Peer-to-peer lending offers a streamlined alternative to traditional lending by directly connecting borrowers with individual investors, often resulting in lower interest rates and faster approval processes. Traditional lending institutions typically provide more regulatory protection and larger loan amounts but involve more stringent credit checks and longer processing times. Choosing between these options depends on the borrower's urgency, credit profile, and preferred risk tolerance.

Table of Comparison

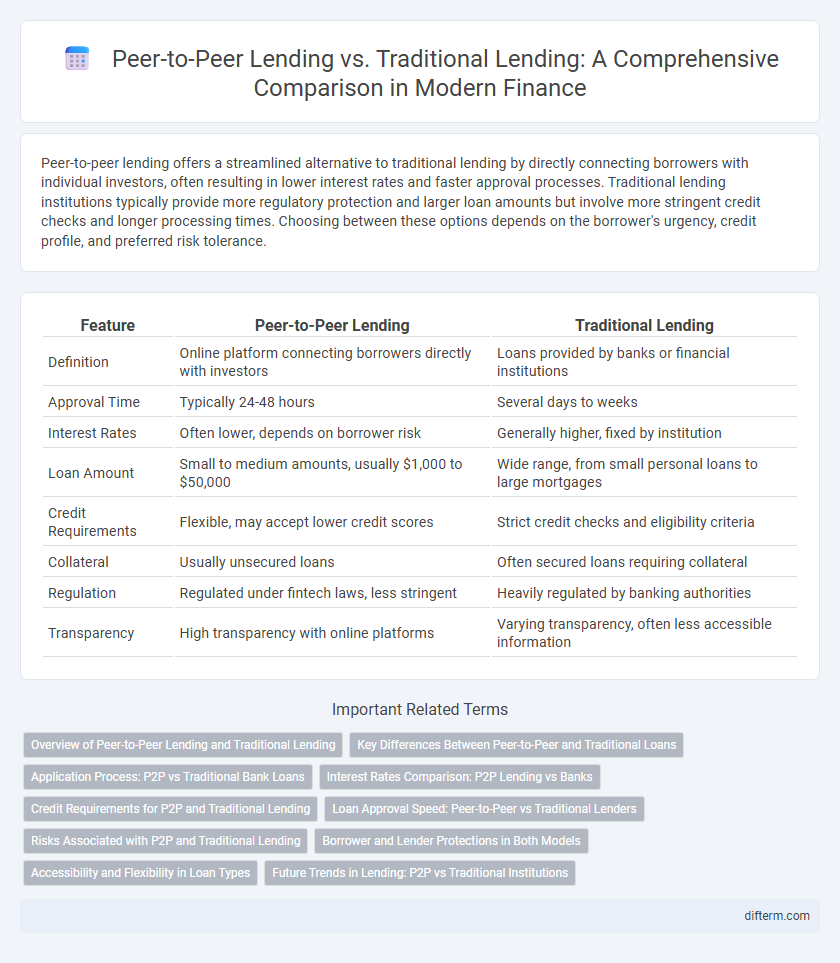

| Feature | Peer-to-Peer Lending | Traditional Lending |

|---|---|---|

| Definition | Online platform connecting borrowers directly with investors | Loans provided by banks or financial institutions |

| Approval Time | Typically 24-48 hours | Several days to weeks |

| Interest Rates | Often lower, depends on borrower risk | Generally higher, fixed by institution |

| Loan Amount | Small to medium amounts, usually $1,000 to $50,000 | Wide range, from small personal loans to large mortgages |

| Credit Requirements | Flexible, may accept lower credit scores | Strict credit checks and eligibility criteria |

| Collateral | Usually unsecured loans | Often secured loans requiring collateral |

| Regulation | Regulated under fintech laws, less stringent | Heavily regulated by banking authorities |

| Transparency | High transparency with online platforms | Varying transparency, often less accessible information |

Overview of Peer-to-Peer Lending and Traditional Lending

Peer-to-peer (P2P) lending connects individual borrowers directly with private investors through online platforms, bypassing traditional financial institutions, and often offers faster approval and competitive interest rates. Traditional lending involves banks or credit unions evaluating borrowers using stringent credit criteria and providing regulated loan products with structured repayment terms. P2P lending provides increased accessibility for borrowers with diverse credit profiles, but traditional lending remains preferred for large loan amounts due to regulatory protections and established credibility.

