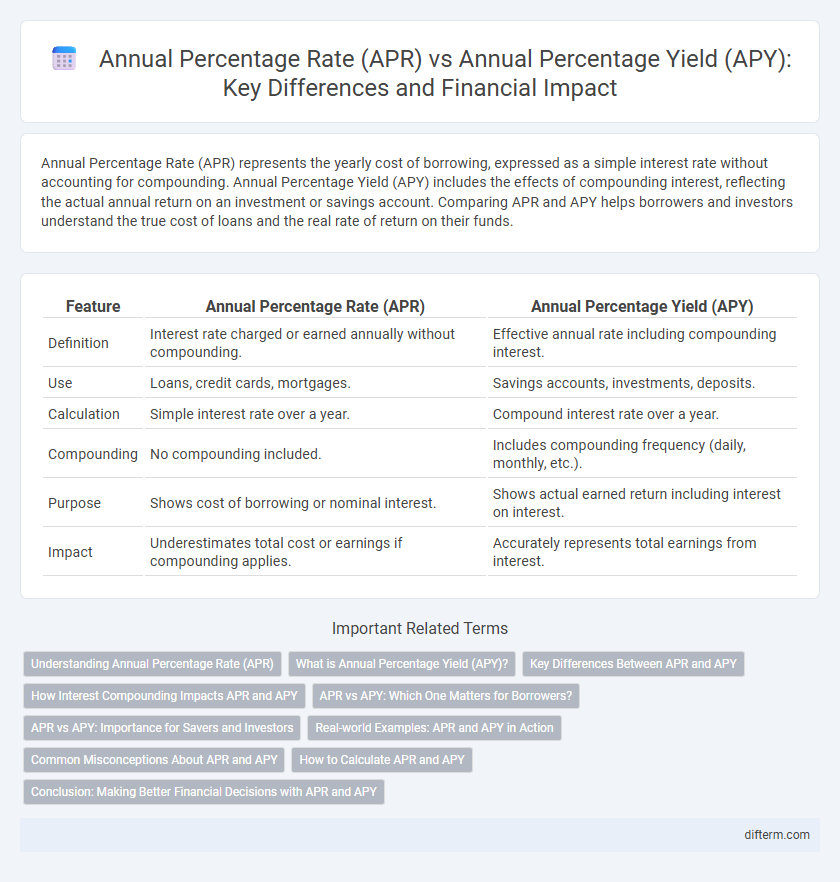

Annual Percentage Rate (APR) represents the yearly cost of borrowing, expressed as a simple interest rate without accounting for compounding. Annual Percentage Yield (APY) includes the effects of compounding interest, reflecting the actual annual return on an investment or savings account. Comparing APR and APY helps borrowers and investors understand the true cost of loans and the real rate of return on their funds.

Table of Comparison

| Feature | Annual Percentage Rate (APR) | Annual Percentage Yield (APY) |

|---|---|---|

| Definition | Interest rate charged or earned annually without compounding. | Effective annual rate including compounding interest. |

| Use | Loans, credit cards, mortgages. | Savings accounts, investments, deposits. |

| Calculation | Simple interest rate over a year. | Compound interest rate over a year. |

| Compounding | No compounding included. | Includes compounding frequency (daily, monthly, etc.). |

| Purpose | Shows cost of borrowing or nominal interest. | Shows actual earned return including interest on interest. |

| Impact | Underestimates total cost or earnings if compounding applies. | Accurately represents total earnings from interest. |

Understanding Annual Percentage Rate (APR)

Annual Percentage Rate (APR) represents the yearly cost of borrowing expressed as a percentage, including interest charges and certain fees, but excluding compounding effects. It provides a standardized measure for comparing loan costs across different financial products, such as mortgages, credit cards, and personal loans. Understanding APR helps consumers evaluate the true cost of credit and make informed decisions about borrowing options.

What is Annual Percentage Yield (APY)?

