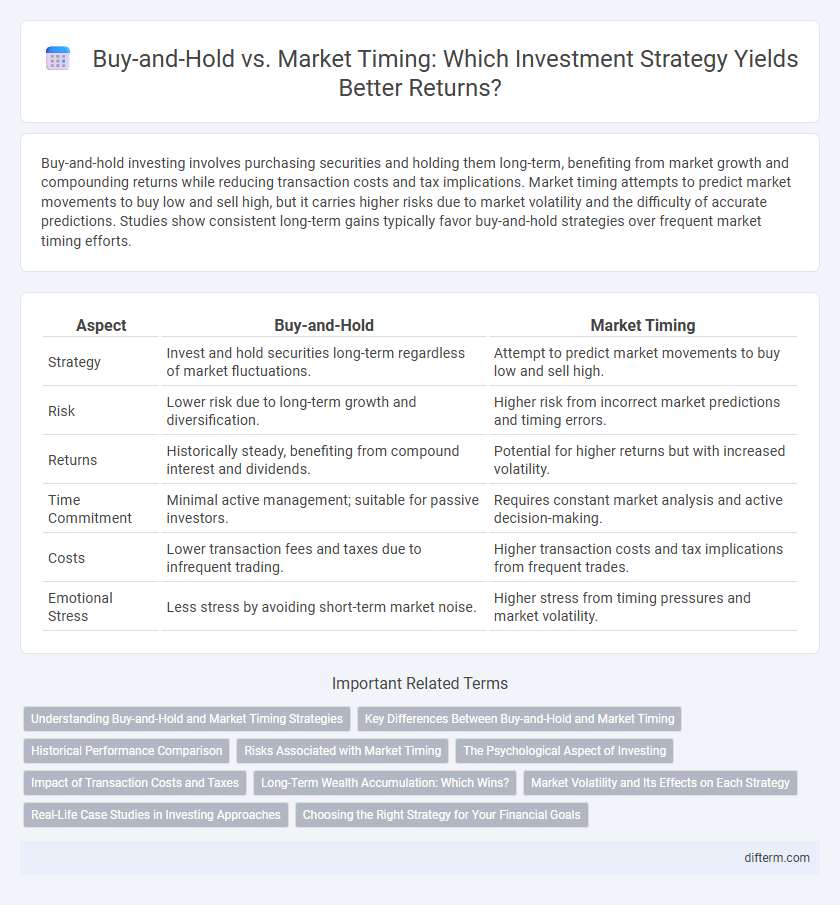

Buy-and-hold investing involves purchasing securities and holding them long-term, benefiting from market growth and compounding returns while reducing transaction costs and tax implications. Market timing attempts to predict market movements to buy low and sell high, but it carries higher risks due to market volatility and the difficulty of accurate predictions. Studies show consistent long-term gains typically favor buy-and-hold strategies over frequent market timing efforts.

Table of Comparison

| Aspect | Buy-and-Hold | Market Timing |

|---|---|---|

| Strategy | Invest and hold securities long-term regardless of market fluctuations. | Attempt to predict market movements to buy low and sell high. |

| Risk | Lower risk due to long-term growth and diversification. | Higher risk from incorrect market predictions and timing errors. |

| Returns | Historically steady, benefiting from compound interest and dividends. | Potential for higher returns but with increased volatility. |

| Time Commitment | Minimal active management; suitable for passive investors. | Requires constant market analysis and active decision-making. |

| Costs | Lower transaction fees and taxes due to infrequent trading. | Higher transaction costs and tax implications from frequent trades. |

| Emotional Stress | Less stress by avoiding short-term market noise. | Higher stress from timing pressures and market volatility. |

Understanding Buy-and-Hold and Market Timing Strategies

Buy-and-hold strategy involves purchasing securities and retaining them over a long period, benefiting from compound growth and market appreciation despite short-term volatility. Market timing strategy attempts to predict market movements to buy low and sell high, requiring accurate forecasts of market peaks and troughs. Studies show buy-and-hold often outperforms market timing due to reduced trading costs and lower risk of mistiming the market.

