Hedge funds primarily invest in publicly traded securities to generate short-term returns through diverse trading strategies, while venture capital focuses on long-term investments in early-stage private startups with high growth potential. Hedge funds often employ leverage and derivatives to manage risk and enhance returns, whereas venture capital provides capital in exchange for equity stakes and actively supports portfolio companies' development. Investors choose hedge funds for liquidity and market-driven performance, whereas venture capital appeals to those seeking exposure to innovative businesses and significant capital appreciation over time.

Table of Comparison

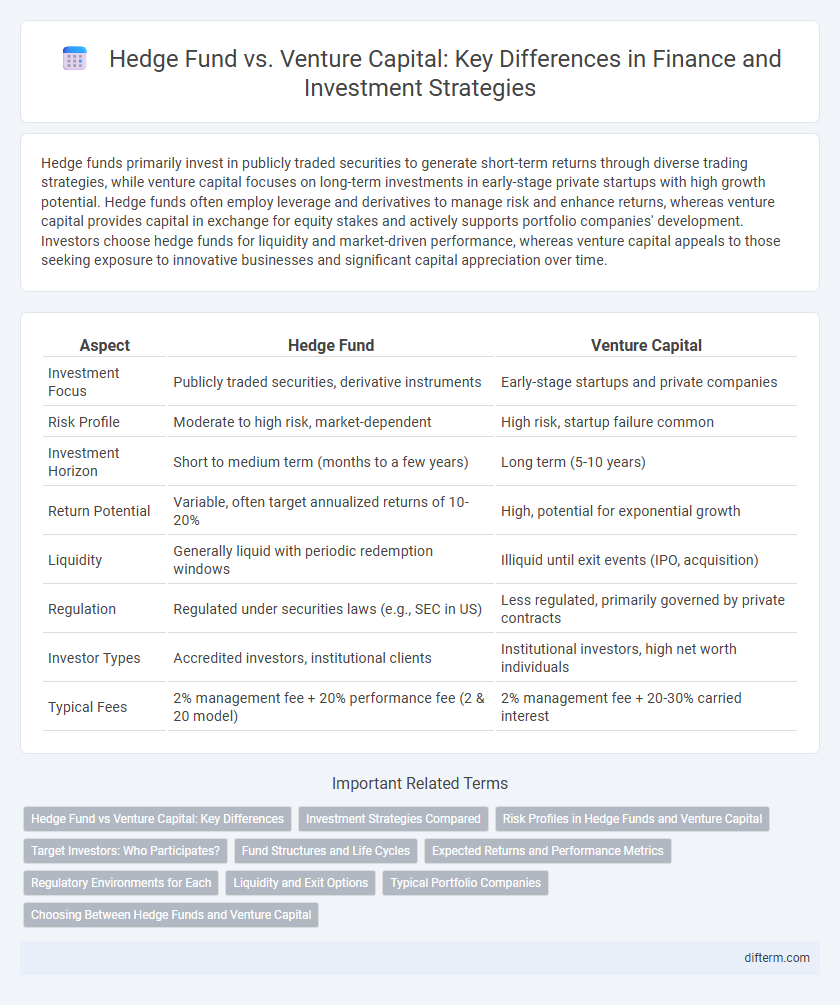

| Aspect | Hedge Fund | Venture Capital |

|---|---|---|

| Investment Focus | Publicly traded securities, derivative instruments | Early-stage startups and private companies |

| Risk Profile | Moderate to high risk, market-dependent | High risk, startup failure common |

| Investment Horizon | Short to medium term (months to a few years) | Long term (5-10 years) |

| Return Potential | Variable, often target annualized returns of 10-20% | High, potential for exponential growth |

| Liquidity | Generally liquid with periodic redemption windows | Illiquid until exit events (IPO, acquisition) |

| Regulation | Regulated under securities laws (e.g., SEC in US) | Less regulated, primarily governed by private contracts |

| Investor Types | Accredited investors, institutional clients | Institutional investors, high net worth individuals |

| Typical Fees | 2% management fee + 20% performance fee (2 & 20 model) | 2% management fee + 20-30% carried interest |

Hedge Fund vs Venture Capital: Key Differences

Hedge funds primarily invest in publicly traded securities to maximize short-term returns using strategies like leverage, derivatives, and short selling, targeting high liquidity and flexibility. Venture capital focuses on funding early-stage startups and high-growth companies, emphasizing long-term equity stakes and active involvement in company development. Key differences include investment horizon, risk tolerance, asset types, and return expectations.