Annual Percentage Yield (APY) represents the real rate of return on an investment or savings account, factoring in the effect of compounding interest over a one-year period. Unlike the Annual Percentage Rate (APR), which reflects simple interest without compounding, APY provides a more accurate measure of the actual earnings or cost by incorporating the frequency of interest payments. Financial institutions use APY to help consumers compare the profitability of deposit accounts, ensuring transparency in potential returns.

Key Differences Between APR and APY

Annual Percentage Rate (APR) represents the yearly cost of borrowing without compounding, highlighting the interest rate charged on loans or credit. Annual Percentage Yield (APY) reflects the total interest earned on an investment or savings account, including compounding effects over a year. Key differences include APR focusing on loan costs with simple interest and APY emphasizing investment returns with compounded interest, impacting borrower expenses and investor gains differently.

How Interest Compounding Impacts APR and APY

Interest compounding significantly affects the difference between Annual Percentage Rate (APR) and Annual Percentage Yield (APY), as APR represents the nominal interest rate without accounting for compounding within the year, while APY includes the effect of compound interest, providing a true measure of annual return. More frequent compounding periods, such as daily or monthly, increase the APY compared to the APR by effectively earning interest on previously accrued interest. Understanding this distinction is crucial for comparing financial products like loans and investment accounts to evaluate their real cost or yield accurately.

APR vs APY: Which One Matters for Borrowers?

APR (Annual Percentage Rate) represents the yearly cost of borrowing expressed as a percentage, including interest and fees, while APY (Annual Percentage Yield) reflects the actual return on an investment accounting for compound interest. For borrowers, APR is the critical metric as it indicates the total interest paid over the loan term, helping to compare loan offers effectively. APY is more relevant to savers and investors since it measures earnings growth through compounding rather than borrowing costs.

APR vs APY: Importance for Savers and Investors

Annual Percentage Rate (APR) represents the cost of borrowing or the interest rate without compounding, directly affecting loan repayments, while Annual Percentage Yield (APY) includes compound interest, reflecting the true growth of investments or savings over time. Savers and investors benefit from understanding APY to accurately compare the returns on savings accounts, certificates of deposit, and investment products, as APY reveals the actual earning potential. APR is crucial for borrowers to assess the total cost of credit, whereas APY helps maximize returns by accounting for interest compounding frequency, making the distinction essential for informed financial decisions.

Real-world Examples: APR and APY in Action

APR represents the yearly interest charged on loans without accounting for compounding, while APY reflects the real rate of return including compound interest, crucial for investment comparison. For instance, a mortgage with a 4% APR may seem cheaper than a savings account offering 3.8% APY, but the compounding effect in APY often yields higher returns over time. Understanding these differences is essential for consumers evaluating credit cards, loans, or investment products to make informed financial decisions.

Common Misconceptions About APR and APY

Many individuals mistakenly believe that Annual Percentage Rate (APR) and Annual Percentage Yield (APY) represent the same financial metric, leading to confusion when comparing loan costs and investment returns. APR calculates the yearly interest cost without compounding, while APY accounts for compounding, reflecting the true annual return on investments or savings. Understanding that APR applies mainly to loans and credit costs, whereas APY pertains to earnings on savings or investments, is crucial for accurate financial decision-making.

How to Calculate APR and APY

Annual Percentage Rate (APR) is calculated by multiplying the periodic interest rate by the number of periods in a year, reflecting the simple interest cost of borrowing. Annual Percentage Yield (APY) accounts for compound interest and is calculated using the formula APY = (1 + r/n)n - 1, where r is the nominal interest rate and n is the number of compounding periods per year. Understanding the difference between APR and APY is crucial for comparing loan and investment products accurately.

Conclusion: Making Better Financial Decisions with APR and APY

Understanding the difference between Annual Percentage Rate (APR) and Annual Percentage Yield (APY) empowers consumers to compare loan and investment options accurately, as APR reflects borrowing costs while APY shows the actual earnings including compounding interest. Prioritizing APR for loans and APY for savings helps in evaluating true financial impacts, leading to more informed decisions. Utilizing these metrics ensures optimized financial planning and maximized returns or minimized costs over time.

Annual Percentage Rate vs Annual Percentage Yield Infographic

difterm.com

difterm.com