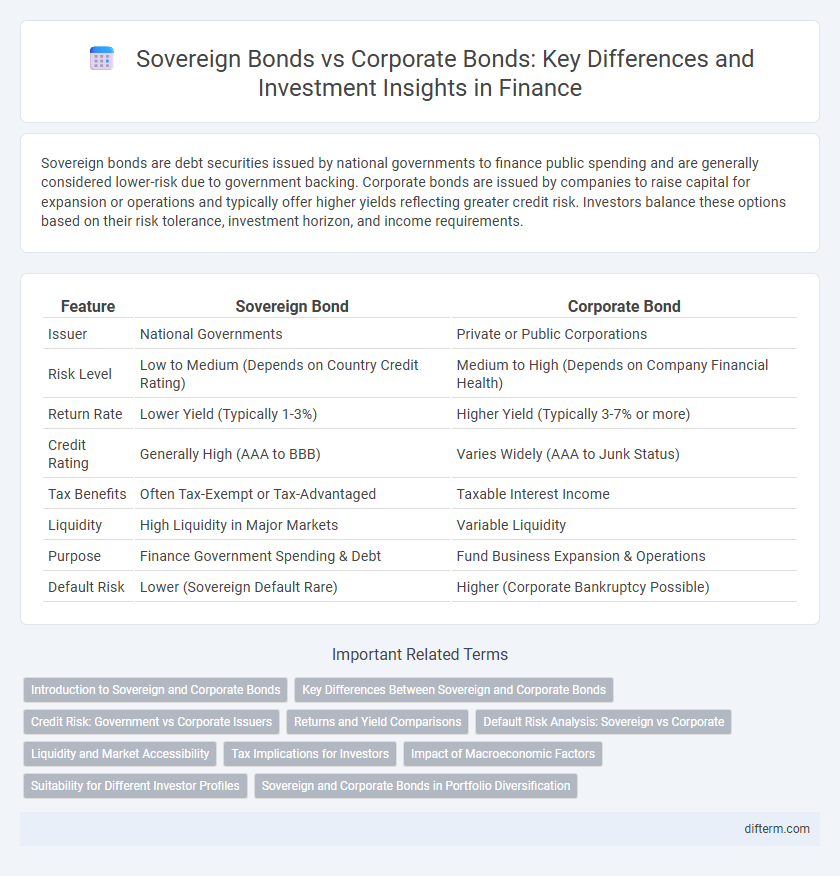

Sovereign bonds are debt securities issued by national governments to finance public spending and are generally considered lower-risk due to government backing. Corporate bonds are issued by companies to raise capital for expansion or operations and typically offer higher yields reflecting greater credit risk. Investors balance these options based on their risk tolerance, investment horizon, and income requirements.

Table of Comparison

| Feature | Sovereign Bond | Corporate Bond |

|---|---|---|

| Issuer | National Governments | Private or Public Corporations |

| Risk Level | Low to Medium (Depends on Country Credit Rating) | Medium to High (Depends on Company Financial Health) |

| Return Rate | Lower Yield (Typically 1-3%) | Higher Yield (Typically 3-7% or more) |

| Credit Rating | Generally High (AAA to BBB) | Varies Widely (AAA to Junk Status) |

| Tax Benefits | Often Tax-Exempt or Tax-Advantaged | Taxable Interest Income |

| Liquidity | High Liquidity in Major Markets | Variable Liquidity |

| Purpose | Finance Government Spending & Debt | Fund Business Expansion & Operations |

| Default Risk | Lower (Sovereign Default Rare) | Higher (Corporate Bankruptcy Possible) |

Introduction to Sovereign and Corporate Bonds

Sovereign bonds are debt securities issued by national governments to finance public spending and manage national debt, typically offering lower risk due to government backing. Corporate bonds are debt instruments issued by companies to raise capital for business expansion or operations, often yielding higher returns but with increased credit risk compared to sovereign bonds. Investors evaluate factors like credit ratings, interest rates, and economic conditions when choosing between sovereign and corporate bonds for portfolio diversification.

