A credit score is a numerical summary of your creditworthiness, while a credit report provides a detailed history of your credit activity, including loans, payments, and inquiries. Lenders use credit scores to quickly assess risk, whereas credit reports offer comprehensive data that supports credit decisions and dispute resolution. Understanding both elements is crucial for managing personal finance and improving borrowing opportunities.

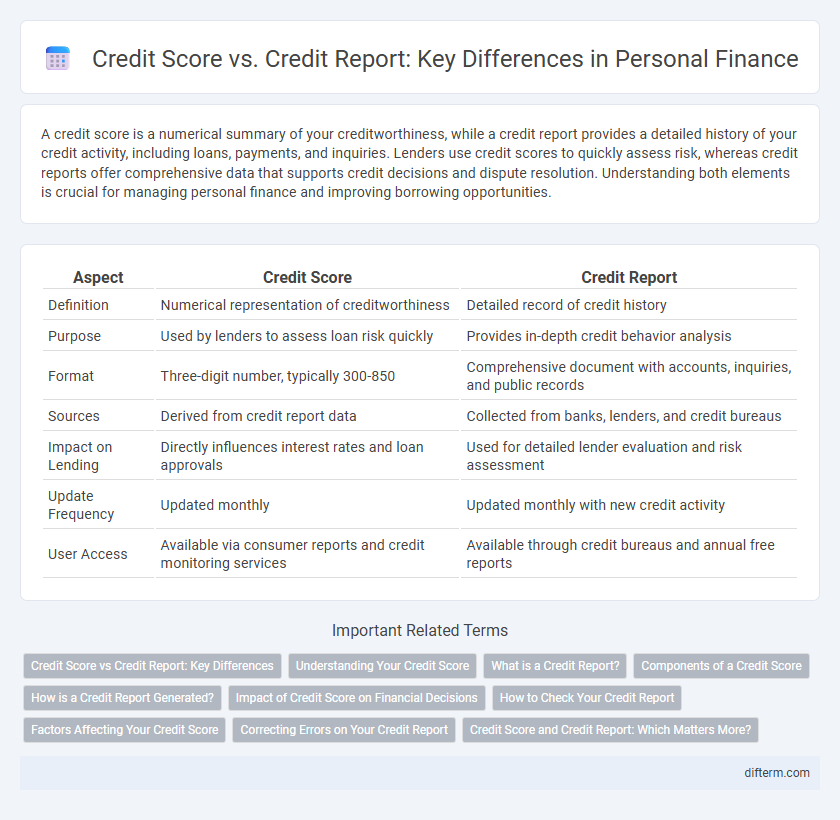

Table of Comparison

| Aspect | Credit Score | Credit Report |

|---|---|---|

| Definition | Numerical representation of creditworthiness | Detailed record of credit history |

| Purpose | Used by lenders to assess loan risk quickly | Provides in-depth credit behavior analysis |

| Format | Three-digit number, typically 300-850 | Comprehensive document with accounts, inquiries, and public records |

| Sources | Derived from credit report data | Collected from banks, lenders, and credit bureaus |

| Impact on Lending | Directly influences interest rates and loan approvals | Used for detailed lender evaluation and risk assessment |

| Update Frequency | Updated monthly | Updated monthly with new credit activity |

| User Access | Available via consumer reports and credit monitoring services | Available through credit bureaus and annual free reports |

Credit Score vs Credit Report: Key Differences

Credit scores provide a numerical summary of an individual's creditworthiness, typically ranging from 300 to 850, while credit reports offer a detailed history of credit activity, including account types, payment history, and public records. Credit scores are used by lenders to quickly assess risk, whereas credit reports contain comprehensive data that influences credit scoring models and lending decisions. Understanding the distinction between credit score and credit report is crucial for effective financial management and improving credit outcomes.

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness, ranging typically from 300 to 850, and is derived from the data in your credit report. Key factors influencing your credit score include payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Monitoring your credit report regularly helps identify inaccuracies that may negatively impact your credit score and overall financial health.

What is a Credit Report?

A credit report is a detailed record of an individual's credit history, including loan accounts, credit card usage, payment history, and outstanding debts. It is compiled by credit bureaus such as Equifax, Experian, and TransUnion, and provides lenders with crucial information to assess creditworthiness. Unlike a credit score, which is a numerical value, the credit report contains comprehensive data that influences lending decisions.

Components of a Credit Score

A credit score is a numerical representation of creditworthiness derived from key components including payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. Payment history typically accounts for approximately 35% of the score, emphasizing the importance of timely debt repayments. Credit utilization, representing about 30%, measures the ratio of current credit card balances to credit limits, influencing the overall score significantly.

How is a Credit Report Generated?

A credit report is generated by credit bureaus collecting detailed information from lenders, credit card companies, and public records to compile a comprehensive financial history. Data includes payment history, outstanding debts, credit inquiries, and account types, which are aggregated to reflect an individual's creditworthiness. This report serves as the foundation for calculating the credit score used by financial institutions in lending decisions.

Impact of Credit Score on Financial Decisions

Credit scores play a critical role in shaping financial decisions by influencing loan approvals, interest rates, and credit limits, with higher scores often securing more favorable terms. Lenders utilize credit scores as quick indicators of creditworthiness, directly impacting borrowing costs and eligibility for various financial products. Understanding the difference between credit scores, which are numerical summaries, and detailed credit reports can help consumers better manage their financial reputations and improve outcomes in credit evaluations.

How to Check Your Credit Report

To check your credit report, visit authorized credit bureaus such as Equifax, Experian, or TransUnion, which provide detailed information on your credit history and current credit status. Accessing your credit report typically involves submitting your personal information, such as Social Security number, and may be free once per year through AnnualCreditReport.com. Regularly monitoring your credit report helps identify errors, detect fraudulent activity, and improve your overall credit score by understanding the factors affecting it.

Factors Affecting Your Credit Score

Payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries are the primary factors affecting your credit score. Late payments, high credit card balances relative to limits, and multiple recent credit applications can lower your credit score. Understanding these elements is essential for managing creditworthiness and improving financial opportunities.

Correcting Errors on Your Credit Report

Correcting errors on your credit report is crucial for maintaining an accurate credit score that lenders rely on for financial decisions. Disputing inaccuracies directly with credit bureaus can lead to updates that improve creditworthiness and borrowing terms. Regularly reviewing your credit report helps identify and rectify mistakes such as incorrect account information or fraudulent activity, which can negatively impact your credit score.

Credit Score and Credit Report: Which Matters More?

Credit scores serve as a numerical summary of creditworthiness, directly influencing loan approvals and interest rates, while credit reports provide detailed histories of credit activities and account statuses. Lenders prioritize credit scores for quick risk assessment but often review credit reports to verify accuracy and detect potential fraud. Understanding both elements is essential, yet the credit score typically holds greater immediate significance in financial decision-making.

Credit Score vs Credit Report Infographic

difterm.com

difterm.com