Investment-grade bonds offer lower risk and steady returns due to strong credit ratings from agencies, making them suitable for conservative investors seeking capital preservation. Junk bonds provide higher yields to compensate for increased default risk, appealing to investors willing to accept volatility for potential high returns. Understanding the risk-reward profile of each bond type is crucial for effective portfolio diversification and risk management.

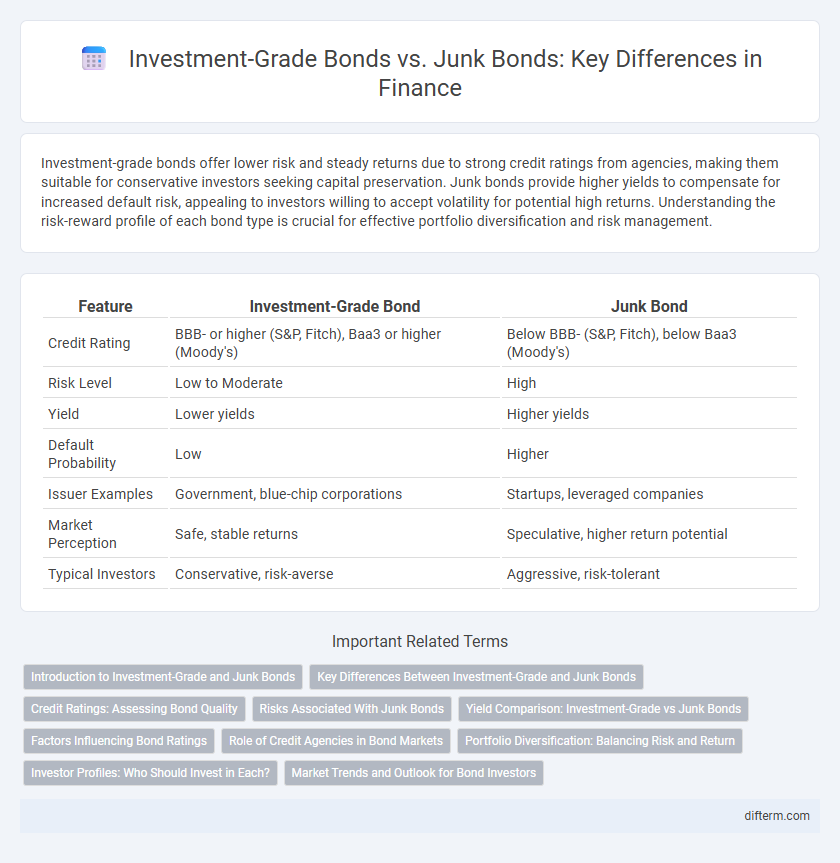

Table of Comparison

| Feature | Investment-Grade Bond | Junk Bond |

|---|---|---|

| Credit Rating | BBB- or higher (S&P, Fitch), Baa3 or higher (Moody's) | Below BBB- (S&P, Fitch), below Baa3 (Moody's) |

| Risk Level | Low to Moderate | High |

| Yield | Lower yields | Higher yields |

| Default Probability | Low | Higher |

| Issuer Examples | Government, blue-chip corporations | Startups, leveraged companies |

| Market Perception | Safe, stable returns | Speculative, higher return potential |

| Typical Investors | Conservative, risk-averse | Aggressive, risk-tolerant |

Introduction to Investment-Grade and Junk Bonds

Investment-grade bonds carry a credit rating of BBB- or higher from agencies like S&P or Moody's, indicating lower risk and higher creditworthiness, which attracts conservative investors seeking stable returns. Junk bonds, rated below BBB-, offer higher yields to compensate for increased default risk and are favored by investors willing to accept volatility for potential gains. Understanding the risk-return tradeoff between these bond types is crucial for effective portfolio diversification and risk management in fixed-income investing.

