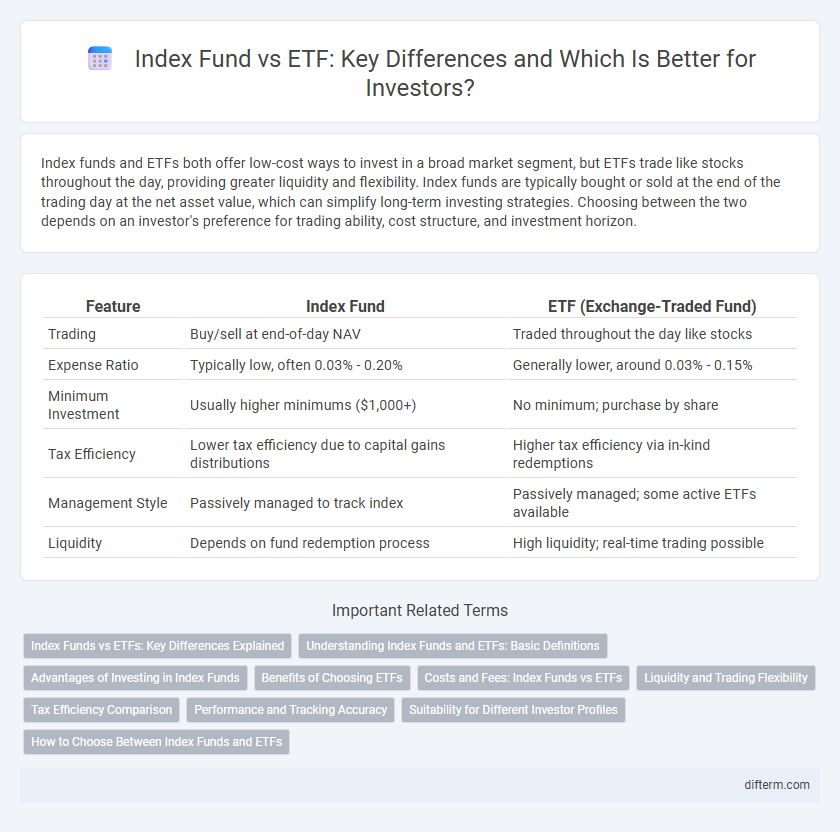

Index funds and ETFs both offer low-cost ways to invest in a broad market segment, but ETFs trade like stocks throughout the day, providing greater liquidity and flexibility. Index funds are typically bought or sold at the end of the trading day at the net asset value, which can simplify long-term investing strategies. Choosing between the two depends on an investor's preference for trading ability, cost structure, and investment horizon.

Table of Comparison

| Feature | Index Fund | ETF (Exchange-Traded Fund) |

|---|---|---|

| Trading | Buy/sell at end-of-day NAV | Traded throughout the day like stocks |

| Expense Ratio | Typically low, often 0.03% - 0.20% | Generally lower, around 0.03% - 0.15% |

| Minimum Investment | Usually higher minimums ($1,000+) | No minimum; purchase by share |

| Tax Efficiency | Lower tax efficiency due to capital gains distributions | Higher tax efficiency via in-kind redemptions |

| Management Style | Passively managed to track index | Passively managed; some active ETFs available |

| Liquidity | Depends on fund redemption process | High liquidity; real-time trading possible |

Index Funds vs ETFs: Key Differences Explained

Index funds and ETFs both track market indexes but differ in trading methods and cost structures. Index funds trade once daily at net asset value, while ETFs trade like stocks throughout the day with real-time pricing. Expense ratios tend to be lower for ETFs, but index funds offer simplicity and automatic investment options, making each suitable for different investor preferences.

Understanding Index Funds and ETFs: Basic Definitions

Index funds are mutual funds designed to replicate the performance of a specific market index, offering broad market exposure with low management fees. Exchange-Traded Funds (ETFs) trade like stocks on exchanges, providing liquidity, real-time pricing, and flexible investment options while also tracking an underlying index. Both investment vehicles aim to deliver diversified portfolio returns, but ETFs offer greater trading flexibility and potential tax advantages compared to traditional index funds.

Advantages of Investing in Index Funds

Index funds offer low expense ratios and automatic diversification by tracking a broad market index, reducing investment risk. They provide a straightforward, passive investment strategy with minimal management fees compared to actively managed funds. Many investors benefit from tax efficiency and consistent performance aligned with overall market returns through index fund investing.

Benefits of Choosing ETFs

ETFs offer greater trading flexibility with real-time price updates and the ability to buy or sell shares throughout the trading day, unlike index funds priced only at market close. Lower expense ratios and tax efficiency due to in-kind redemptions make ETFs a cost-effective investment option. Diversification across various asset classes, combined with transparency in holdings, enhances portfolio management and risk control for investors.

Costs and Fees: Index Funds vs ETFs

Index funds typically have expense ratios ranging from 0.10% to 0.25%, often higher than ETFs due to active management and administrative costs. ETFs usually incur lower fees, with expense ratios commonly between 0.03% and 0.10%, benefiting from passive management and lower operating expenses. Trading ETFs may involve brokerage commissions and bid-ask spreads, which investors need to consider alongside the expense ratio for total cost evaluation.

Liquidity and Trading Flexibility

Index funds typically offer lower liquidity since they are bought and sold at the end-of-day net asset value (NAV), limiting trading flexibility. ETFs trade throughout the day on exchanges with real-time price fluctuations, providing higher liquidity and the ability to execute various trading strategies like limit orders and intraday buys or sells. Investors seeking dynamic market access often prefer ETFs for their superior liquidity and flexible trading options.

Tax Efficiency Comparison

Index funds typically generate more capital gains distributions than ETFs, resulting in higher tax liabilities for investors. ETFs use an in-kind creation and redemption mechanism that allows for greater tax efficiency by minimizing capital gains events. This structural difference often makes ETFs a more tax-efficient option for long-term investors seeking to reduce taxable distributions.

Performance and Tracking Accuracy

Index funds typically offer stable performance by mirroring the underlying benchmark through full replication or stratified sampling, ensuring minimal tracking error. ETFs provide similar exposure but trade on exchanges, allowing intraday pricing and slightly more variability in tracking accuracy due to market price fluctuations. Both investment vehicles aim for efficient market replication, yet ETFs may exhibit modest deviations from net asset value impacting performance proximity to the index.

Suitability for Different Investor Profiles

Index funds offer a cost-effective, passive investment solution ideal for long-term investors seeking broad market exposure with minimal management. ETFs provide greater flexibility and liquidity, making them suitable for active traders and investors who require intraday trading capabilities and tax efficiency. Risk tolerance, investment horizon, and preferred trading style guide the suitability of index funds versus ETFs for different investor profiles.

How to Choose Between Index Funds and ETFs

When choosing between index funds and ETFs, consider factors such as trading flexibility, expense ratios, and tax efficiency. ETFs offer intraday trading and often lower costs, suitable for active investors seeking liquidity. Index funds provide simplicity with automatic investing and may be preferable for long-term, hands-off investors aiming for consistent portfolio growth.

Index Fund vs ETF Infographic

difterm.com

difterm.com