Variance swaps provide direct exposure to the variance of an asset's returns, allowing investors to hedge or speculate on the squared volatility, whereas volatility swaps offer a more intuitive instrument by targeting the actual volatility, expressed as the square root of variance. Variance swaps tend to be more sensitive to large price jumps and extreme market movements, making them valuable for strategies involving tail risks, while volatility swaps typically exhibit smoother payoffs aligned with changes in implied volatility. Choosing between variance and volatility swaps depends on the specific risk profile and market outlook, with traders considering factors such as the skew of volatility and the desired exposure to positive and negative price shocks.

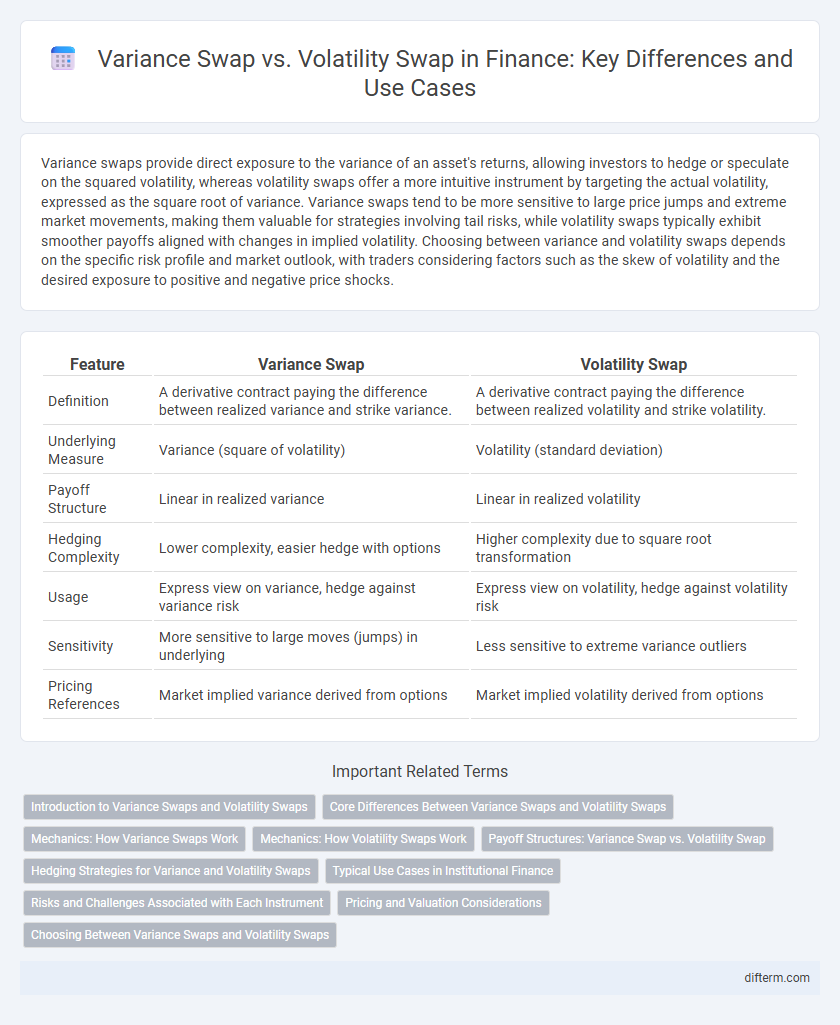

Table of Comparison

| Feature | Variance Swap | Volatility Swap |

|---|---|---|

| Definition | A derivative contract paying the difference between realized variance and strike variance. | A derivative contract paying the difference between realized volatility and strike volatility. |

| Underlying Measure | Variance (square of volatility) | Volatility (standard deviation) |

| Payoff Structure | Linear in realized variance | Linear in realized volatility |

| Hedging Complexity | Lower complexity, easier hedge with options | Higher complexity due to square root transformation |

| Usage | Express view on variance, hedge against variance risk | Express view on volatility, hedge against volatility risk |

| Sensitivity | More sensitive to large moves (jumps) in underlying | Less sensitive to extreme variance outliers |

| Pricing References | Market implied variance derived from options | Market implied volatility derived from options |

Introduction to Variance Swaps and Volatility Swaps

Variance swaps allow investors to trade future realized variance of an asset's returns, providing direct exposure to the variance measure without the influence of drift. Volatility swaps, on the other hand, offer exposure to the future realized volatility, which is the square root of variance, enabling more intuitive hedging of volatility risk. Both instruments are over-the-counter derivatives used for volatility management but differ in payoff structures and sensitivity to market movements.

