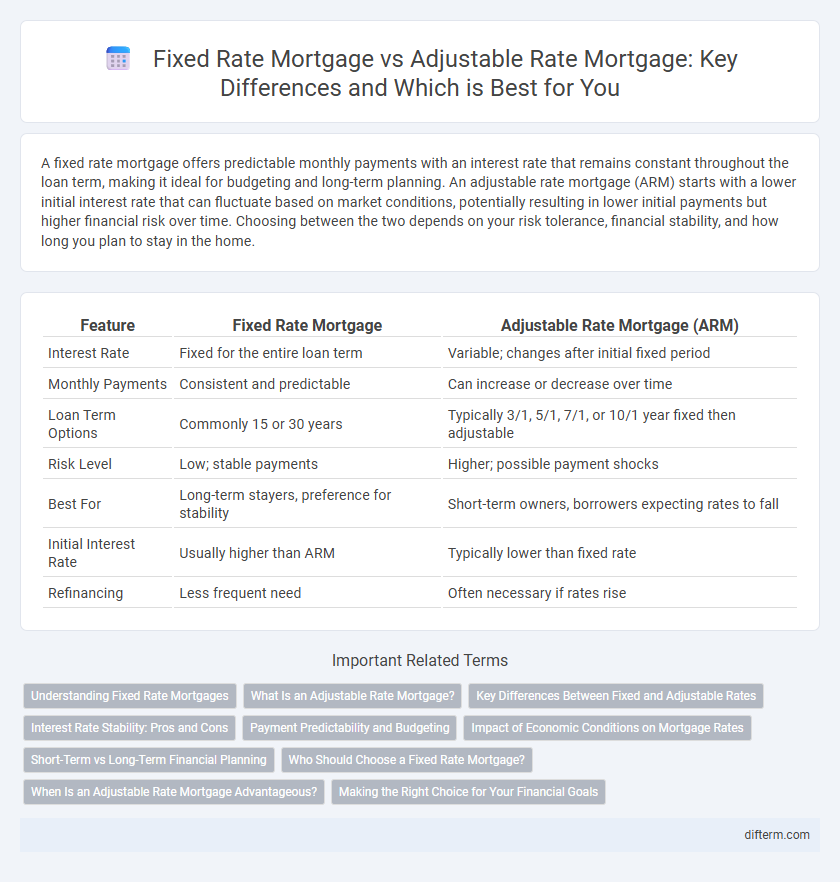

A fixed rate mortgage offers predictable monthly payments with an interest rate that remains constant throughout the loan term, making it ideal for budgeting and long-term planning. An adjustable rate mortgage (ARM) starts with a lower initial interest rate that can fluctuate based on market conditions, potentially resulting in lower initial payments but higher financial risk over time. Choosing between the two depends on your risk tolerance, financial stability, and how long you plan to stay in the home.

Table of Comparison

| Feature | Fixed Rate Mortgage | Adjustable Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Fixed for the entire loan term | Variable; changes after initial fixed period |

| Monthly Payments | Consistent and predictable | Can increase or decrease over time |

| Loan Term Options | Commonly 15 or 30 years | Typically 3/1, 5/1, 7/1, or 10/1 year fixed then adjustable |

| Risk Level | Low; stable payments | Higher; possible payment shocks |

| Best For | Long-term stayers, preference for stability | Short-term owners, borrowers expecting rates to fall |

| Initial Interest Rate | Usually higher than ARM | Typically lower than fixed rate |

| Refinancing | Less frequent need | Often necessary if rates rise |

Understanding Fixed Rate Mortgages

Fixed rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, typically 15 to 30 years, providing financial stability and easier budgeting. Borrowers benefit from protection against market fluctuations, making fixed-rate loans ideal in a rising interest rate environment. Understanding the long-term cost implications and initial interest rates is crucial when choosing a fixed rate mortgage versus an adjustable rate mortgage.

What Is an Adjustable Rate Mortgage?

