Cash flow represents the total amount of money being transferred into and out of a business, reflecting its liquidity during a specific period. Free cash flow, however, measures the cash a company generates after accounting for capital expenditures necessary to maintain or expand its asset base. Understanding the distinction between cash flow and free cash flow is crucial for evaluating a firm's financial health and its ability to generate shareholder value.

Table of Comparison

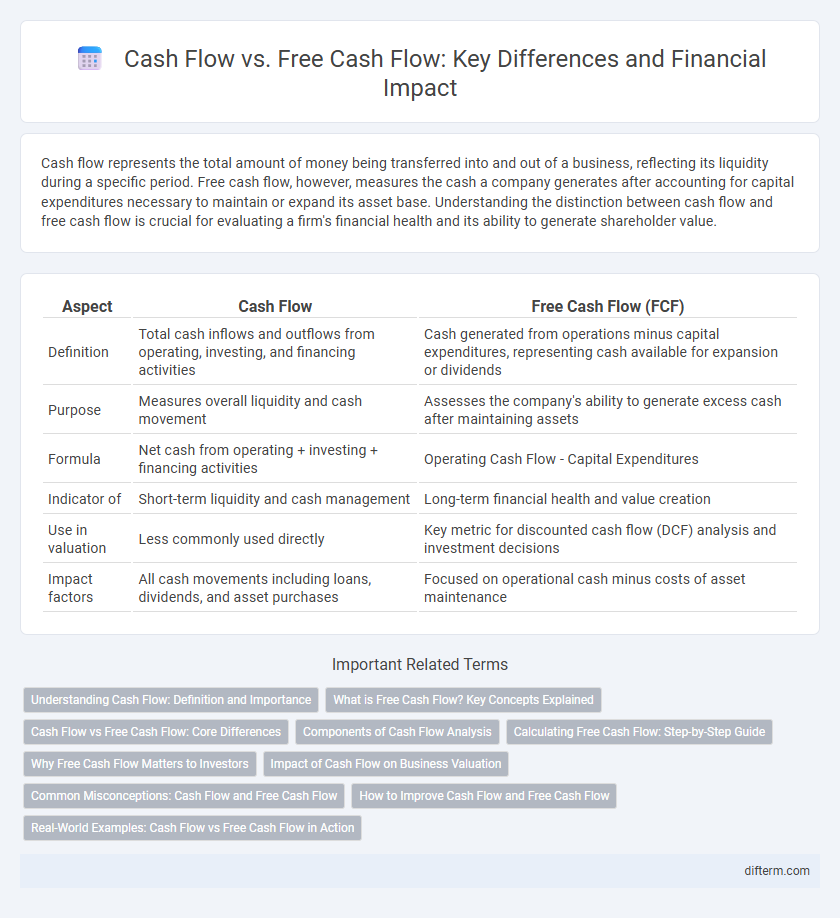

| Aspect | Cash Flow | Free Cash Flow (FCF) |

|---|---|---|

| Definition | Total cash inflows and outflows from operating, investing, and financing activities | Cash generated from operations minus capital expenditures, representing cash available for expansion or dividends |

| Purpose | Measures overall liquidity and cash movement | Assesses the company's ability to generate excess cash after maintaining assets |

| Formula | Net cash from operating + investing + financing activities | Operating Cash Flow - Capital Expenditures |

| Indicator of | Short-term liquidity and cash management | Long-term financial health and value creation |

| Use in valuation | Less commonly used directly | Key metric for discounted cash flow (DCF) analysis and investment decisions |

| Impact factors | All cash movements including loans, dividends, and asset purchases | Focused on operational cash minus costs of asset maintenance |

Understanding Cash Flow: Definition and Importance

Cash flow represents the total amount of money moving in and out of a business, highlighting its liquidity and operational efficiency. Free cash flow specifically measures the cash available after accounting for capital expenditures, indicating the firm's ability to generate surplus cash for expansion or debt repayment. Understanding these metrics is crucial for assessing financial health, investment potential, and strategic decision-making in corporate finance.

