SaaS valuation prioritizes recurring revenue, customer retention rates, and growth metrics such as Monthly Recurring Revenue (MRR) and Customer Lifetime Value (CLTV), reflecting the subscription-based model's predictability and scalability. Traditional valuation methods emphasize historical earnings, tangible assets, and cash flow stability, which may undervalue SaaS companies with strong future growth potential but limited physical assets. Understanding these differences is crucial for investors to accurately assess risk and growth opportunities in SaaS versus traditional business models.

Table of Comparison

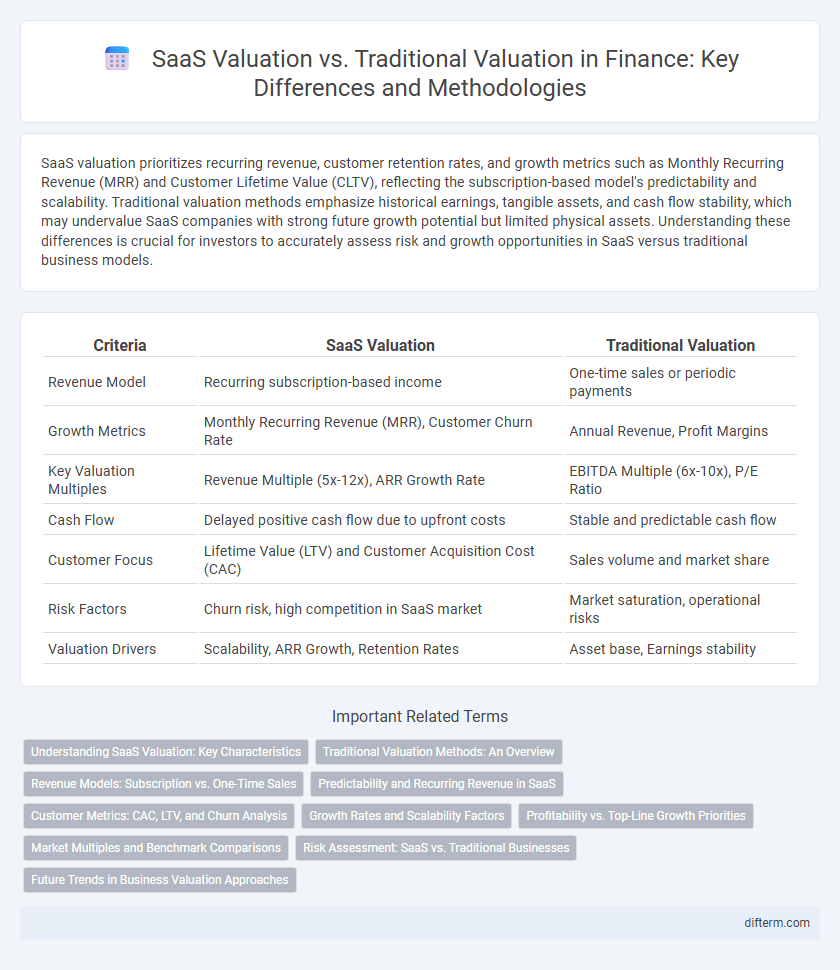

| Criteria | SaaS Valuation | Traditional Valuation |

|---|---|---|

| Revenue Model | Recurring subscription-based income | One-time sales or periodic payments |

| Growth Metrics | Monthly Recurring Revenue (MRR), Customer Churn Rate | Annual Revenue, Profit Margins |

| Key Valuation Multiples | Revenue Multiple (5x-12x), ARR Growth Rate | EBITDA Multiple (6x-10x), P/E Ratio |

| Cash Flow | Delayed positive cash flow due to upfront costs | Stable and predictable cash flow |

| Customer Focus | Lifetime Value (LTV) and Customer Acquisition Cost (CAC) | Sales volume and market share |

| Risk Factors | Churn risk, high competition in SaaS market | Market saturation, operational risks |

| Valuation Drivers | Scalability, ARR Growth, Retention Rates | Asset base, Earnings stability |

Understanding SaaS Valuation: Key Characteristics

SaaS valuation emphasizes metrics such as Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), and churn rate, reflecting the subscription-based revenue model and customer retention. Unlike traditional valuation methods relying heavily on EBITDA and asset value, SaaS relies on growth potential and unit economics due to its scalable digital offerings. Key characteristics include strong revenue predictability, high gross margins, and rapid scalability driving higher valuation multiples.

