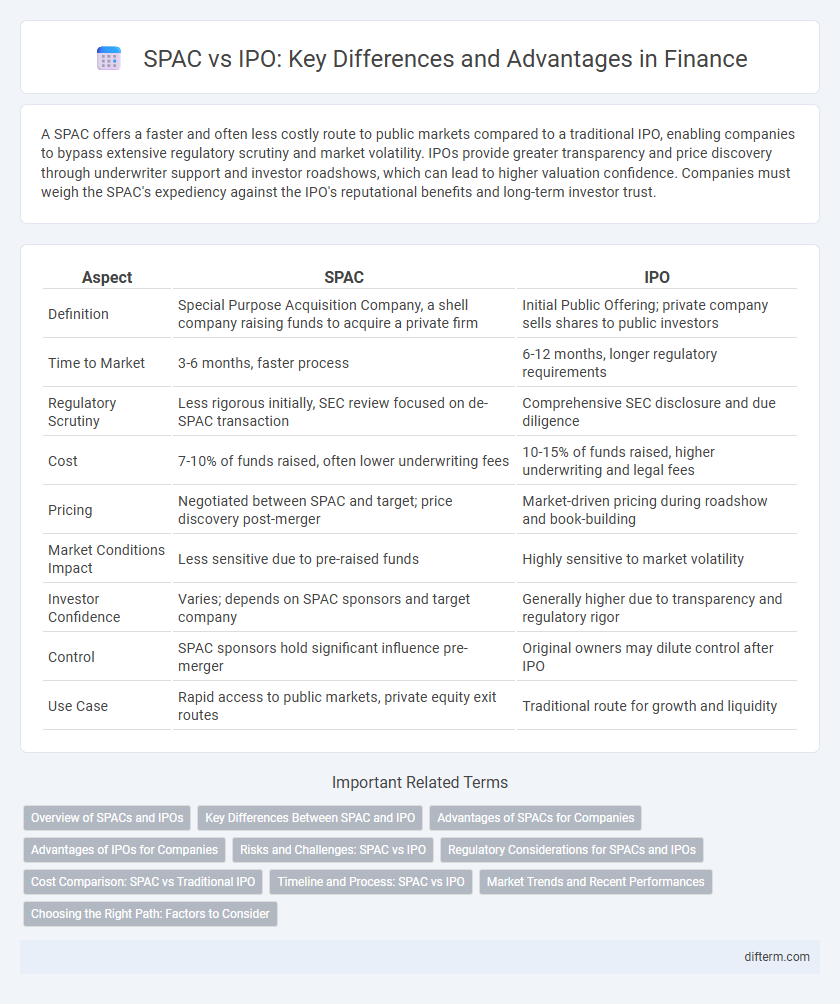

A SPAC offers a faster and often less costly route to public markets compared to a traditional IPO, enabling companies to bypass extensive regulatory scrutiny and market volatility. IPOs provide greater transparency and price discovery through underwriter support and investor roadshows, which can lead to higher valuation confidence. Companies must weigh the SPAC's expediency against the IPO's reputational benefits and long-term investor trust.

Table of Comparison

| Aspect | SPAC | IPO |

|---|---|---|

| Definition | Special Purpose Acquisition Company, a shell company raising funds to acquire a private firm | Initial Public Offering; private company sells shares to public investors |

| Time to Market | 3-6 months, faster process | 6-12 months, longer regulatory requirements |

| Regulatory Scrutiny | Less rigorous initially, SEC review focused on de-SPAC transaction | Comprehensive SEC disclosure and due diligence |

| Cost | 7-10% of funds raised, often lower underwriting fees | 10-15% of funds raised, higher underwriting and legal fees |

| Pricing | Negotiated between SPAC and target; price discovery post-merger | Market-driven pricing during roadshow and book-building |

| Market Conditions Impact | Less sensitive due to pre-raised funds | Highly sensitive to market volatility |

| Investor Confidence | Varies; depends on SPAC sponsors and target company | Generally higher due to transparency and regulatory rigor |

| Control | SPAC sponsors hold significant influence pre-merger | Original owners may dilute control after IPO |

| Use Case | Rapid access to public markets, private equity exit routes | Traditional route for growth and liquidity |

Overview of SPACs and IPOs

Special Purpose Acquisition Companies (SPACs) offer a streamlined alternative to traditional Initial Public Offerings (IPOs) by allowing private companies to go public through a merger with an existing shell company, accelerating market entry and reducing regulatory complexities. IPOs involve a company issuing new shares to the public for the first time, typically requiring extensive disclosures, underwriter involvement, and regulatory approval, which can extend the timeline and increase costs. While SPACs provide speed and certainty in capital raising, IPOs remain a transparent and established method for companies seeking long-term market credibility and price discovery.