Investment Strategies Compared

Hedge funds employ diverse investment strategies including long-short equity, market neutral, and global macro to generate returns across various market conditions. Venture capital focuses primarily on early-stage investments, backing startups and innovative companies with high growth potential. While hedge funds prioritize liquidity and short- to medium-term gains, venture capital targets long-term value creation through equity stakes in emerging businesses.

Risk Profiles in Hedge Funds and Venture Capital

Hedge funds typically exhibit a varied risk profile, employing strategies like short selling, leverage, and derivatives to achieve absolute returns while managing downside risk. Venture capital investments carry higher risk due to early-stage company exposure but offer substantial upside potential through equity stakes in high-growth startups. Understanding the distinct risk-return trade-offs is crucial for investors allocating capital between hedge funds and venture capital opportunities.

Target Investors: Who Participates?

Hedge funds primarily attract high-net-worth individuals and institutional investors seeking liquidity and diverse asset exposure with shorter investment horizons. Venture capital targets accredited investors, including wealthy individuals and institutional funds, aiming for high-growth startups with longer-term commitments. Both require significant capital but differ in risk tolerance and investment timelines.

Fund Structures and Life Cycles

Hedge funds typically operate as open-ended funds allowing continuous investor entry and exit, with a flexible life cycle and short-term investment horizons focused on liquid assets. Venture capital funds are structured as closed-end limited partnerships with fixed terms of 10 to 12 years, emphasizing long-term investments in illiquid startup equity. The structural differences impact liquidity, risk profile, and investor commitment, shaping their distinct fund management approaches and return expectations.

Expected Returns and Performance Metrics

Hedge funds typically target annualized returns between 8% and 15%, employing volatility-adjusted metrics like the Sharpe ratio and Sortino ratio to assess risk-adjusted performance. Venture capital investments aim for higher returns, often exceeding 20% IRR, evaluated through multiples on invested capital (MOIC) and time-weighted internal rates of return (IRR) across portfolio startups. Hedge funds emphasize liquidity and short-to-medium term performance, while venture capital focuses on long-term value creation and exit valuations via IPOs or acquisitions.

Regulatory Environments for Each

Hedge funds operate under the Securities and Exchange Commission (SEC) regulations primarily through the Investment Advisers Act of 1940, requiring registration and adherence to disclosure and compliance mandates to protect investors and maintain market integrity. Venture capital firms typically benefit from exemptions under the SEC's Regulation D, allowing them to raise capital with less stringent reporting requirements, focusing instead on high-risk, long-term investments in startups and early-stage companies. Differences in regulatory oversight result in hedge funds facing more rigorous compliance standards compared to the relatively flexible regulatory environment governing venture capital investments.

Liquidity and Exit Options

Hedge funds offer higher liquidity with daily or monthly redemption opportunities, allowing investors to access capital relatively quickly. Venture capital investments are typically illiquid, often requiring 7 to 10 years to reach exit events like IPOs or acquisitions. The extended lock-up periods in venture capital contrast with the flexible exit strategies available in hedge funds, influencing investor risk tolerance and investment horizon.

Typical Portfolio Companies

Hedge funds typically invest in publicly traded securities such as stocks, bonds, derivatives, and currencies, aiming for short- to medium-term returns through strategies like long/short equity, arbitrage, and global macro. Venture capital funds focus on early-stage startups and high-growth companies in technology, healthcare, and biotech sectors, providing capital in exchange for equity to support innovation and scalability. Portfolio companies in hedge funds are usually established firms with liquidity, while venture capital portfolios emphasize high-risk, high-reward private enterprises with potential for exponential growth.

Choosing Between Hedge Funds and Venture Capital

Choosing between hedge funds and venture capital depends on investment goals and risk tolerance. Hedge funds typically offer liquid assets with diverse strategies targeting short-term gains, while venture capital focuses on long-term growth by investing in early-stage startups with higher risk and potential for substantial returns. Investors seeking steady liquidity may prefer hedge funds, whereas those aiming for exponential growth in innovative companies might opt for venture capital.

Hedge Fund vs Venture Capital Infographic

difterm.com

difterm.com