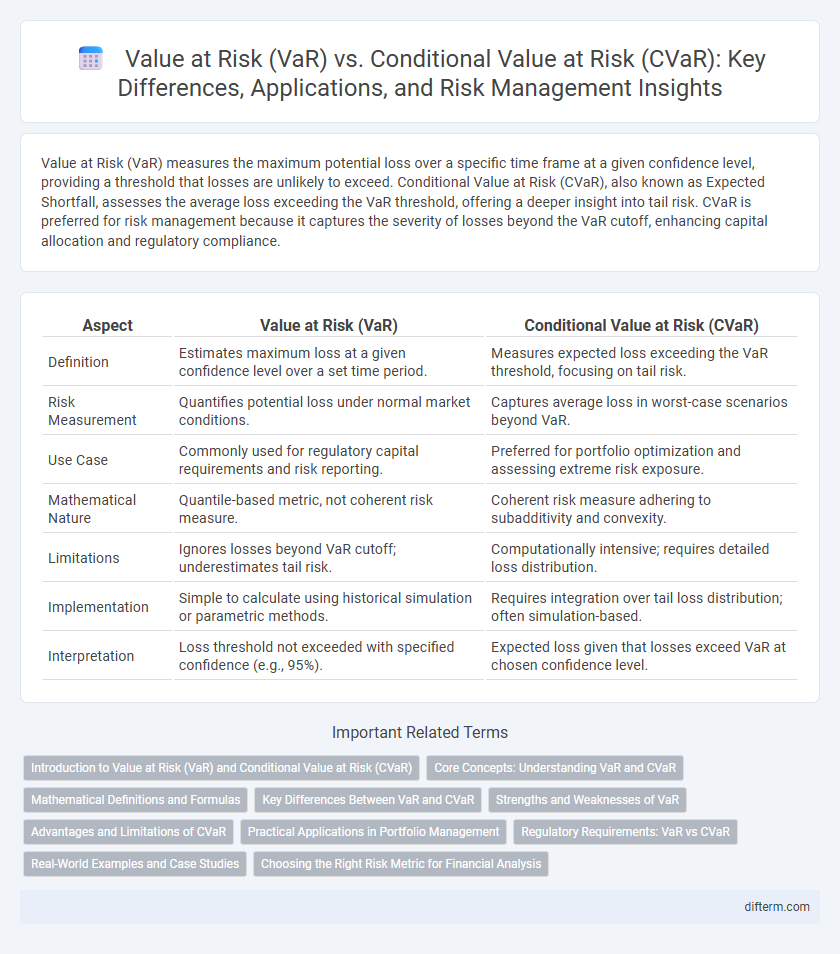

Value at Risk (VaR) measures the maximum potential loss over a specific time frame at a given confidence level, providing a threshold that losses are unlikely to exceed. Conditional Value at Risk (CVaR), also known as Expected Shortfall, assesses the average loss exceeding the VaR threshold, offering a deeper insight into tail risk. CVaR is preferred for risk management because it captures the severity of losses beyond the VaR cutoff, enhancing capital allocation and regulatory compliance.

Table of Comparison

| Aspect | Value at Risk (VaR) | Conditional Value at Risk (CVaR) |

|---|---|---|

| Definition | Estimates maximum loss at a given confidence level over a set time period. | Measures expected loss exceeding the VaR threshold, focusing on tail risk. |

| Risk Measurement | Quantifies potential loss under normal market conditions. | Captures average loss in worst-case scenarios beyond VaR. |

| Use Case | Commonly used for regulatory capital requirements and risk reporting. | Preferred for portfolio optimization and assessing extreme risk exposure. |

| Mathematical Nature | Quantile-based metric, not coherent risk measure. | Coherent risk measure adhering to subadditivity and convexity. |

| Limitations | Ignores losses beyond VaR cutoff; underestimates tail risk. | Computationally intensive; requires detailed loss distribution. |

| Implementation | Simple to calculate using historical simulation or parametric methods. | Requires integration over tail loss distribution; often simulation-based. |

| Interpretation | Loss threshold not exceeded with specified confidence (e.g., 95%). | Expected loss given that losses exceed VaR at chosen confidence level. |

Introduction to Value at Risk (VaR) and Conditional Value at Risk (CVaR)

Value at Risk (VaR) quantifies the maximum potential loss over a specific time frame at a given confidence level, serving as a fundamental risk metric in finance. Conditional Value at Risk (CVaR), also known as Expected Shortfall, provides the average loss exceeding the VaR threshold, offering a more comprehensive measure of tail risk. Both VaR and CVaR are critical for portfolio risk management, with CVaR addressing limitations in VaR by incorporating extreme loss scenarios.

Core Concepts: Understanding VaR and CVaR

Value at Risk (VaR) quantifies the maximum expected loss over a specific time frame at a given confidence level, serving as a threshold for risk exposure. Conditional Value at Risk (CVaR), also known as Expected Shortfall, measures the average loss exceeding the VaR threshold, providing deeper insight into tail risk and extreme market events. Both metrics are essential for portfolio risk management, with CVaR offering enhanced sensitivity to downside risk compared to VaR.