Key Differences Between Peer-to-Peer and Traditional Loans

Peer-to-peer (P2P) lending connects borrowers directly with individual investors through online platforms, bypassing traditional financial institutions, resulting in potentially lower interest rates and faster approval times. Traditional loans typically involve banks or credit unions, featuring stricter credit requirements, collateral demands, and standardized loan products. P2P lending offers increased transparency and flexibility, while traditional lending provides greater regulatory protection and established credit-building opportunities.

Application Process: P2P vs Traditional Bank Loans

Peer-to-peer lending platforms streamline the application process by leveraging online interfaces that require minimal documentation and provide faster approval times compared to traditional bank loans. Traditional lending involves extensive credit evaluations, in-person meetings, and longer processing periods due to regulatory compliance and underwriting standards. P2P lending offers accessibility to borrowers with varying credit profiles, while banks prioritize established credit histories and collateral requirements.

Interest Rates Comparison: P2P Lending vs Banks

Peer-to-peer (P2P) lending platforms typically offer lower interest rates compared to traditional banks due to reduced overhead costs and streamlined online processes. Borrowers on P2P platforms can expect average interest rates ranging from 6% to 12%, whereas traditional bank loans often carry rates between 10% and 20%, depending on creditworthiness and loan type. The competitive rates in P2P lending attract borrowers seeking affordable financing, while investors benefit from higher returns than conventional savings accounts.

Credit Requirements for P2P and Traditional Lending

Peer-to-peer (P2P) lending platforms typically have more flexible credit requirements compared to traditional lending institutions, often accepting borrowers with lower credit scores or limited credit history. Traditional lenders generally require higher credit scores, extensive financial documentation, and a proven repayment history to minimize risk. This flexibility in P2P lending can increase accessibility for individuals and small businesses who might be rejected by banks due to stringent credit criteria.

Loan Approval Speed: Peer-to-Peer vs Traditional Lenders

Peer-to-peer lending platforms typically offer faster loan approval speeds, often processing applications within 24 to 48 hours due to automated underwriting and streamlined digital processes. Traditional lenders, such as banks, usually require several days to weeks for approval, involving manual credit assessments, collateral verification, and compliance checks. Faster approval times in peer-to-peer lending make it an attractive option for borrowers seeking quick access to funds compared to conventional financial institutions.

Risks Associated with P2P and Traditional Lending

Peer-to-peer (P2P) lending exposes investors to higher default risks due to lack of collateral and limited regulatory oversight compared to traditional lending institutions. Traditional banks mitigate credit risk through stringent borrower assessments, collateral requirements, and insured deposits, reducing potential financial losses. However, both lending methods face inherent liquidity risks and economic downturn impacts that may hinder borrower repayment capabilities.

Borrower and Lender Protections in Both Models

Peer-to-peer lending platforms implement stringent borrower verification and risk assessment algorithms to mitigate default risk, while offering lenders transparent loan performance data and diversified investment options to enhance protection. Traditional lending institutions rely on regulatory frameworks, collateral requirements, and credit scoring to safeguard both borrower repayment capacity and lender financial interests. Legal recourse mechanisms and centralized oversight in traditional finance contrast with decentralized dispute resolution and platform-specific policies in peer-to-peer lending, shaping different risk profiles and protection levels for participants.

Accessibility and Flexibility in Loan Types

Peer-to-peer lending platforms offer greater accessibility by connecting borrowers directly with individual investors, bypassing traditional financial institutions' stringent criteria. These platforms often provide more flexible loan types, including personal, business, and short-term loans tailored to diverse borrower needs. In contrast, traditional lending typically involves fixed loan products with rigid terms and higher qualification thresholds, limiting options for borrowers with non-standard credit profiles.

Future Trends in Lending: P2P vs Traditional Institutions

Peer-to-peer lending platforms leverage blockchain technology and AI-powered credit scoring to enhance transaction transparency and reduce default rates, signaling a shift toward more personalized and efficient lending processes. Traditional financial institutions are increasingly adopting digital transformation strategies, integrating fintech innovations like machine learning and open banking APIs to remain competitive and improve customer experience. The convergence of regulatory advancements and technological integration will drive a hybrid lending landscape where P2P platforms and traditional banks coexist, offering diversified credit solutions tailored to evolving borrower needs.

Peer-to-Peer Lending vs Traditional Lending Infographic

difterm.com

difterm.com