Key Differences Between Buy-and-Hold and Market Timing

Buy-and-hold investing involves purchasing securities and holding them long-term regardless of market fluctuations, aiming to benefit from overall market growth and compounding returns. Market timing attempts to predict market movements to buy low and sell high, requiring accurate forecasts of market peaks and troughs, which is challenging and risky. The primary difference lies in the strategic approach: buy-and-hold emphasizes patience and minimizing transaction costs, while market timing focuses on short-term decisions to exploit market volatility.

Historical Performance Comparison

Historical performance comparisons demonstrate that buy-and-hold strategies typically outperform market timing due to consistent exposure to market gains and dividend reinvestments. Market timing often leads to missed opportunities during key market rallies, reducing overall portfolio returns. Data from multiple decades show investors who maintain long-term positions achieve higher average returns with lower transaction costs and taxes.

Risks Associated with Market Timing

Market timing involves predicting market movements to buy low and sell high, but it carries significant risks due to market volatility and unpredictability. Frequent trading increases transaction costs and tax liabilities, eroding overall returns. Studies show that missing just a few of the best market days can drastically reduce long-term investment performance, emphasizing the risk of mistiming.

The Psychological Aspect of Investing

Investor behavior in buy-and-hold strategies typically reflects long-term discipline and emotional resilience, reducing the impact of market volatility. Market timing often triggers cognitive biases such as fear and greed, leading to impulsive decisions that can erode returns. Understanding the psychological aspect is crucial for maintaining investment consistency and optimizing portfolio performance.

Impact of Transaction Costs and Taxes

Transaction costs and taxes significantly impact the net returns of buy-and-hold versus market timing strategies, with frequent trading in market timing incurring higher brokerage fees and capital gains taxes. Buy-and-hold investors benefit from lower transaction costs and tax deferral, enhancing compound growth over long periods. Studies show that the cumulative drag from transaction costs and taxes often erodes the potential outperformance that market timing might achieve.

Long-Term Wealth Accumulation: Which Wins?

Buy-and-hold investing consistently outperforms market timing in long-term wealth accumulation due to its ability to capture overall market growth and compound returns over extended periods. Market timing often leads to missed opportunities during key market rallies and higher transaction costs, reducing net returns. Historical data from major indices like the S&P 500 shows that investors who maintain their positions over decades typically achieve significantly higher wealth compared to those attempting to time market entry and exit points.

Market Volatility and Its Effects on Each Strategy

Market volatility significantly impacts Buy-and-Hold and Market Timing strategies differently; Buy-and-Hold investors often endure short-term market fluctuations but benefit from long-term economic growth and compounding returns. Market Timing aims to capitalize on volatility by entering and exiting positions based on market signals, but it risks mistiming trades, leading to missed gains or increased losses. Historical data shows that frequent trading during volatile periods often results in lower overall returns compared to a disciplined Buy-and-Hold approach.

Real-Life Case Studies in Investing Approaches

Real-life case studies reveal that buy-and-hold investors often outperform market timers due to the difficulty of accurately predicting short-term market movements. For example, studies show that staying invested in broad market indices like the S&P 500 over decades yields higher cumulative returns than attempting to time entry and exit points. Historical data from bear markets also highlight that market timers frequently miss rebounds, resulting in significantly lower portfolio growth compared to disciplined buy-and-hold strategies.

Choosing the Right Strategy for Your Financial Goals

Buy-and-hold strategy suits long-term investors seeking steady wealth accumulation through compounding and reduced transaction costs. Market timing appeals to those with market expertise aiming to capitalize on short-term price fluctuations but requires precise predictions and carries higher risks. Aligning your choice with risk tolerance, financial goals, and investment horizon ensures optimal portfolio performance.

Buy-and-Hold vs Market Timing Infographic

difterm.com

difterm.com