An adjustable rate mortgage (ARM) features an interest rate that fluctuates periodically based on an underlying benchmark or index, such as the LIBOR or Treasury rates. Initial rates on ARMs are typically lower than fixed-rate mortgages but can increase or decrease after a predefined initial period, affecting monthly payments. Borrowers should consider interest rate caps, adjustment intervals, and margin rates to assess the potential risks and cost variability of an ARM.

Key Differences Between Fixed and Adjustable Rates

Fixed rate mortgages offer a consistent interest rate throughout the loan term, ensuring stable monthly payments and predictable budgeting. Adjustable rate mortgages (ARMs) start with a lower initial rate that adjusts periodically based on market indexes, potentially leading to fluctuating payments over time. The key differences lie in payment stability, interest rate predictability, and risk exposure to future rate changes.

Interest Rate Stability: Pros and Cons

Fixed rate mortgages offer consistent interest rates throughout the loan term, providing predictable monthly payments and protection against market fluctuations. Adjustable rate mortgages feature variable interest rates that can decrease initial payments but introduce uncertainty due to potential rate increases over time. Borrowers prioritizing payment stability may prefer fixed rates, while those seeking lower initial costs might consider adjustable rates despite interest rate volatility risks.

Payment Predictability and Budgeting

Fixed rate mortgages offer consistent monthly payments throughout the loan term, providing strong payment predictability and easier budget planning for homeowners. Adjustable rate mortgages (ARMs) typically start with lower initial interest rates, but payment amounts can fluctuate based on market conditions, complicating long-term budgeting. Understanding payment stability is crucial for borrowers prioritizing financial certainty and minimizing the risk of payment shock.

Impact of Economic Conditions on Mortgage Rates

Fixed rate mortgage rates generally remain stable regardless of short-term economic fluctuations, offering predictable monthly payments during periods of inflation or economic uncertainty. Adjustable rate mortgage (ARM) rates fluctuate with market interest rates, often tied to benchmarks like the U.S. Treasury yield or the LIBOR index, making them sensitive to changes in Federal Reserve policies and economic growth indicators. Economic conditions such as inflation, employment rates, and GDP growth heavily influence the movement of ARM rates, potentially increasing borrowing costs when the economy strengthens.

Short-Term vs Long-Term Financial Planning

Fixed rate mortgages provide stable monthly payments, ideal for long-term financial planning by offering predictability and protection against interest rate fluctuations. Adjustable rate mortgages (ARMs) often start with lower initial rates, benefiting short-term financial strategies or plans to refinance before rate adjustments occur. Choosing between these mortgage types depends on the borrower's timeline, risk tolerance, and interest rate forecasts.

Who Should Choose a Fixed Rate Mortgage?

Homebuyers seeking predictable monthly payments and long-term financial stability should choose a fixed rate mortgage, especially when interest rates are low or expected to rise. Fixed rate mortgages are ideal for individuals with stable incomes who prefer to avoid the uncertainty of fluctuating rates associated with adjustable rate mortgages (ARMs). This option provides peace of mind by locking in interest rates for the entire loan term, making budgeting and financial planning more straightforward.

When Is an Adjustable Rate Mortgage Advantageous?

An adjustable rate mortgage (ARM) is advantageous when borrowers plan to sell or refinance before the initial fixed-rate period ends, typically 5 to 7 years, allowing them to benefit from lower initial interest rates compared to fixed-rate mortgages. Homebuyers expecting rising income or anticipating variable interest rates to remain stable or decline can save on interest payments during the adjustable phase. ARMs are also beneficial in low-interest-rate environments where borrowers seek reduced monthly payments and flexibility in their mortgage terms.

Making the Right Choice for Your Financial Goals

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage depends on your long-term financial goals and risk tolerance. Fixed-rate mortgages provide stability with consistent monthly payments, ideal for budgeting and long-term homeownership plans. Adjustable-rate mortgages may offer lower initial rates but carry the risk of increased payments, which can be beneficial for borrowers expecting income growth or planning to sell before adjustments occur.

Fixed rate mortgage vs adjustable rate mortgage Infographic

difterm.com

difterm.com