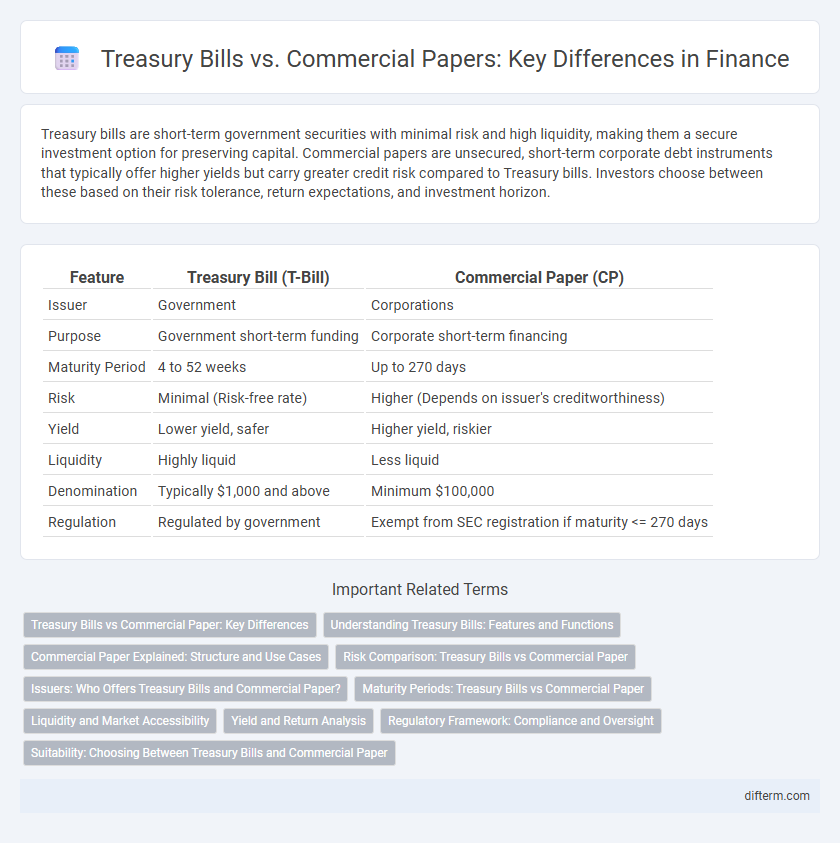

Treasury bills are short-term government securities with minimal risk and high liquidity, making them a secure investment option for preserving capital. Commercial papers are unsecured, short-term corporate debt instruments that typically offer higher yields but carry greater credit risk compared to Treasury bills. Investors choose between these based on their risk tolerance, return expectations, and investment horizon.

Table of Comparison

| Feature | Treasury Bill (T-Bill) | Commercial Paper (CP) |

|---|---|---|

| Issuer | Government | Corporations |

| Purpose | Government short-term funding | Corporate short-term financing |

| Maturity Period | 4 to 52 weeks | Up to 270 days |

| Risk | Minimal (Risk-free rate) | Higher (Depends on issuer's creditworthiness) |

| Yield | Lower yield, safer | Higher yield, riskier |

| Liquidity | Highly liquid | Less liquid |

| Denomination | Typically $1,000 and above | Minimum $100,000 |

| Regulation | Regulated by government | Exempt from SEC registration if maturity <= 270 days |

Treasury Bills vs Commercial Paper: Key Differences

Treasury bills (T-bills) are short-term government securities with maturities ranging from a few days to one year, offering low risk and high liquidity, whereas commercial paper (CP) is an unsecured, short-term corporate debt instrument typically issued by large corporations with maturities up to 270 days. T-bills are backed by the full faith and credit of the government, making them virtually risk-free, while commercial paper carries higher credit risk but generally provides higher yields. The primary difference lies in the issuer and risk profile: T-bills finance government operations, and commercial paper funds corporate working capital needs.

Understanding Treasury Bills: Features and Functions

Treasury bills are short-term government debt securities issued at a discount, maturing within one year, primarily used to manage liquidity and fund government operations. They offer high liquidity, low risk due to government backing, and typically have lower yields compared to commercial paper. Investors prefer Treasury bills for secure, short-term investments with guaranteed returns backed by the full faith of the issuing government.

Commercial Paper Explained: Structure and Use Cases

Commercial paper is a short-term unsecured promissory note issued by corporations to finance working capital needs, typically with maturities ranging from 1 to 270 days. Its structure involves a fixed face value and a discounted issuance price, enabling issuers to raise funds quickly without collateral. Commonly used for funding payroll, inventory, and short-term liabilities, commercial paper offers a cost-effective alternative to bank loans for creditworthy companies.

Risk Comparison: Treasury Bills vs Commercial Paper

Treasury bills, issued by the government, carry minimal default risk due to sovereign backing, making them one of the safest short-term investments. Commercial paper, issued by corporations, entails higher credit risk as repayment depends on the issuer's financial health and market conditions. Investors often demand higher yields on commercial paper to compensate for its relatively elevated risk compared to Treasury bills.

Issuers: Who Offers Treasury Bills and Commercial Paper?

Treasury bills are issued by the government to finance short-term fiscal needs and manage national debt efficiently. Commercial paper is offered by large corporations and financial institutions seeking quick, unsecured funding for working capital or operational expenses. Both instruments provide investors with low-risk investment options but originate from distinctly different issuers with varying credit risk profiles.

Maturity Periods: Treasury Bills vs Commercial Paper

Treasury bills (T-bills) typically have maturity periods ranging from a few days up to one year, making them short-term government debt instruments with high liquidity and low risk. Commercial paper, issued by corporations, usually matures within 1 to 270 days, offering a slightly longer but still short-term financing option that is unsecured and dependent on the issuer's creditworthiness. The choice between T-bills and commercial paper often hinges on the desired maturity duration and risk tolerance in corporate or government short-term financing strategies.

Liquidity and Market Accessibility

Treasury bills offer higher liquidity due to their short maturities and active secondary market, making them easily convertible to cash with minimal price fluctuation. Commercial papers typically have lower liquidity as they are unsecured, short-term corporate debt instruments with less active trading platforms, restricting immediate market access. Investors favor Treasury bills for quick liquidation, while commercial papers suit those seeking slightly higher yields with moderate market accessibility.

Yield and Return Analysis

Treasury bills typically offer lower yields compared to commercial papers due to their government backing and lower default risk, making them a safer investment with more predictable returns. Commercial papers, issued by corporations, generally provide higher yields to compensate for increased credit risk, resulting in potentially greater but less certain returns. Analyzing yield spreads and maturity profiles is essential for investors balancing return potential against risk exposure in short-term debt instruments.

Regulatory Framework: Compliance and Oversight

Treasury bills are government-issued securities regulated under stringent federal laws with oversight by central banks and government regulatory agencies, ensuring high transparency and minimal default risk. Commercial paper, typically issued by corporations, falls under securities regulation frameworks like the Securities Act and requires adherence to disclosure mandates enforced by agencies such as the SEC, with less stringent credit quality standards compared to government debt. Compliance for commercial paper involves maintaining credit ratings and timely investor communication, while treasury bills benefit from sovereign backing and comprehensive legal protections.

Suitability: Choosing Between Treasury Bills and Commercial Paper

Treasury bills offer unmatched safety due to government backing, making them ideal for risk-averse investors seeking short-term liquidity. Commercial paper provides higher yields but carries greater credit risk, suitable for institutional investors comfortable with corporate credit exposure. Choosing between these instruments depends on the investor's risk tolerance, time horizon, and income requirements.

Treasury bill vs Commercial paper Infographic

difterm.com

difterm.com