Callable bonds offer issuers the flexibility to redeem the bond before maturity, often resulting in higher yields to compensate investors for reinvestment risk. Non-callable bonds provide investors with predictable cash flows and protection from early redemption, making them more attractive for those seeking stable income. The choice between callable and non-callable bonds affects risk, yield, and investment strategy depending on market interest rate expectations.

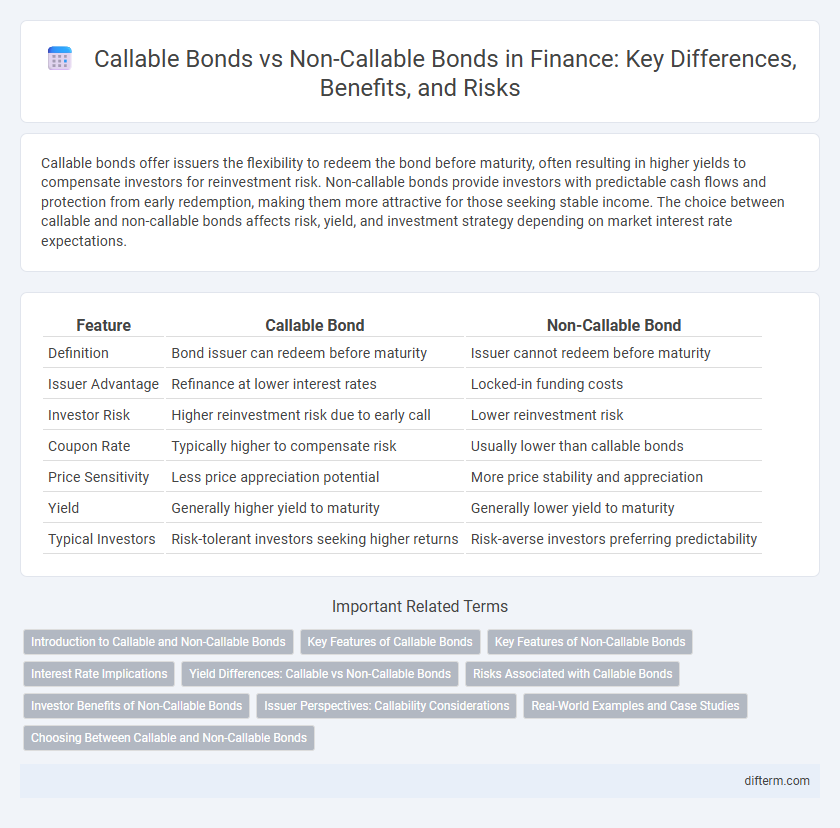

Table of Comparison

| Feature | Callable Bond | Non-Callable Bond |

|---|---|---|

| Definition | Bond issuer can redeem before maturity | Issuer cannot redeem before maturity |

| Issuer Advantage | Refinance at lower interest rates | Locked-in funding costs |

| Investor Risk | Higher reinvestment risk due to early call | Lower reinvestment risk |

| Coupon Rate | Typically higher to compensate risk | Usually lower than callable bonds |

| Price Sensitivity | Less price appreciation potential | More price stability and appreciation |

| Yield | Generally higher yield to maturity | Generally lower yield to maturity |

| Typical Investors | Risk-tolerant investors seeking higher returns | Risk-averse investors preferring predictability |

Introduction to Callable and Non-Callable Bonds

Callable bonds permit issuers to redeem the bond before maturity, offering flexibility to refinance debt at lower interest rates, but introducing reinvestment risk for investors. Non-callable bonds guarantee fixed interest payments until maturity, providing investors predictable income and protection from early redemption risk. The trade-off between callable and non-callable bonds centers on yield differences, with callable bonds typically offering higher yields to compensate investors for call risk.

Key Features of Callable Bonds

Callable bonds provide issuers the flexibility to redeem the bond before maturity, typically after a specified call protection period. These bonds often offer higher yields compared to non-callable bonds to compensate investors for the reinvestment risk associated with early redemption. Key features include a predetermined call price, call schedule, and potential price volatility linked to interest rate changes and issuer call decisions.

Key Features of Non-Callable Bonds

Non-callable bonds guarantee investors fixed interest payments until maturity without the risk of early redemption by the issuer, enhancing income predictability. These bonds typically offer lower yields compared to callable bonds because of the reduced reinvestment risk. Their fixed-term structure attracts conservative investors seeking stable cash flows and protection against interest rate volatility.

Interest Rate Implications

Callable bonds typically offer higher interest rates than non-callable bonds to compensate investors for the risk that the issuer may redeem the bond early if interest rates decline. Non-callable bonds provide more predictable cash flows and protect investors from reinvestment risk associated with falling interest rates. The interest rate implications highlight the trade-off between call risk and yield, influencing investor preference based on market rate expectations.

Yield Differences: Callable vs Non-Callable Bonds

Yield differences between callable and non-callable bonds arise primarily from call risk embedded in callable bonds, which typically offer higher yields to compensate investors for the issuer's option to redeem the bond before maturity. Non-callable bonds provide more stable cash flows, resulting in generally lower yields due to the absence of early redemption risk. Investors demand a yield premium on callable bonds to offset potential reinvestment risk and uncertain holding periods.

Risks Associated with Callable Bonds

Callable bonds carry higher risks due to the issuer's right to redeem the bond before maturity, which can lead to reinvestment risk for investors if interest rates decline. This early redemption often forces bondholders to reinvest at lower yields, reducing expected returns. The call feature also introduces market price volatility, making callable bonds less predictable and potentially less attractive compared to non-callable bonds.

Investor Benefits of Non-Callable Bonds

Non-callable bonds provide investors with predictable cash flows, eliminating the risk of early redemption that reduces interest income. They offer greater price stability and protection against reinvestment risk, as issuers cannot redeem the bond before maturity. This certainty enhances portfolio planning and long-term income strategies for investors seeking dependable returns.

Issuer Perspectives: Callability Considerations

Issuers prefer callable bonds for their flexibility to refinance debt if interest rates decline, reducing interest expenses and managing liabilities efficiently. Non-callable bonds, while typically carrying lower yields due to investor protection against early redemption, limit issuer options for restructuring debt during favorable market conditions. Callability considerations directly impact issuer cost of capital and strategic debt management decisions in dynamic financial environments.

Real-World Examples and Case Studies

Callable bonds issued by companies like Verizon have allowed issuers to refinance debt at lower interest rates, demonstrating practical advantages in fluctuating markets. In contrast, non-callable bonds such as U.S. Treasury securities provide investors with predictable income streams and protection against early redemption risk, emphasizing their appeal for conservative portfolios. Case studies from the 2008 financial crisis highlight how callable bonds exposed investors to reinvestment risk during declining rates, whereas holders of non-callable bonds maintained stable returns.

Choosing Between Callable and Non-Callable Bonds

Choosing between callable and non-callable bonds depends on the investor's risk tolerance and income stability preferences. Callable bonds offer higher yields to compensate for issuer's early redemption risk, benefiting issuers when interest rates decline but exposing investors to reinvestment risk. Non-callable bonds provide fixed income certainty with no call risk, suitable for investors seeking predictable cash flows and long-term investment security.

Callable bond vs Non-callable bond Infographic

difterm.com

difterm.com