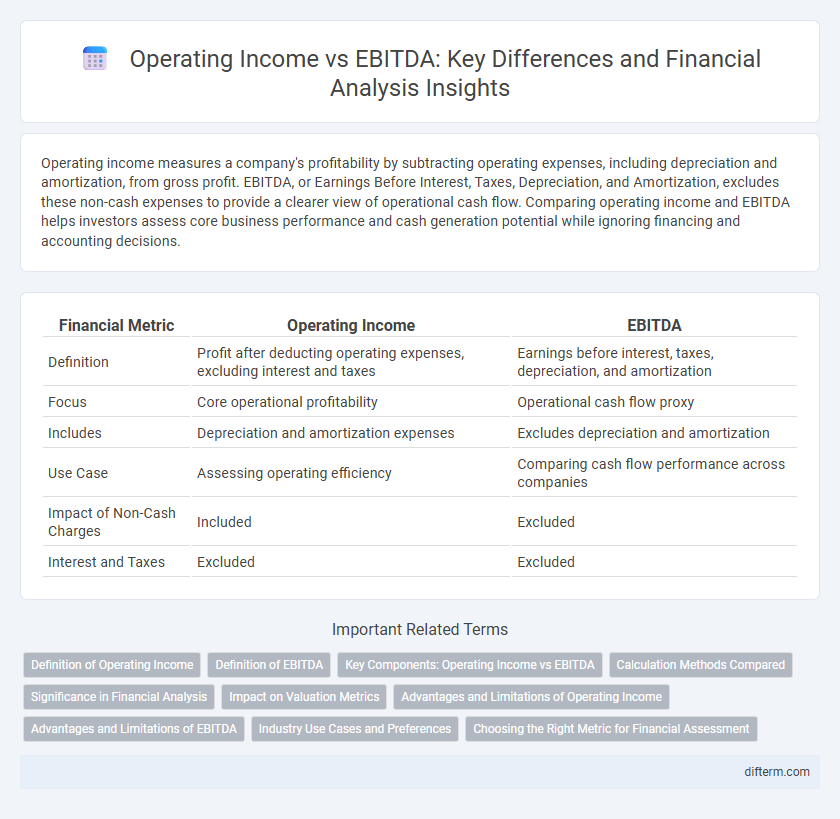

Operating income measures a company's profitability by subtracting operating expenses, including depreciation and amortization, from gross profit. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, excludes these non-cash expenses to provide a clearer view of operational cash flow. Comparing operating income and EBITDA helps investors assess core business performance and cash generation potential while ignoring financing and accounting decisions.

Table of Comparison

| Financial Metric | Operating Income | EBITDA |

|---|---|---|

| Definition | Profit after deducting operating expenses, excluding interest and taxes | Earnings before interest, taxes, depreciation, and amortization |

| Focus | Core operational profitability | Operational cash flow proxy |

| Includes | Depreciation and amortization expenses | Excludes depreciation and amortization |

| Use Case | Assessing operating efficiency | Comparing cash flow performance across companies |

| Impact of Non-Cash Charges | Included | Excluded |

| Interest and Taxes | Excluded | Excluded |

Definition of Operating Income

Operating income, also known as operating profit, measures a company's earnings from core business operations, excluding non-operating income and expenses such as interest and taxes. It is calculated by subtracting operating expenses, including cost of goods sold (COGS) and selling, general, and administrative (SG&A) expenses, from gross profit. Operating income provides a clear view of profitability derived from day-to-day business activities, making it essential for assessing operational efficiency.

Definition of EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures a company's operational profitability by excluding non-cash expenses and financial costs. Operating income, also known as operating profit, includes depreciation and amortization expenses, providing a measure of profit from core business activities before interest and taxes. EBITDA is widely used to assess a company's cash-generating ability and compare operational efficiency across businesses without the impact of capital structure and accounting policies.

Key Components: Operating Income vs EBITDA

Operating income, also known as operating profit, reflects a company's earnings after deducting operating expenses such as cost of goods sold, wages, and depreciation, providing insight into core business profitability. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, excludes non-operating expenses and non-cash charges, offering a clearer view of operating cash flow potential. Comparing these key components helps investors evaluate operational efficiency by isolating cash earnings (EBITDA) from accounting and financial structuring effects captured in operating income.

Calculation Methods Compared

Operating income is calculated by subtracting operating expenses, including cost of goods sold (COGS), selling, general and administrative expenses (SG&A), and depreciation from gross profit. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is derived by adding back depreciation and amortization expenses to operating income. The primary difference lies in EBITDA excluding non-cash expenses like depreciation and amortization, offering a clearer view of a company's operational cash flow.

Significance in Financial Analysis

Operating income, representing core business profitability after deducting operating expenses, plays a crucial role in assessing a company's operational efficiency and core earnings quality. EBITDA excludes depreciation and amortization, offering a clearer view of cash flow generation and operational performance before non-cash charges. Comparing operating income and EBITDA provides a comprehensive understanding of profitability and cash flow, aiding investors and analysts in evaluating financial health and operational strengths.

Impact on Valuation Metrics

Operating income reflects a company's core profitability by subtracting operating expenses from gross profit, directly influencing valuation metrics such as the EBIT multiple. EBITDA, which adds back depreciation and amortization to operating income, provides a clearer picture of cash flow potential by excluding non-cash expenses, often resulting in higher valuation multiples like EV/EBITDA. Investors prefer EBITDA for comparing companies with different capital structures or asset ages, while operating income offers insights into operational efficiency impacting earnings multiples.

Advantages and Limitations of Operating Income

Operating income provides a clear picture of a company's profitability by including all operating expenses such as depreciation and amortization, offering a realistic view of operating efficiency. Its advantage lies in reflecting true operational performance and the impact of non-cash expenses, while limitations include exclusion of non-operating income and expenses, which can obscure overall financial health. Unlike EBITDA, operating income may understate cash flow potential but delivers a more conservative measure of profit from core business operations.

Advantages and Limitations of EBITDA

EBITDA offers a clear view of operational profitability by excluding non-cash expenses like depreciation and amortization, making it useful for comparing companies with different asset structures. This metric enhances cash flow visibility and is favored by investors for assessing core business performance without the influence of financing and accounting decisions. However, EBITDA overlooks capital expenditures, changes in working capital, and debt servicing costs, limiting its effectiveness in evaluating overall financial health and long-term sustainability.

Industry Use Cases and Preferences

Operating income is widely preferred in industries with significant depreciation and amortization expenses, such as manufacturing and telecommunications, as it reflects core profitability after operating costs. EBITDA is favored in sectors like technology and startups where cash flow analysis is critical, providing a clearer picture of operational performance by excluding non-cash expenses. Financial analysts often use EBITDA for valuation and credit assessments, while operating income serves better for internal management decisions and operational efficiency evaluations.

Choosing the Right Metric for Financial Assessment

Operating income measures a company's profitability after deducting operating expenses, providing insight into core business performance, while EBITDA excludes depreciation and amortization to highlight cash flow potential. Choosing the right metric depends on the analysis goal: operating income offers a clearer picture of operational efficiency, whereas EBITDA is preferred for assessing cash generation and comparing companies with different capital structures. Financial analysts often use both metrics in tandem to gain a comprehensive understanding of a firm's financial health and operating performance.

Operating income vs EBITDA Infographic

difterm.com

difterm.com