What is Free Cash Flow? Key Concepts Explained

Free Cash Flow (FCF) represents the cash generated by a company after accounting for capital expenditures needed to maintain or expand its asset base, providing insight into the actual liquidity available to investors and creditors. It is calculated by subtracting capital expenditures from operating cash flow, highlighting the funds available for dividends, debt repayment, and reinvestment. Understanding FCF is crucial for evaluating a company's financial health and its ability to generate sustainable growth beyond just reported earnings.

Cash Flow vs Free Cash Flow: Core Differences

Cash flow represents the total amount of cash generated and used by a company during a specific period, encompassing operations, investments, and financing activities. Free cash flow (FCF) is a subset of cash flow, calculated by deducting capital expenditures from operating cash flow, highlighting the cash available for distribution to investors or for expansion. Understanding the core differences between cash flow and free cash flow is crucial for assessing a company's financial health and its ability to generate sustainable earnings.

Components of Cash Flow Analysis

Cash flow analysis primarily focuses on operating, investing, and financing activities to assess a company's liquidity and financial health. Free cash flow is derived by subtracting capital expenditures from operating cash flow, highlighting the cash available for expansion, debt repayment, or dividends. Understanding these components allows investors to evaluate a company's ability to generate sustainable cash and fund future growth.

Calculating Free Cash Flow: Step-by-Step Guide

Calculating free cash flow involves starting with operating cash flow, which is the net cash generated from core business operations, then subtracting capital expenditures, reflecting investments in property, plant, and equipment. Free cash flow provides a clear picture of the cash available to investors after maintaining or expanding asset bases. Understanding this metric enables better assessment of a company's financial health and its ability to generate sustainable profits.

Why Free Cash Flow Matters to Investors

Free cash flow represents the cash a company generates after accounting for capital expenditures, providing a clearer picture of financial health compared to total cash flow. Investors prioritize free cash flow as it indicates the company's ability to maintain operations, pay dividends, reduce debt, and fund growth initiatives without relying on external financing. Strong free cash flow signals efficient management and sustainable profitability, making it a key metric for investment decisions.

Impact of Cash Flow on Business Valuation

Cash flow directly influences business valuation by reflecting the company's liquidity and operational efficiency, essential for sustaining daily activities and covering liabilities. Free cash flow, representing cash generated after capital expenditures, provides a clearer picture of the firm's capacity to generate value for shareholders and invest in growth. Investors prioritize businesses with strong free cash flow as it signals financial health, stability, and potential for dividend payments or debt reduction, thereby enhancing valuation metrics.

Common Misconceptions: Cash Flow and Free Cash Flow

Cash flow represents the total amount of money moving in and out of a business, while free cash flow specifically measures the cash available after capital expenditures are deducted from operating cash flow. A common misconception is that high cash flow always indicates strong financial health, ignoring that free cash flow provides a clearer picture of a company's ability to generate sustainable cash for investors and growth. Investors often overlook that free cash flow accounts for necessary reinvestments, making it a more precise metric for evaluating firm's financial flexibility.

How to Improve Cash Flow and Free Cash Flow

Improving cash flow and free cash flow involves accelerating receivables, managing payables strategically, and optimizing inventory levels to maintain liquidity. Implementing efficient expense control measures and investing in revenue-generating activities enhance cash inflow while reducing unnecessary capital expenditures increases free cash flow. Regular financial analysis and forecasting enable proactive decision-making to sustain healthy operational cash flow and maximize free cash flow for business growth.

Real-World Examples: Cash Flow vs Free Cash Flow in Action

Cash flow represents the total cash generated and used by a company in its operations, while free cash flow (FCF) specifically measures the cash available after capital expenditures necessary to maintain or expand asset base. For example, Apple reported a strong operating cash flow of $104 billion in 2023, but its free cash flow was approximately $90 billion after deducting capital expenditures. This distinction highlights that investors and analysts track free cash flow to assess a firm's ability to generate surplus cash for dividends, debt repayment, or reinvestment beyond day-to-day business needs.

Cash flow vs Free cash flow Infographic

difterm.com

difterm.com