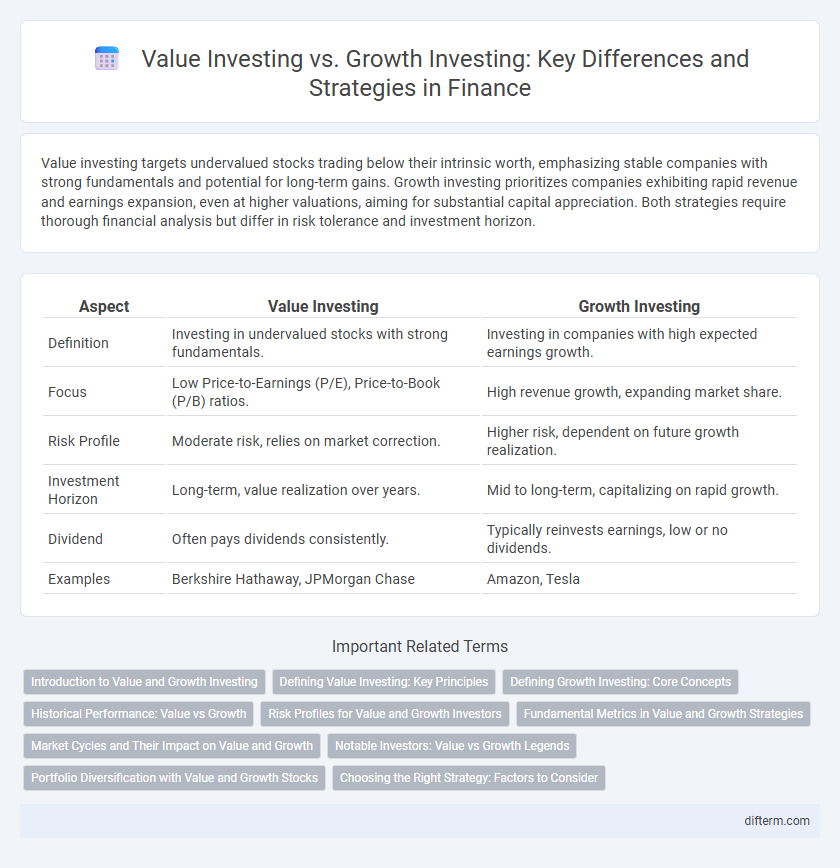

Value investing targets undervalued stocks trading below their intrinsic worth, emphasizing stable companies with strong fundamentals and potential for long-term gains. Growth investing prioritizes companies exhibiting rapid revenue and earnings expansion, even at higher valuations, aiming for substantial capital appreciation. Both strategies require thorough financial analysis but differ in risk tolerance and investment horizon.

Table of Comparison

| Aspect | Value Investing | Growth Investing |

|---|---|---|

| Definition | Investing in undervalued stocks with strong fundamentals. | Investing in companies with high expected earnings growth. |

| Focus | Low Price-to-Earnings (P/E), Price-to-Book (P/B) ratios. | High revenue growth, expanding market share. |

| Risk Profile | Moderate risk, relies on market correction. | Higher risk, dependent on future growth realization. |

| Investment Horizon | Long-term, value realization over years. | Mid to long-term, capitalizing on rapid growth. |

| Dividend | Often pays dividends consistently. | Typically reinvests earnings, low or no dividends. |

| Examples | Berkshire Hathaway, JPMorgan Chase | Amazon, Tesla |

Introduction to Value and Growth Investing

Value investing focuses on identifying undervalued stocks by analyzing financial metrics such as price-to-earnings (P/E) ratios and book value to find opportunities overlooked by the market. Growth investing targets companies with high earnings growth potential, emphasizing revenue expansion, market share increases, and innovation-driven profitability. Both strategies require thorough fundamental analysis but cater to different risk tolerances and investment horizons.