Key Differences Between Sovereign and Corporate Bonds

Sovereign bonds are debt securities issued by national governments, typically considered lower-risk due to government backing and ability to generate tax revenue, whereas corporate bonds are issued by companies and carry higher credit risk dependent on the issuer's financial health. Sovereign bonds often have longer maturities and lower yields, reflecting their relative safety, while corporate bonds offer higher yields to compensate for increased default risk and market sensitivity. Credit ratings from agencies like Moody's or S&P play a crucial role in assessing risk levels, with sovereign bonds often rated higher than corporate bonds of equivalent maturity.

Credit Risk: Government vs Corporate Issuers

Sovereign bonds generally exhibit lower credit risk compared to corporate bonds due to the backing of government authority and taxation power, reducing default probability. Corporate bonds carry higher credit risk reflecting company-specific factors such as operational performance, market competition, and financial leverage. Credit rating agencies often assign higher ratings to sovereign bonds, which translates into lower yield spreads relative to corporate bonds within similar maturity profiles.

Returns and Yield Comparisons

Sovereign bonds generally offer lower yields compared to corporate bonds due to their lower credit risk and higher credit ratings, making them a safer investment option. Corporate bonds tend to provide higher returns to compensate for increased default risk, especially in lower-rated or high-yield categories. Yield spreads between corporate and sovereign bonds fluctuate based on market conditions, economic outlook, and issuer creditworthiness, directly affecting the risk-return tradeoff for investors.

Default Risk Analysis: Sovereign vs Corporate

Sovereign bonds generally exhibit lower default risk compared to corporate bonds due to government backing and taxation authority, which enhances repayment capacity. Corporate bonds face higher default risk influenced by company financial health, industry conditions, and market volatility. Credit rating agencies assess these risks by evaluating factors such as debt levels, economic environment, and cash flow stability for sovereign issuers, while focusing on creditworthiness, profitability, and operational risks for corporations.

Liquidity and Market Accessibility

Sovereign bonds typically offer higher liquidity and broader market accessibility due to government backing and global demand, making them easier to trade in secondary markets. Corporate bonds may exhibit lower liquidity, especially for smaller issuers, as they depend on company creditworthiness and investor interest, limiting market accessibility. Investors prioritize sovereign debt for easier entry and exit, while corporate bonds require deeper analysis of market conditions and issuer credit profiles.

Tax Implications for Investors

Sovereign bonds often offer tax advantages such as exemption from state and local taxes, making them attractive to investors seeking tax-efficient income. Corporate bonds typically do not provide similar tax benefits, with interest income subject to federal, state, and local taxation. Understanding the differential tax treatment is crucial for optimizing after-tax returns in fixed-income portfolios.

Impact of Macroeconomic Factors

Macroeconomic factors such as interest rate fluctuations, inflation rates, and GDP growth critically influence the performance and risk profiles of sovereign bonds and corporate bonds. Sovereign bonds often react more directly to national fiscal policies and geopolitical stability, while corporate bonds are more sensitive to industry trends and corporate earnings influenced by economic cycles. Understanding these distinctions helps investors assess credit risk, yield expectations, and market volatility in differing economic environments.

Suitability for Different Investor Profiles

Sovereign bonds typically suit risk-averse investors seeking stable income backed by government creditworthiness, providing lower default risk but modest returns. Corporate bonds appeal to investors willing to accept higher risk for greater yield potential, with suitability depending on the issuer's credit rating and financial health. Portfolio diversification benefits arise from balancing sovereign bonds' safety and corporate bonds' income growth potential.

Sovereign and Corporate Bonds in Portfolio Diversification

Sovereign bonds, issued by governments, offer lower risk and stable returns, making them essential for portfolio diversification by providing a safety net during market volatility. Corporate bonds, issued by companies, typically yield higher returns but carry greater credit risk, serving to enhance portfolio growth potential. Combining sovereign and corporate bonds balances risk and reward, optimizing overall portfolio resilience and income generation.

Sovereign bond vs Corporate bond Infographic

difterm.com

difterm.com