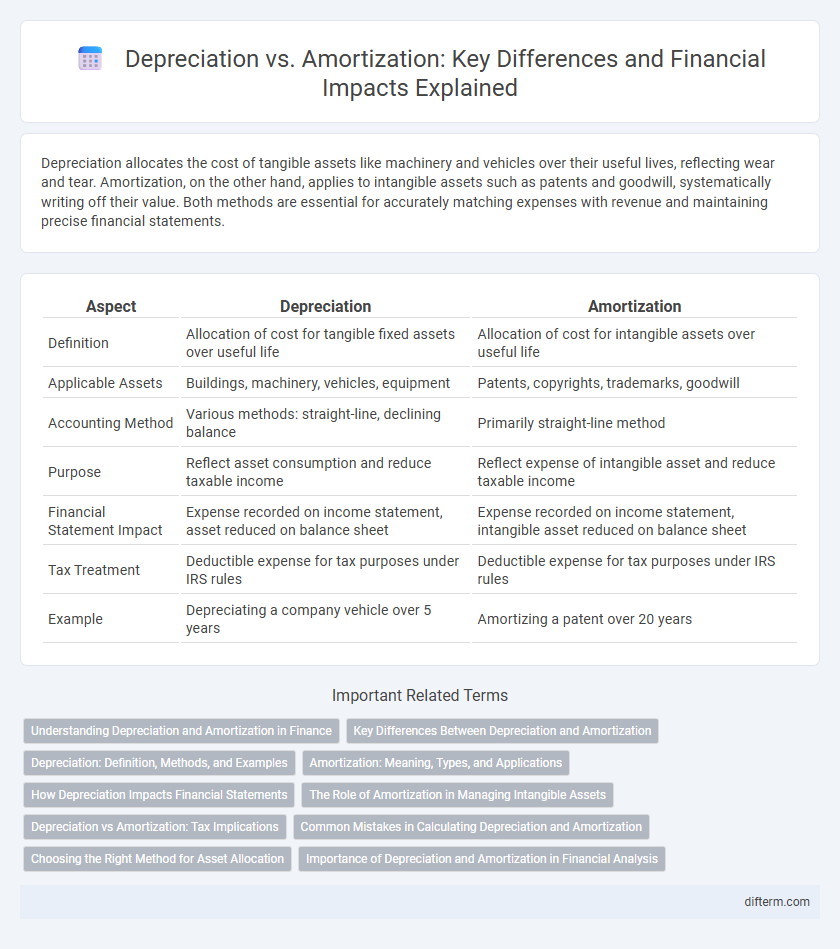

Depreciation allocates the cost of tangible assets like machinery and vehicles over their useful lives, reflecting wear and tear. Amortization, on the other hand, applies to intangible assets such as patents and goodwill, systematically writing off their value. Both methods are essential for accurately matching expenses with revenue and maintaining precise financial statements.

Table of Comparison

| Aspect | Depreciation | Amortization |

|---|---|---|

| Definition | Allocation of cost for tangible fixed assets over useful life | Allocation of cost for intangible assets over useful life |

| Applicable Assets | Buildings, machinery, vehicles, equipment | Patents, copyrights, trademarks, goodwill |

| Accounting Method | Various methods: straight-line, declining balance | Primarily straight-line method |

| Purpose | Reflect asset consumption and reduce taxable income | Reflect expense of intangible asset and reduce taxable income |

| Financial Statement Impact | Expense recorded on income statement, asset reduced on balance sheet | Expense recorded on income statement, intangible asset reduced on balance sheet |

| Tax Treatment | Deductible expense for tax purposes under IRS rules | Deductible expense for tax purposes under IRS rules |

| Example | Depreciating a company vehicle over 5 years | Amortizing a patent over 20 years |

Understanding Depreciation and Amortization in Finance

Depreciation allocates the cost of tangible assets like machinery and vehicles over their useful life, reflecting wear and tear or obsolescence. Amortization applies to intangible assets such as patents, trademarks, and goodwill, systematically expensing their cost over a specified period. Both methods enhance financial reporting accuracy by matching expenses to the periods benefited, aiding in precise asset valuation and tax calculations.