Key Differences Between SPAC and IPO

SPACs (Special Purpose Acquisition Companies) offer a faster route to public markets by merging with a private company, bypassing the lengthy regulatory process typical of IPOs (Initial Public Offerings). IPOs require extensive disclosures and roadshows, leading to higher costs and time commitments compared to SPAC mergers, which provide more certainty on valuation and capital raised upfront. Investors face differing risks as SPACs depend on the expertise of the promoters and the success of the acquisition, whereas IPOs involve direct investment in an established company with transparent financial history.

Advantages of SPACs for Companies

SPACs offer companies faster access to public markets by bypassing the lengthy IPO registration process, which can cut the timeline from months to weeks. They provide greater pricing certainty, as the valuation is negotiated upfront with the SPAC sponsors, reducing market volatility risks during the offering. Enhanced flexibility in deal structuring and the potential to raise additional capital through PIPE investments make SPACs attractive alternatives to traditional IPOs.

Advantages of IPOs for Companies

IPOs provide companies with direct access to public capital markets, often resulting in higher valuation transparency and enhanced investor confidence. The rigorous regulatory scrutiny in IPOs boosts corporate governance and market credibility, attracting long-term institutional investors. Unlike SPACs, IPOs allow companies to establish a clear market price through roadshows and book-building processes, optimizing capital raising efficiency.

Risks and Challenges: SPAC vs IPO

SPACs pose risks such as less regulatory scrutiny and potential conflicts of interest, which can lead to inflated valuations and reduced investor protections compared to traditional IPOs. IPOs, while generally subject to stricter SEC regulations and disclosure requirements, face challenges like market volatility and longer timeframes for capital raising. Both methods require careful due diligence to navigate risks including dilution, market reception, and sponsor incentives.

Regulatory Considerations for SPACs and IPOs

SPACs face distinct regulatory scrutiny from the SEC, particularly regarding disclosure requirements and sponsor incentives, which differ from traditional IPO mandates. IPOs require extensive financial disclosures, underwriter involvement, and compliance with the Securities Act of 1933, ensuring investor protection through rigorous examination. Navigating the regulatory landscape for both SPACs and IPOs demands attention to evolving SEC rules and potential state-level securities regulations.

Cost Comparison: SPAC vs Traditional IPO

SPACs generally offer a faster and potentially less expensive route to public markets compared to traditional IPOs, with typical underwriting fees around 3-5% versus 7% or higher for IPOs. However, SPAC transactions often involve additional costs such as PIPE financing and sponsor promote structures, which can dilute shareholder value and increase overall expenses. Traditional IPOs incur substantial legal, accounting, and marketing expenses, but provide greater pricing transparency and market validation.

Timeline and Process: SPAC vs IPO

SPACs typically complete the process within 3 to 6 months by merging with a private company, significantly faster than traditional IPOs, which usually take 6 to 12 months due to extensive regulatory filings and roadshows. The SPAC timeline involves a blind pool capital raise before acquiring a target, whereas IPOs require detailed financial disclosures and SEC approvals upfront. This streamlined SPAC process reduces market uncertainty, but IPOs provide greater transparency through rigorous due diligence and investor scrutiny.

Market Trends and Recent Performances

SPACs have experienced a surge in popularity since 2020, driven by market volatility and investor appetite for faster public listings, while IPOs traditionally offer more regulatory scrutiny and price stability. Recent performance data reveals that SPACs often face post-merger valuation declines, with average returns underperforming traditional IPOs over a 12-month period. Market trends indicate a cooling in SPAC issuance in 2024, reflecting increased SEC regulations and investor caution compared to steady IPO activity.

Choosing the Right Path: Factors to Consider

Evaluating the choice between a SPAC and an IPO hinges on factors such as time to market, regulatory scrutiny, and capital-raising goals. SPACs offer a faster route with potentially less regulatory burden, appealing to companies seeking expedited liquidity. In contrast, traditional IPOs provide greater price discovery and market validation, often preferred by firms prioritizing long-term investor confidence and transparency.

SPAC vs IPO Infographic

difterm.com

difterm.com