Core Differences Between Variance Swaps and Volatility Swaps

Variance swaps and volatility swaps are both derivative instruments used to hedge or speculate on future market volatility, but variance swaps settle based on the realized variance (square of volatility), while volatility swaps settle directly on realized volatility. Variance swaps provide a payoff proportional to the squared volatility, which makes them more sensitive to large price swings and thus potentially more profitable in high-volatility environments. In contrast, volatility swaps offer a linear exposure to volatility, often making them easier to price and hedge but less sensitive to extreme market movements compared to variance swaps.

Mechanics: How Variance Swaps Work

Variance swaps provide a payoff based on the difference between the realized variance of an underlying asset's returns and the agreed-upon variance strike, calculated as the square of the asset's daily return volatility over the contract period. The payoff formula is proportional to the variance not volatility, making variance swaps more sensitive to large price moves due to the squaring effect. These instruments are typically settled in cash at maturity, allowing investors to directly trade future variance without exposure to the direction of the asset price.

Mechanics: How Volatility Swaps Work

Volatility swaps are derivatives allowing investors to trade future realized volatility directly, with payouts based on the difference between realized volatility and the predetermined strike volatility. The mechanics involve calculating realized volatility typically through the standard deviation of logarithmic returns of the underlying asset over the contract period. Unlike variance swaps that base payouts on realized variance (volatility squared), volatility swaps provide a linear exposure to volatility movements, making their payoff more intuitive and sensitive to actual volatility changes.

Payoff Structures: Variance Swap vs. Volatility Swap

Variance swaps deliver payoffs based on the difference between the realized variance of an underlying asset and the variance strike, squared and annualized, making the payout highly sensitive to large price moves. Volatility swaps, in contrast, generate payoffs tied to the difference between realized volatility, the square root of realized variance, and the volatility strike, providing a more linear exposure to price fluctuations. The convexity in variance swaps typically results in higher payoffs during extreme market volatility compared to volatility swaps, which offer smoother, volatility-proportional returns.

Hedging Strategies for Variance and Volatility Swaps

Variance swaps provide direct exposure to realized variance, allowing traders to hedge or speculate on the magnitude of asset price fluctuations with a payoff linked to the square of volatility. Volatility swaps, by contrast, offer exposure to realized volatility itself, delivering payoffs proportional to the asset's standard deviation, which suits hedging strategies seeking linear sensitivity to volatility movements. Effective hedging of variance swaps involves dynamic adjustments using options and delta-hedging, while volatility swaps require calibration to volatility surface dynamics to manage convexity and basis risk.

Typical Use Cases in Institutional Finance

Variance swaps are primarily employed by institutional investors seeking to hedge or gain exposure to the variance of an underlying asset's returns, enabling precise risk management of extreme market moves and volatility clustering. Volatility swaps are favored for directly trading or hedging the implied volatility level of an asset, commonly used by hedge funds and portfolio managers to speculate on or protect against changes in market volatility. Both instruments offer tailored approaches in managing volatility risk, with variance swaps providing exposure to squared volatility and volatility swaps focusing on the asset's volatility magnitude.

Risks and Challenges Associated with Each Instrument

Variance swaps expose investors to the risk of large jumps in underlying asset prices, causing realized variance to spike unexpectedly, which can lead to significant mark-to-market losses. Volatility swaps carry the challenge of volatility skew and smile effects, making their pricing and hedging more complex due to the nonlinear relationship between implied and realized volatility. Both instruments face liquidity risk and counterparty risk, but variance swaps typically involve higher sensitivity to extreme events and model risk in volatility estimation.

Pricing and Valuation Considerations

Variance swaps are priced based on the expected variance of the underlying asset's returns, using a portfolio of options across strikes to replicate realized variance, while volatility swaps focus on the expected volatility, often requiring a nonlinear transformation of variance swap prices. Valuation of variance swaps is typically more straightforward due to their linear relationship with realized variance, whereas volatility swaps demand adjustments for convexity and the volatility of volatility, making the pricing more complex. Market factors such as implied volatility skew, interest rates, and dividend yields critically influence both instruments' fair values, but volatility swaps are more sensitive to higher moments of the return distribution.

Choosing Between Variance Swaps and Volatility Swaps

Choosing between variance swaps and volatility swaps depends on the desired exposure to market fluctuations; variance swaps provide a payoff linked to the realized variance, capturing squared volatility, while volatility swaps offer a payoff based on the realized volatility itself. Variance swaps tend to be more sensitive to large market moves due to the squared term, making them preferable for investors seeking direct exposure to variability in asset returns. Volatility swaps are more intuitive for traders wanting to hedge or speculate on volatility without amplifying large swings, as their payoff scales linearly with volatility.

Variance swap vs volatility swap Infographic

difterm.com

difterm.com