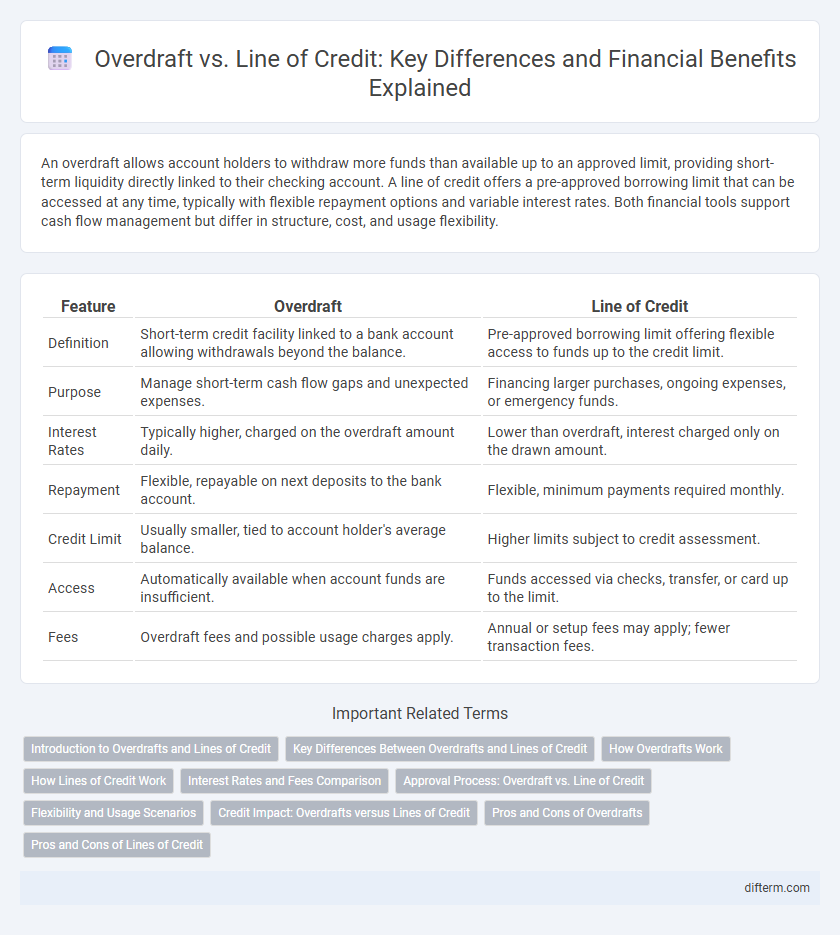

An overdraft allows account holders to withdraw more funds than available up to an approved limit, providing short-term liquidity directly linked to their checking account. A line of credit offers a pre-approved borrowing limit that can be accessed at any time, typically with flexible repayment options and variable interest rates. Both financial tools support cash flow management but differ in structure, cost, and usage flexibility.

Table of Comparison

| Feature | Overdraft | Line of Credit |

|---|---|---|

| Definition | Short-term credit facility linked to a bank account allowing withdrawals beyond the balance. | Pre-approved borrowing limit offering flexible access to funds up to the credit limit. |

| Purpose | Manage short-term cash flow gaps and unexpected expenses. | Financing larger purchases, ongoing expenses, or emergency funds. |

| Interest Rates | Typically higher, charged on the overdraft amount daily. | Lower than overdraft, interest charged only on the drawn amount. |

| Repayment | Flexible, repayable on next deposits to the bank account. | Flexible, minimum payments required monthly. |

| Credit Limit | Usually smaller, tied to account holder's average balance. | Higher limits subject to credit assessment. |

| Access | Automatically available when account funds are insufficient. | Funds accessed via checks, transfer, or card up to the limit. |

| Fees | Overdraft fees and possible usage charges apply. | Annual or setup fees may apply; fewer transaction fees. |

Introduction to Overdrafts and Lines of Credit

Overdrafts and lines of credit are flexible financial tools that provide short-term liquidity solutions for individuals and businesses. An overdraft allows account holders to withdraw funds beyond their current balance up to a predetermined limit, typically linked to a checking account. Lines of credit offer a fixed borrowing limit from which users can draw funds repeatedly, paying interest only on the amount utilized.