Key Differences Between Depreciation and Amortization

Depreciation applies to tangible fixed assets such as machinery and vehicles, reflecting the asset's loss in value over time due to wear and tear. Amortization, on the other hand, relates to intangible assets like patents, copyrights, and goodwill, systematically reducing their book value over their useful life. The key difference lies in the type of asset each method accounts for, with depreciation focused on physical assets and amortization on intangible assets, both impacting financial statements through expense recognition.

Depreciation: Definition, Methods, and Examples

Depreciation is the accounting process of allocating the cost of tangible fixed assets over their useful lives to reflect wear and tear or obsolescence. Common methods of depreciation include straight-line, declining balance, and units of production, each impacting financial statements differently. For example, the straight-line method evenly spreads the cost of machinery over its estimated useful life, enhancing asset management and tax reporting accuracy.

Amortization: Meaning, Types, and Applications

Amortization refers to the systematic allocation of the cost of intangible assets, such as patents, trademarks, or goodwill, over their useful life, ensuring accurate expense matching in financial statements. Common types of amortization include straight-line amortization, which evenly spreads costs over time, and accelerated amortization, allowing higher expenses in earlier periods. In finance, amortization is essential for managing asset valuation, tax deductions, and monitoring debt repayment schedules, particularly for loans and mortgages.

How Depreciation Impacts Financial Statements

Depreciation reduces the book value of tangible assets on the balance sheet, reflecting wear and tear or obsolescence over time. It appears as an expense on the income statement, lowering net income and taxable income, which impacts cash flow indirectly. Accumulated depreciation is recorded on the balance sheet as a contra asset, providing a clearer picture of an asset's net value.

The Role of Amortization in Managing Intangible Assets

Amortization plays a critical role in managing intangible assets by systematically allocating their cost over their useful life, ensuring accurate financial reporting and tax compliance. This process helps companies reflect the consumption of value from patents, trademarks, and copyrights, aligning expenses with revenue generation. Unlike depreciation, which applies to tangible assets, amortization addresses the unique challenges of valuing and expensing non-physical assets.

Depreciation vs Amortization: Tax Implications

Depreciation and amortization both affect taxable income by reducing reported earnings through expense recognition, but depreciation applies to tangible assets like machinery, while amortization pertains to intangible assets such as patents or copyrights. Tax regulations often prescribe different recovery periods and methods for each, influencing the timing and amount of deductible expenses. Understanding the specific IRS guidelines for depreciation and amortization schedules is critical for optimizing tax liability and accurately reporting asset costs over time.

Common Mistakes in Calculating Depreciation and Amortization

Common mistakes in calculating depreciation and amortization include using incorrect asset lifespans, which leads to inaccurate expense recognition and distorted financial statements. Another frequent error is failing to apply the appropriate method, such as straight-line for depreciable assets or matching amortization schedules to intangible asset usage, resulting in misaligned expense timing. Overlooking residual values or ignoring changes in asset conditions can further skew calculations, impacting tax liabilities and asset valuation.

Choosing the Right Method for Asset Allocation

Selecting the appropriate method between depreciation and amortization depends on the nature of the asset, with depreciation applied to tangible assets like machinery and buildings, and amortization used for intangible assets such as patents and copyrights. Accurate asset allocation requires evaluating asset lifespan, usage patterns, and potential impairment to determine the optimal expense recognition over time. Implementing tailored methods enhances financial reporting accuracy and supports strategic investment decisions.

Importance of Depreciation and Amortization in Financial Analysis

Depreciation and amortization are critical in financial analysis as they allocate the cost of tangible and intangible assets over their useful lives, providing a more accurate picture of a company's profitability. These non-cash expenses affect net income and cash flow statements, influencing investment decisions and valuation metrics like EBITDA and ROA. Understanding the impact of depreciation and amortization helps analysts assess asset utilization, operational efficiency, and long-term financial health.

Depreciation vs Amortization Infographic

difterm.com

difterm.com