Traditional Valuation Methods: An Overview

Traditional valuation methods such as discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions remain foundational in finance for assessing company worth. These approaches rely heavily on historical financial data, earnings, and asset values to project future potential and determine market value. While effective for established firms with tangible assets and stable cash flow, they may underrepresent growth potential in high-innovation sectors like SaaS, which demand different metrics and valuation models.

Revenue Models: Subscription vs. One-Time Sales

Subscription revenue models in SaaS valuation offer predictable, recurring cash flows that enhance long-term valuation stability and investor confidence, contrasting with traditional one-time sales models that depend heavily on continuous new customer acquisition. SaaS companies often demonstrate higher customer lifetime value (CLTV) and lower churn rates, leading to more sustainable revenue projections compared to the lump-sum revenue spikes typical of traditional sales. This shift toward recurring revenues directly impacts valuation multiples, with SaaS firms frequently commanding premium multiples based on monthly recurring revenue (MRR) or annual recurring revenue (ARR) metrics.

Predictability and Recurring Revenue in SaaS

SaaS valuation emphasizes predictability and recurring revenue, making cash flow projections more reliable compared to traditional valuation methods that often rely on one-time sales or asset-based metrics. The subscription-based model ensures steady revenue streams, reducing volatility and providing clearer insights into long-term financial health. Investors prioritize metrics like Monthly Recurring Revenue (MRR) and Customer Lifetime Value (CLTV) to assess SaaS companies, contrasting with traditional firms where earnings and book value play a larger role.

Customer Metrics: CAC, LTV, and Churn Analysis

Customer metrics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), and churn rate are essential in SaaS valuation, providing insights into the sustainability and growth potential of subscription-based models. SaaS companies typically exhibit higher CAC due to ongoing marketing and onboarding expenses but offset this with higher LTV through recurring revenue streams, making churn analysis critical to predicting long-term profitability. Traditional valuation methods often prioritize historical financial statements, whereas SaaS valuation emphasizes customer retention and acquisition dynamics to assess future cash flows and scalability.

Growth Rates and Scalability Factors

SaaS valuation models prioritize recurring revenue growth rates and high gross margins as key drivers, reflecting scalable subscription-based business models that rapidly expand with low incremental costs. Traditional valuation approaches emphasize asset-based metrics and earnings multiples, often underestimating the impact of customer retention and lifetime value inherent in SaaS growth trajectories. Scalability factors in SaaS, such as cloud infrastructure and automated customer acquisition, enable exponential revenue increases compared to the more linear growth patterns seen in traditional industries.

Profitability vs. Top-Line Growth Priorities

SaaS valuation heavily emphasizes top-line growth metrics such as Annual Recurring Revenue (ARR) and customer acquisition rates, reflecting market demand and scalability potential rather than immediate profitability. Traditional valuation models prioritize profitability indicators like EBITDA margins and net income, focusing on sustainable cash flow and cost efficiency. Investors in SaaS companies often accept near-term losses to capture market share, making revenue growth the primary valuation driver over short-term earnings.

Market Multiples and Benchmark Comparisons

SaaS valuation heavily relies on recurring revenue multiples such as EV/ARR (Enterprise Value to Annual Recurring Revenue), which typically range between 5x and 15x depending on growth rates and churn. Traditional valuation methods often emphasize EBITDA multiples, with averages spanning 6x to 12x based on industry benchmarks and profitability metrics. Benchmark comparisons for SaaS prioritize customer lifetime value and churn rates, while traditional firms focus more on historical financial performance and asset valuation.

Risk Assessment: SaaS vs. Traditional Businesses

SaaS valuation incorporates recurring revenue models and customer churn rates as critical risk factors, contrasting with traditional valuation methods that emphasize asset tangibility and cash flow stability. The subscription-based nature of SaaS introduces unique volatility in revenue streams, requiring advanced risk-adjusted discount rates and growth assumptions. Traditional businesses rely more on historical financial performance and market comparables, leading to different risk profiles and valuation multiples.

Future Trends in Business Valuation Approaches

The future of business valuation increasingly favors SaaS valuation models due to their emphasis on recurring revenue, customer lifetime value, and churn rates, reflecting more dynamic and data-driven metrics than traditional asset-based approaches. Advanced analytics and machine learning are being integrated to assess SaaS companies' growth potential and operational efficiency, offering granular insights into subscription economics and market scalability. This shift drives a broader adoption of real-time, predictive valuation techniques that better capture intangible assets and evolving market conditions in technology-driven sectors.

SaaS Valuation vs Traditional Valuation Infographic

difterm.com

difterm.com