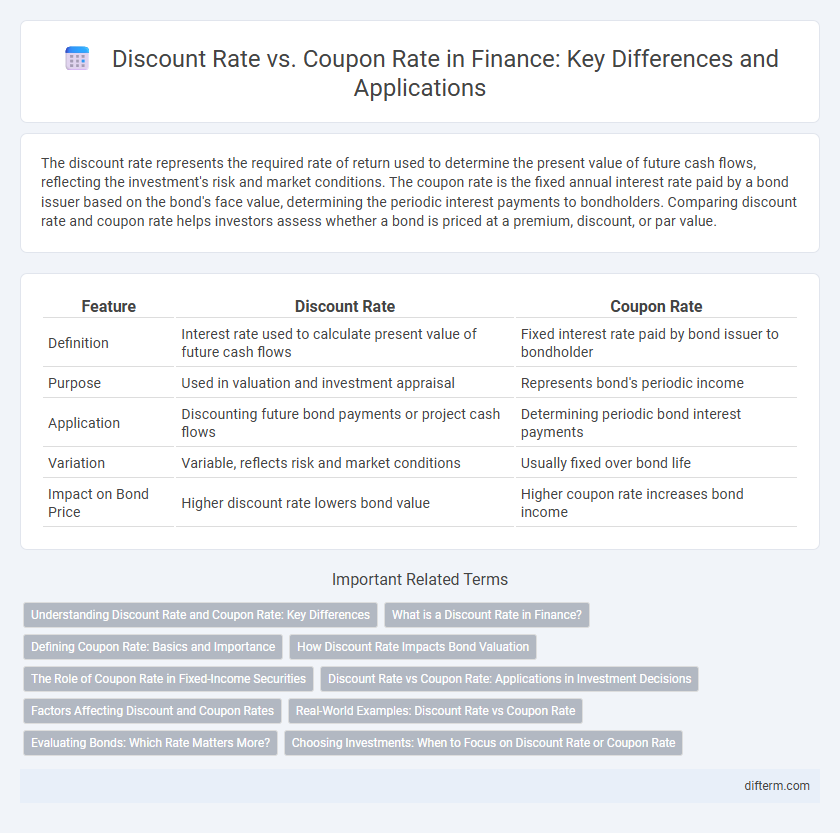

The discount rate represents the required rate of return used to determine the present value of future cash flows, reflecting the investment's risk and market conditions. The coupon rate is the fixed annual interest rate paid by a bond issuer based on the bond's face value, determining the periodic interest payments to bondholders. Comparing discount rate and coupon rate helps investors assess whether a bond is priced at a premium, discount, or par value.

Table of Comparison

| Feature | Discount Rate | Coupon Rate |

|---|---|---|

| Definition | Interest rate used to calculate present value of future cash flows | Fixed interest rate paid by bond issuer to bondholder |

| Purpose | Used in valuation and investment appraisal | Represents bond's periodic income |

| Application | Discounting future bond payments or project cash flows | Determining periodic bond interest payments |

| Variation | Variable, reflects risk and market conditions | Usually fixed over bond life |

| Impact on Bond Price | Higher discount rate lowers bond value | Higher coupon rate increases bond income |

Understanding Discount Rate and Coupon Rate: Key Differences

The discount rate is the interest rate used to determine the present value of future cash flows, reflecting the opportunity cost and risk level associated with an investment. The coupon rate represents the fixed annual interest payment expressed as a percentage of the bond's face value, indicating the income investors receive from the bond. Understanding the difference between the discount rate and coupon rate is essential for evaluating bond pricing, yield calculations, and investment decisions.

What is a Discount Rate in Finance?

The discount rate in finance is the interest rate used to determine the present value of future cash flows, reflecting the opportunity cost of capital and the risk associated with the investment. It differs from the coupon rate, which is the fixed interest paid by a bond issuer to bondholders based on the bond's face value. Understanding the discount rate is crucial for valuing bonds, projects, and other financial assets accurately.

Defining Coupon Rate: Basics and Importance

The coupon rate is the fixed annual interest percentage paid by a bond issuer to bondholders, based on the bond's face value. It is crucial in determining the periodic income investors receive, influencing bond pricing and yield calculations in financial markets. Understanding the coupon rate helps assess the attractiveness and risk level of fixed-income investments relative to prevailing discount rates.

How Discount Rate Impacts Bond Valuation

The discount rate directly influences bond valuation by determining the present value of future cash flows, with a higher discount rate leading to a lower bond price. When the discount rate exceeds the coupon rate, bonds trade at a discount, reflecting higher risk or interest rates in the market. Accurate assessment of the discount rate is crucial for investors to evaluate bond profitability and market value effectively.

The Role of Coupon Rate in Fixed-Income Securities

The coupon rate in fixed-income securities determines the periodic interest payments investors receive, directly impacting bond valuation and income predictability. Unlike the discount rate, which reflects the market's required rate of return and influences a bond's present value, the coupon rate remains fixed throughout the bond's life. This fixed income stream is crucial for investors seeking stable cash flows and assessing yield compared to fluctuating market interest rates.

Discount Rate vs Coupon Rate: Applications in Investment Decisions

The discount rate reflects the investor's required rate of return, used to value future cash flows by discounting them to their present value, while the coupon rate represents the fixed annual interest payment of a bond based on its face value. In investment decisions, a bond trading below par value typically has a discount rate higher than its coupon rate, signaling higher yield and potential risk. Evaluating the relationship between discount rate and coupon rate aids investors in determining whether bonds are fair-valued, undervalued, or overvalued relative to current market conditions.

Factors Affecting Discount and Coupon Rates

Discount rates are primarily influenced by market interest rates, inflation expectations, and the credit risk of the issuer, which reflect the opportunity cost and risk premium investors demand. Coupon rates are set at issuance, based on prevailing interest rates, issuer's creditworthiness, and the bond's maturity, aiming to attract investors while balancing issuer cost. Changes in economic conditions and monetary policy shifts cause discount rates to fluctuate, while coupon rates remain fixed, impacting bond pricing and yield dynamics.

Real-World Examples: Discount Rate vs Coupon Rate

The discount rate reflects the current market interest rate used to calculate the present value of future bond payments, while the coupon rate is the fixed annual interest payment set when the bond is issued. For example, if a bond's coupon rate is 5% but the prevailing market discount rate rises to 6%, the bond's price will fall below its face value, trading at a discount. Conversely, when the discount rate is lower than the coupon rate, as seen in many government bonds during low-interest environments, the bond price climbs above par, trading at a premium.

Evaluating Bonds: Which Rate Matters More?

When evaluating bonds, the discount rate is crucial for determining the present value of future cash flows, reflecting the bond's market risk and opportunity cost. The coupon rate indicates the fixed annual interest payment based on the bond's face value, influencing the income investors receive. Investors prioritize the discount rate for assessing bond valuation and potential returns relative to prevailing market conditions.

Choosing Investments: When to Focus on Discount Rate or Coupon Rate

When evaluating bond investments, prioritize the discount rate to assess the present value of future cash flows, reflecting market conditions and risk. Focus on the coupon rate when income stability and periodic interest payments are the primary concerns, especially for income-focused investors. Selecting between discount and coupon rates depends on investment goals, risk tolerance, and market interest rate forecasts.

Discount rate vs Coupon rate Infographic

difterm.com

difterm.com