Key Differences Between Overdrafts and Lines of Credit

Overdrafts and lines of credit both provide flexible borrowing options, but overdrafts allow account holders to withdraw more than their balance up to a preset limit, typically used for short-term cash flow gaps. Lines of credit offer a set borrowing limit from which funds can be drawn, repaid, and borrowed again, suitable for ongoing financing needs and larger expenses. Interest on overdrafts is usually charged daily on the overdrawn amount, whereas lines of credit often feature lower interest rates and may have fixed or variable repayment terms.

How Overdrafts Work

Overdrafts allow account holders to withdraw more money than their available balance up to a pre-approved limit, providing short-term liquidity for unexpected expenses or cash flow gaps. Interest is typically charged only on the overdrawn amount, with fees varying based on the lender's policies and the overdraft type, such as authorized or unauthorized. This financial tool offers convenience but requires careful management to avoid high costs and potential account restrictions.

How Lines of Credit Work

Lines of credit provide borrowers with flexible access to funds up to a predetermined credit limit, allowing interest to be charged only on the amount utilized rather than the entire credit line. These revolving credit facilities can be unsecured or secured by collateral, enabling individuals or businesses to manage cash flow effectively and cover short-term financial needs. Repayments restore the available credit, making lines of credit ideal for ongoing expenses, unlike overdrafts which typically function as short-term emergency borrowing linked directly to a checking account.

Interest Rates and Fees Comparison

Overdrafts typically carry higher interest rates and daily fees compared to lines of credit, making them a more expensive short-term borrowing option. Lines of credit often feature lower, variable interest rates and may include annual maintenance fees but provide more flexible repayment terms. Comparing these costs is essential for choosing the most cost-effective source of emergency or ongoing credit.

Approval Process: Overdraft vs. Line of Credit

The approval process for overdrafts typically involves a quick review of the account holder's banking history and current balance, often resulting in immediate or near-immediate access. In contrast, obtaining a line of credit requires a more comprehensive evaluation, including credit scores, income verification, and detailed financial statements, which can extend approval times from days to weeks. Banks assess risk more rigorously for lines of credit due to higher borrowing limits and longer repayment terms compared to overdrafts.

Flexibility and Usage Scenarios

Overdrafts offer flexible, short-term borrowing linked directly to a checking account, ideal for managing unexpected expenses or temporary cash flow shortages. Lines of credit provide a larger pool of funds with customizable repayment terms, suited for ongoing financial needs such as business expansion or major purchases. Both financial tools enhance liquidity, but lines of credit typically support longer-term planning, while overdrafts focus on immediate, short-duration coverage.

Credit Impact: Overdrafts versus Lines of Credit

Overdrafts typically have a minimal impact on credit scores if repaid quickly, as they are often considered short-term credit extensions linked to checking accounts. Lines of credit, on the other hand, can significantly influence credit scores since they represent a formal borrowing arrangement, reported to credit bureaus, affecting credit utilization and payment history. Maintaining low balances and timely payments on lines of credit can improve creditworthiness, whereas frequent overdraft usage may signal financial distress to lenders.

Pros and Cons of Overdrafts

Overdrafts provide immediate access to funds by allowing accounts to go negative, offering flexibility for short-term cash flow gaps without the need for prior approval. However, overdrafts often carry higher interest rates and fees compared to other credit facilities, potentially increasing the cost of borrowing when used frequently or for extended periods. Unlike lines of credit, overdrafts lack set credit limits and repayment schedules, which can lead to unpredictable expenses and financial strain if not managed carefully.

Pros and Cons of Lines of Credit

Lines of credit provide flexible access to funds, allowing borrowers to draw and repay repeatedly up to a preset limit, which supports effective cash flow management and emergency funding. Interest is typically charged only on the amount used rather than the entire credit limit, making it cost-effective for short-term borrowing compared to fixed loans. However, lines of credit often have variable interest rates that can increase costs unpredictably, and lenders may require collateral or a strong credit history, limiting accessibility for some borrowers.

Overdraft vs Line of credit Infographic

difterm.com

difterm.com