Defining Value Investing: Key Principles

Value investing centers on identifying undervalued stocks by analyzing financial metrics such as the price-to-earnings (P/E) ratio, book value, and dividend yield to assess intrinsic worth. This strategy emphasizes purchasing securities trading below their intrinsic value, offering a margin of safety to minimize downside risk. Investors focus on stable companies with strong fundamentals, often favoring sectors like consumer goods, energy, and financials known for consistent cash flows and resilience during economic cycles.

Defining Growth Investing: Core Concepts

Growth investing centers on identifying companies with potential for substantial revenue and earnings expansion, often in innovative or emerging industries. Investors prioritize metrics such as high earnings growth rates, strong cash flow generation, and market share gains over current dividends or valuations. This strategy seeks capital appreciation by targeting stocks with above-average growth prospects, accepting higher volatility and risk for the possibility of significant returns.

Historical Performance: Value vs Growth

Historical performance data reveals that value investing has traditionally outperformed growth investing during market downturns and periods of economic uncertainty, providing more stable returns through dividends and undervalued stocks. Conversely, growth investing has often excelled in bull markets, driven by rapid earnings expansion and innovation in sectors like technology and consumer discretionary. Analyzing long-term returns from indices such as the Russell 1000 Value and Growth highlights cyclical shifts, with value outperforming over extensive horizons but growth dominating in shorter, high-growth market phases.

Risk Profiles for Value and Growth Investors

Value investing typically involves lower risk as it targets undervalued companies with stable cash flows and established business models, providing a margin of safety against market volatility. Growth investing carries higher risk due to its emphasis on companies with rapid earnings expansion but often with uncertain profitability and higher valuation multiples. Understanding the distinct risk profiles helps investors align strategies with their risk tolerance and financial goals.

Fundamental Metrics in Value and Growth Strategies

Value investing relies heavily on fundamental metrics such as low price-to-earnings (P/E) ratios, high dividend yields, and strong book-to-market ratios to identify undervalued stocks with solid financial health. Growth investing prioritizes metrics like earnings growth rate, return on equity (ROE), and revenue growth to target companies with above-average expansion potential. Analyzing these fundamental indicators enables investors to choose between stable, undervalued assets and high-potential, rapidly expanding firms based on their financial objectives.

Market Cycles and Their Impact on Value and Growth

Market cycles significantly influence the performance of value investing and growth investing strategies, with value stocks typically outperforming during economic recoveries and growth stocks excelling in expansion phases. During downturns or market corrections, value investing tends to provide more stability due to its focus on undervalued companies with strong fundamentals, while growth investing, characterized by high earnings potential and innovation, may experience greater volatility. Understanding these cyclical behaviors helps investors allocate assets more effectively to optimize returns across varying economic environments.

Notable Investors: Value vs Growth Legends

Warren Buffett exemplifies value investing by focusing on undervalued companies with strong fundamentals and a margin of safety, while Peter Lynch represents growth investing through his emphasis on companies with high earnings potential and rapid expansion. Benjamin Graham, known as the father of value investing, pioneered strategies centered on intrinsic value and financial discipline, contrasting with Philip Fisher's growth investing approach that prioritizes innovation and long-term growth prospects. These investment legends highlight the fundamental differences in strategy and risk tolerance between value and growth investing styles.

Portfolio Diversification with Value and Growth Stocks

Portfolio diversification combining value and growth stocks mitigates risk while capitalizing on different market cycles, enhancing long-term returns. Value stocks offer stability with lower price-to-earnings ratios and consistent dividends, while growth stocks provide higher potential returns through rapid earnings expansion. Balancing these asset classes creates a resilient portfolio that adapts to economic fluctuations and maximizes wealth accumulation.

Choosing the Right Strategy: Factors to Consider

Choosing the right investment strategy requires evaluating risk tolerance, investment horizon, and financial goals to determine whether value investing or growth investing aligns better with an investor's profile. Value investing targets undervalued companies with strong fundamentals and potential for long-term appreciation, while growth investing focuses on companies with high earnings growth potential, often involving greater volatility. Analyzing market conditions, sector trends, and individual company metrics such as P/E ratios and revenue growth rates can help investors make informed decisions that balance risk and return effectively.

Value Investing vs Growth Investing Infographic

difterm.com

difterm.com