Key Differences Between Investment-Grade and Junk Bonds

Investment-grade bonds are issued by entities with strong credit ratings, indicating lower default risk and offering steady, but generally lower, interest returns. Junk bonds carry higher risk due to lower credit ratings, leading to higher yield potential to compensate investors for increased default probability. The key differences lie in credit quality, risk exposure, and yield, which influence investor choice based on risk tolerance and income objectives.

Credit Ratings: Assessing Bond Quality

Investment-grade bonds carry credit ratings from major agencies such as Moody's, S&P, and Fitch classified as Baa3/BBB- or higher, indicating lower default risk and higher creditworthiness. Junk bonds, rated below Baa3/BBB-, exhibit higher default risk due to weaker financial stability, demanding higher yields to attract investors. Credit ratings serve as critical indicators for assessing bond quality, influencing investment decisions, risk tolerance, and portfolio diversification strategies.

Risks Associated With Junk Bonds

Junk bonds, also known as high-yield bonds, carry significantly higher credit risk compared to investment-grade bonds due to their lower credit ratings, often below BBB- by S&P or Baa3 by Moody's. These bonds are more susceptible to default during economic downturns, leading to potential loss of principal and interest payments for investors. The elevated risk is compensated by higher yields, but investors must carefully assess the issuer's financial stability and market volatility before investing.

Yield Comparison: Investment-Grade vs Junk Bonds

Investment-grade bonds typically offer lower yields due to their higher credit ratings and lower default risk, making them attractive to conservative investors seeking stable returns. In contrast, junk bonds, rated below investment grade, provide significantly higher yields as compensation for their elevated credit risk and greater chance of default. This yield differential often reflects the risk premium investors demand when investing in lower-rated, high-yield bonds versus secure, investment-grade fixed-income securities.

Factors Influencing Bond Ratings

Investment-grade bonds receive high ratings from credit agencies such as Moody's, S&P, and Fitch, reflecting low default risk due to strong issuer creditworthiness, stable cash flows, and solid financial health. Junk bonds, or high-yield bonds, carry lower ratings caused by higher default risks linked to volatile earnings, weaker balance sheets, and economic uncertainty. Key factors influencing bond ratings include issuer credit quality, debt-to-equity ratios, interest coverage, macroeconomic conditions, and sector-specific risks.

Role of Credit Agencies in Bond Markets

Credit rating agencies assess the creditworthiness of issuers, categorizing bonds as investment-grade or junk based on default risk and financial stability. Investment-grade bonds receive high ratings (BBB-/Baa3 or above), signaling lower risk and attracting conservative investors seeking reliable returns. Junk bonds, rated below investment-grade, carry higher risk and yield, with credit agencies providing critical transparency that influences pricing, market access, and investor confidence in bond markets.

Portfolio Diversification: Balancing Risk and Return

Investment-grade bonds offer lower default risk and stable returns, making them suitable for conservative portfolio components, while junk bonds provide higher yields with increased credit risk, appealing to investors seeking growth through riskier assets. Diversifying a portfolio by balancing investment-grade and junk bonds can optimize risk-adjusted returns, leveraging the safety of high-quality bonds alongside the income potential of high-yield bonds. Strategic allocation between these bond types enhances portfolio resilience against market volatility and credit events.

Investor Profiles: Who Should Invest in Each?

Investment-grade bonds appeal to risk-averse investors seeking stable returns and preservation of capital, typically including retirees and institutional investors prioritizing safety. Junk bonds suit risk-tolerant investors aiming for higher yields, such as aggressive growth portfolios or those diversifying into high-risk, high-reward assets. Understanding credit ratings and individual risk appetite is crucial for aligning bond choices with financial goals.

Market Trends and Outlook for Bond Investors

Investment-grade bonds typically offer lower yields but higher credit quality, attracting conservative investors amid fluctuating interest rates and economic uncertainties. Junk bonds provide higher yields to compensate for increased default risk, appealing to investors seeking greater income in a recovering market with improving corporate earnings. Market trends indicate a cautious shift towards investment-grade bonds during tightening monetary policies, while junk bonds gain attention in periods of economic expansion and easing credit conditions.

Investment-grade bond vs Junk bond Infographic

difterm.com

difterm.com