Cross-currency swaps involve the exchange of principal and interest payments in different currencies, mitigating both interest rate and foreign exchange risk, whereas interest rate swaps solely exchange interest payments in the same currency to manage exposure to fluctuations in interest rates. Cross-currency swaps are essential for multinational corporations seeking to hedge against currency volatility in addition to interest rate changes. Interest rate swaps are typically used by entities aiming to convert fixed-rate debt to floating rate or vice versa, optimizing interest expense management within a single currency environment.

Table of Comparison

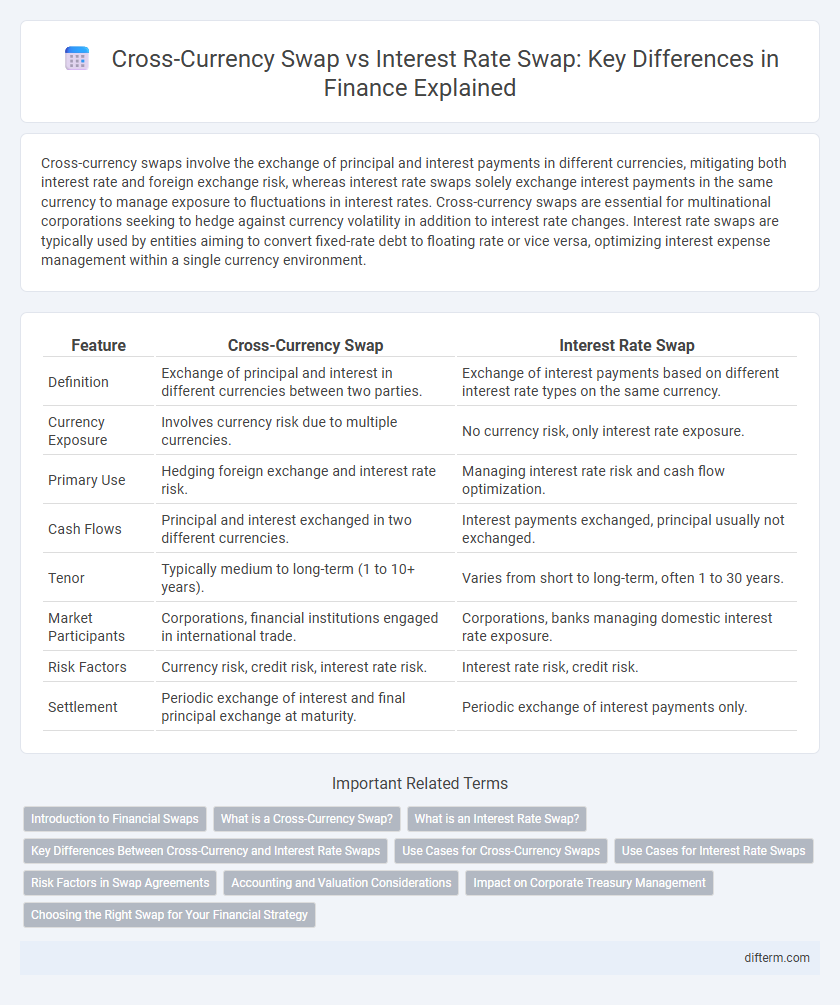

| Feature | Cross-Currency Swap | Interest Rate Swap |

|---|---|---|

| Definition | Exchange of principal and interest in different currencies between two parties. | Exchange of interest payments based on different interest rate types on the same currency. |

| Currency Exposure | Involves currency risk due to multiple currencies. | No currency risk, only interest rate exposure. |

| Primary Use | Hedging foreign exchange and interest rate risk. | Managing interest rate risk and cash flow optimization. |

| Cash Flows | Principal and interest exchanged in two different currencies. | Interest payments exchanged, principal usually not exchanged. |

| Tenor | Typically medium to long-term (1 to 10+ years). | Varies from short to long-term, often 1 to 30 years. |

| Market Participants | Corporations, financial institutions engaged in international trade. | Corporations, banks managing domestic interest rate exposure. |

| Risk Factors | Currency risk, credit risk, interest rate risk. | Interest rate risk, credit risk. |

| Settlement | Periodic exchange of interest and final principal exchange at maturity. | Periodic exchange of interest payments only. |

Introduction to Financial Swaps

Financial swaps are derivative contracts that enable two parties to exchange cash flows or financial instruments. Cross-currency swaps involve exchanging principal and interest payments in different currencies, managing both interest rate risk and foreign exchange exposure. Interest rate swaps, by contrast, typically involve exchanging fixed-rate and floating-rate interest payments within the same currency, addressing interest rate risk exclusively.

