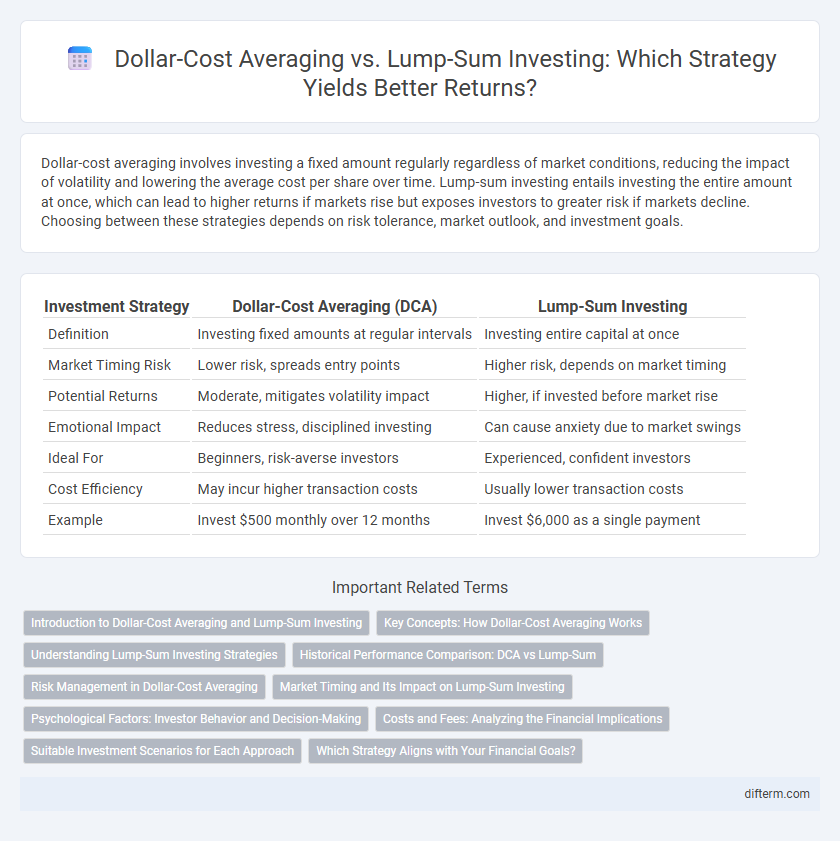

Dollar-cost averaging involves investing a fixed amount regularly regardless of market conditions, reducing the impact of volatility and lowering the average cost per share over time. Lump-sum investing entails investing the entire amount at once, which can lead to higher returns if markets rise but exposes investors to greater risk if markets decline. Choosing between these strategies depends on risk tolerance, market outlook, and investment goals.

Table of Comparison

| Investment Strategy | Dollar-Cost Averaging (DCA) | Lump-Sum Investing |

|---|---|---|

| Definition | Investing fixed amounts at regular intervals | Investing entire capital at once |

| Market Timing Risk | Lower risk, spreads entry points | Higher risk, depends on market timing |

| Potential Returns | Moderate, mitigates volatility impact | Higher, if invested before market rise |

| Emotional Impact | Reduces stress, disciplined investing | Can cause anxiety due to market swings |

| Ideal For | Beginners, risk-averse investors | Experienced, confident investors |

| Cost Efficiency | May incur higher transaction costs | Usually lower transaction costs |

| Example | Invest $500 monthly over 12 months | Invest $6,000 as a single payment |

Introduction to Dollar-Cost Averaging and Lump-Sum Investing

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals regardless of market conditions, reducing the impact of market volatility on the overall purchase price. Lump-sum investing requires deploying the entire investment capital at once, which can potentially maximize returns when markets trend upward but increases exposure to short-term market fluctuations. Both strategies offer distinct risk and reward profiles, with DCA emphasizing risk mitigation and lump-sum prioritizing immediate market exposure.