Mathematical Definitions and Formulas

Value at Risk (VaR) quantifies the maximum potential loss over a given time horizon at a specified confidence level, mathematically defined as the quantile function \( \text{VaR}_\alpha = \inf \{x \in \mathbb{R} : F_X(x) \geq \alpha \} \), where \(F_X\) is the cumulative distribution function of portfolio losses and \( \alpha \) is the confidence level. Conditional Value at Risk (CVaR), also known as Expected Shortfall, measures the expected loss exceeding the VaR threshold, formulated as \( \text{CVaR}_\alpha = \mathbb{E}[X | X \geq \text{VaR}_\alpha] \) or equivalently the integral of tail losses beyond \( \text{VaR}_\alpha \). CVaR provides a coherent risk measure by accounting for the severity of tail risk, unlike VaR which only identifies a quantile cutoff without considering loss magnitudes beyond that quantile.

Key Differences Between VaR and CVaR

Value at Risk (VaR) estimates the maximum potential loss at a given confidence level over a specific time horizon, while Conditional Value at Risk (CVaR) measures the expected loss exceeding the VaR threshold, providing a deeper insight into tail risk. VaR is limited by its focus on a single quantile of the loss distribution, whereas CVaR captures information about the shape and severity of losses beyond that quantile. Financial institutions prefer CVaR for more comprehensive risk management because it accounts for extreme losses and provides a coherent risk measure under regulations like Basel III.

Strengths and Weaknesses of VaR

Value at Risk (VaR) provides a clear, quantifiable measure of the maximum expected loss over a defined period at a given confidence level, making it a popular risk metric in finance. Its strengths include simplicity, ease of communication, and regulatory acceptance, but VaR's major weaknesses are its inability to capture tail risk and lack of subadditivity, which can underestimate potential losses in extreme market conditions. Unlike Conditional Value at Risk (CVaR), VaR does not account for the severity of losses beyond the VaR threshold, limiting its effectiveness in stress testing and risk management strategies.

Advantages and Limitations of CVaR

Conditional Value at Risk (CVaR) offers a more comprehensive risk assessment by evaluating the expected losses beyond the Value at Risk (VaR) threshold, capturing tail risk in financial portfolios more effectively. CVaR provides advantages in stress testing and optimizing portfolios by accounting for extreme market events, which traditional VaR may underestimate. However, CVaR's limitations include increased computational complexity and reliance on accurate tail distribution modeling, potentially leading to estimation errors in highly volatile markets.

Practical Applications in Portfolio Management

Value at Risk (VaR) quantifies the maximum expected loss over a specified time frame at a given confidence level, serving as a primary risk metric for portfolio managers to allocate capital efficiently. Conditional Value at Risk (CVaR) extends VaR by estimating the expected loss exceeding the VaR threshold, providing a more comprehensive view of tail risk and helping in stress testing and scenario analysis. Portfolio optimization processes often integrate CVaR to enhance risk-adjusted returns by minimizing extreme losses, making it a preferred tool for managing portfolios exposed to heavy-tailed risk distributions.

Regulatory Requirements: VaR vs CVaR

Regulatory requirements often mandate the use of Value at Risk (VaR) due to its simplicity and widespread acceptance in quantifying potential portfolio losses under normal market conditions. Conditional Value at Risk (CVaR), also known as Expected Shortfall, is increasingly recommended by regulatory bodies like Basel III for capturing tail risk and providing a more comprehensive risk assessment during extreme market events. Financial institutions adopt CVaR for stress testing and capital adequacy frameworks, enhancing compliance with evolving risk management standards.

Real-World Examples and Case Studies

Value at Risk (VaR) estimates potential losses in a portfolio over a fixed time frame, widely used by banks like JPMorgan to assess daily risk exposure. Conditional Value at Risk (CVaR) offers a deeper insight by quantifying the expected losses beyond the VaR threshold, as demonstrated in portfolio stress testing during the 2008 financial crisis by institutions such as Goldman Sachs. Real-world case studies highlight CVaR's superior effectiveness in capturing tail risk compared to VaR, especially in markets with extreme volatility or systemic shocks.

Choosing the Right Risk Metric for Financial Analysis

Value at Risk (VaR) estimates the maximum potential loss over a given time frame at a specific confidence level but fails to capture losses beyond that threshold. Conditional Value at Risk (CVaR), also known as Expected Shortfall, provides a more comprehensive risk assessment by averaging losses exceeding the VaR, making it more sensitive to tail risk and extreme market events. Financial analysts should select CVaR when dealing with heavy-tailed distributions or when a deeper understanding of extreme losses is crucial for robust risk management.

Value at Risk vs Conditional Value at Risk Infographic

difterm.com

difterm.com