What is a Cross-Currency Swap?

A cross-currency swap is a financial derivative in which two parties exchange principal and interest payments in different currencies, allowing them to manage foreign exchange risk and interest rate exposure simultaneously. This instrument involves the exchange of principal amounts at the beginning and maturity of the contract, with periodic interest payments based on respective interest rates in each currency. Cross-currency swaps are commonly used by multinational corporations and financial institutions to hedge currency risk and optimize funding costs.

What is an Interest Rate Swap?

An interest rate swap is a financial derivative contract where two parties exchange cash flows based on differing interest rate benchmarks, typically swapping fixed-rate payments for floating-rate payments tied to an index like LIBOR or SOFR. This instrument is primarily used to manage interest rate risk, optimize debt servicing costs, or alter the interest rate exposure on existing liabilities or assets. Unlike cross-currency swaps, interest rate swaps do not involve exchanging principal or currency amounts, focusing solely on the interest payments in a single currency.

Key Differences Between Cross-Currency and Interest Rate Swaps

Cross-currency swaps involve the exchange of principal and interest payments in different currencies, offering solutions for managing foreign exchange risk and funding needs across currencies, while interest rate swaps typically exchange fixed and floating interest payments within the same currency to manage interest rate exposure. Cross-currency swaps require consideration of both currency fluctuations and interest rate movements, whereas interest rate swaps focus solely on interest rate variations without currency risk. The complexity and risk profile of cross-currency swaps are higher due to currency risk, making them essential for multinational corporations and financial institutions operating in multiple currencies.

Use Cases for Cross-Currency Swaps

Cross-currency swaps are primarily used by multinational corporations and financial institutions to hedge exposure to foreign exchange rate fluctuations and interest rate risk simultaneously across different currencies. These swaps facilitate financing in foreign currencies at more favorable terms, enabling companies to match cash flows with their currency liabilities and reduce transaction costs compared to borrowing directly in foreign markets. Interest rate swaps, by contrast, focus solely on exchanging interest payments in the same currency, making cross-currency swaps essential for managing currency risk alongside interest rate risk in global financial operations.

Use Cases for Interest Rate Swaps

Interest rate swaps are commonly used by corporations and financial institutions to hedge against fluctuations in interest rates on variable-rate debt, thereby stabilizing cash flows and reducing borrowing costs. These swaps allow parties to exchange fixed interest payments for floating rate obligations, making them ideal for managing interest rate exposure in environments with changing monetary policies. Unlike cross-currency swaps, interest rate swaps do not involve principal exchange or currency risk, focusing purely on optimizing interest expense or income.

Risk Factors in Swap Agreements

Cross-currency swaps carry significant foreign exchange risk due to fluctuations in exchange rates between the two currencies involved, which can lead to basis risk if interest rate movements diverge across markets. Interest rate swaps primarily expose counterparties to interest rate risk, where changes in underlying benchmark rates like LIBOR or SOFR affect payment obligations, potentially resulting in cash flow mismatches. Both swaps involve credit risk from counterparty default and liquidity risk, but cross-currency swaps typically have more complex settlement mechanics that heighten operational and settlement risks.

Accounting and Valuation Considerations

Cross-currency swaps require careful accounting for both foreign exchange risk and interest rate differentials, often involving separate valuation of principal and interest components under IFRS or US GAAP standards. Interest rate swaps focus primarily on the changes in interest rate exposures, with fair value measurement reflecting variations in interest rate curves and credit risk adjustments. Valuation of cross-currency swaps demands incorporation of exchange rate fluctuations and discounting cash flows in multiple currencies, whereas interest rate swaps require discounting based solely on the domestic interest rate curve.

Impact on Corporate Treasury Management

Cross-currency swaps enable corporate treasuries to manage both interest rate risk and foreign exchange risk by exchanging principal and interest payments in different currencies, enhancing liquidity and hedging capabilities in multinational operations. Interest rate swaps focus solely on interest rate exposure by exchanging fixed for floating rate payments within the same currency, streamlining interest cost management but leaving currency risk unaddressed. Implementing cross-currency swaps involves more complexity and monitoring but offers comprehensive risk mitigation critical for corporates with global financing needs.

Choosing the Right Swap for Your Financial Strategy

Cross-currency swaps involve exchanging principal and interest payments in different currencies, useful for managing currency risk and funding foreign investments. Interest rate swaps focus on exchanging fixed and floating interest payments within the same currency, ideal for hedging interest rate exposure. Selecting the right swap depends on your exposure to currency fluctuations versus interest rate volatility and the specific risk management objectives of your financial strategy.

Cross-currency swap vs interest rate swap Infographic

difterm.com

difterm.com