but differ in risk exposure, capital requirements, and regulatory constraints.

Profit Potential and Risk Exposure

Short selling involves borrowing shares to sell at the current price with the goal of buying them back later at a lower price, offering unlimited profit potential if the stock declines sharply. Buying puts limits the maximum loss to the premium paid while providing leveraged downside exposure, but gains are capped by the strike price minus the premium. Risk exposure in short selling includes unlimited losses if the stock price rises, whereas buying puts confines risk to the initial investment, making it a safer hedging strategy.

Margin Requirements and Capital Outlay

Short selling requires a margin account with brokers typically demanding 50% initial margin and ongoing maintenance margins, which expose traders to potential margin calls as stock prices rise. Buying put options involves a fixed capital outlay limited to the premium paid, eliminating margin risk and providing defined maximum loss, making it a less capital-intensive strategy. Margin requirements for short selling create higher capital commitments and risk exposure compared to the straightforward, premium-based cost structure of put option purchases.

Time Decay and Its Impact

Time decay significantly affects the value of put options, causing their premium to erode as expiration approaches, which can lead to substantial losses if the stock price doesn't move as anticipated. Short selling, in contrast, does not involve time decay, allowing investors to hold positions indefinitely while waiting for stock prices to decline. Understanding the distinct impact of time decay on puts versus the absence of this factor in short selling is crucial for risk management and strategy selection in bearish market conditions.

Market Outlook and Suitability

Short selling profits from a declining market by borrowing and selling shares, making it suitable for experienced traders with high risk tolerance and access to margin accounts. Buying put options provides a defined risk strategy by purchasing the right to sell an asset at a predetermined price, appealing to investors seeking leveraged bearish exposure without unlimited losses. Market outlook for short selling requires strong conviction in a price drop, while buying puts allows flexibility for moderate or bearish forecasts with controlled downside risk.

Liquidity and Execution Challenges

Short selling often faces liquidity constraints due to the limited availability of shares to borrow, creating execution challenges especially in volatile markets. Buying put options generally offers better liquidity and more straightforward execution since options markets tend to be more liquid and do not require borrowing shares. However, options pricing models and bid-ask spreads can impact the cost efficiency and execution speed of put option transactions compared to traditional short selling.

Tax Implications of Short Selling vs Buying Puts

Short selling typically incurs short-term capital gains taxes, with profits taxed at ordinary income rates if the position is held for less than a year, while losses may be subject to complex wash-sale rules. Buying puts, classified as options, can produce capital gains or losses taxed as short-term or long-term depending on the holding period and the underlying security's status. Understanding these tax implications is crucial for investors to optimize after-tax returns and comply with IRS regulations governing derivative instruments and short sales.

Hedging and Speculation Uses

Short selling and buying puts both serve as strategic tools for hedging and speculation in finance, allowing investors to profit from anticipated declines in asset prices. Short selling involves borrowing and selling shares to repurchase them later at a lower price, providing direct exposure to downside risk but carrying potential for unlimited losses. Buying put options grants the right to sell assets at a predetermined price, limiting risk to the premium paid while offering flexible hedging against price drops or speculative opportunities in volatile markets.

Key Takeaways: Choosing the Right Strategy

Short selling involves borrowing shares to sell at the current price, aiming to buy them back lower, while buying puts grants the right to sell shares at a predetermined price, limiting potential losses. For investors seeking leveraged downside exposure with limited risk, puts offer defined loss thresholds through premium costs, whereas short selling carries unlimited loss potential due to rising prices. Selecting the right strategy depends on risk tolerance, capital availability, and market outlook, with puts often preferred for hedging and shorts for more aggressive bearish bets.

Short Selling vs Buying Puts Infographic

difterm.com

difterm.com