Key Concepts: How Dollar-Cost Averaging Works

Dollar-cost averaging involves investing a fixed amount of money at regular intervals regardless of market conditions, which reduces the impact of market volatility by purchasing more shares when prices are low and fewer when prices are high. This strategy helps mitigate the risks of market timing and lowers the average cost per share over time. Investors seeking to manage risk in fluctuating markets often prefer dollar-cost averaging to avoid large losses from lump-sum investments during market downturns.

Understanding Lump-Sum Investing Strategies

Lump-sum investing involves committing a large amount of capital into a single investment at once, aiming to capitalize on market growth immediately. This strategy often outperforms dollar-cost averaging in rising markets due to immediate market exposure and potential for higher returns. Key considerations include market volatility tolerance and timing, as poor entrance points can increase risk compared to gradual investment approaches.

Historical Performance Comparison: DCA vs Lump-Sum

Historical performance comparisons reveal lump-sum investing typically outperforms dollar-cost averaging (DCA) in growing wealth over long periods, especially in rising markets where immediate exposure captures more gains. DCA reduces timing risk by spreading investments, which can limit losses during market downturns but may underperform during strong bull markets. Studies analyzing S&P 500 data from 1926 to present show lump-sum investing delivered higher average returns roughly two-thirds of the time, highlighting its advantage when markets trend upward consistently.

Risk Management in Dollar-Cost Averaging

Dollar-cost averaging (DCA) reduces investment risk by spreading contributions over time, thereby minimizing the impact of market volatility on the overall portfolio. By purchasing more shares when prices are low and fewer when prices are high, DCA smooths out market fluctuations and prevents the pitfalls of poor market timing common in lump-sum investing. This disciplined approach to risk management suits investors aiming to mitigate downside risk while steadily building wealth.

Market Timing and Its Impact on Lump-Sum Investing

Market timing significantly affects lump-sum investing as investors attempt to buy at market lows but often face the difficulty of predicting short-term market fluctuations. Lump-sum investing can yield higher returns if timed correctly during market dips, yet it carries the risk of substantial losses when entering before market corrections. Dollar-cost averaging mitigates timing risk by spreading investments over time, reducing exposure to market volatility compared to lump-sum investing.

Psychological Factors: Investor Behavior and Decision-Making

Dollar-cost averaging mitigates emotional biases by spreading investments over time, reducing the anxiety of market timing and potential regret from poor entry points. Lump-sum investing requires strong conviction and risk tolerance, often challenging investors prone to fear and hesitation during volatile markets. Understanding these psychological factors helps investors align strategies with their behavioral tendencies to improve long-term financial outcomes.

Costs and Fees: Analyzing the Financial Implications

Dollar-cost averaging spreads investment purchases over time, potentially reducing the impact of market volatility but often incurring higher cumulative transaction fees compared to lump-sum investing. Lump-sum investing typically benefits from lower total costs due to fewer trades, maximizing capital deployment efficiency. Evaluating brokerage fees, fund expense ratios, and bid-ask spreads is essential in determining the net financial advantage between these strategies.

Suitable Investment Scenarios for Each Approach

Dollar-cost averaging is suited for volatile markets or investors with limited capital, as it spreads purchases over time, reducing the impact of market fluctuations. Lump-sum investing benefits scenarios with a strong market uptrend or long investment horizon, allowing immediate capital deployment to maximize growth potential. Risk tolerance and investment goals are key factors in determining the optimal strategy for individual investors.

Which Strategy Aligns with Your Financial Goals?

Dollar-cost averaging (DCA) mitigates market volatility risk by investing fixed amounts regularly, ideal for risk-averse investors seeking steady portfolio growth over time. Lump-sum investing leverages immediate market opportunities, potentially generating higher returns if the market trends upward but entails greater short-term risk. Aligning your strategy with financial goals involves assessing risk tolerance, investment horizon, and market conditions to optimize portfolio performance.

Dollar-cost averaging vs Lump-sum investing Infographic

difterm.com

difterm.com