Stocks offer ownership in a company and potential for high returns through capital gains and dividends, but with higher risk and market volatility. Bonds represent debt investments with fixed interest payments, typically providing lower risk and more stable income. Investors often balance portfolios by combining stocks for growth and bonds for income and capital preservation.

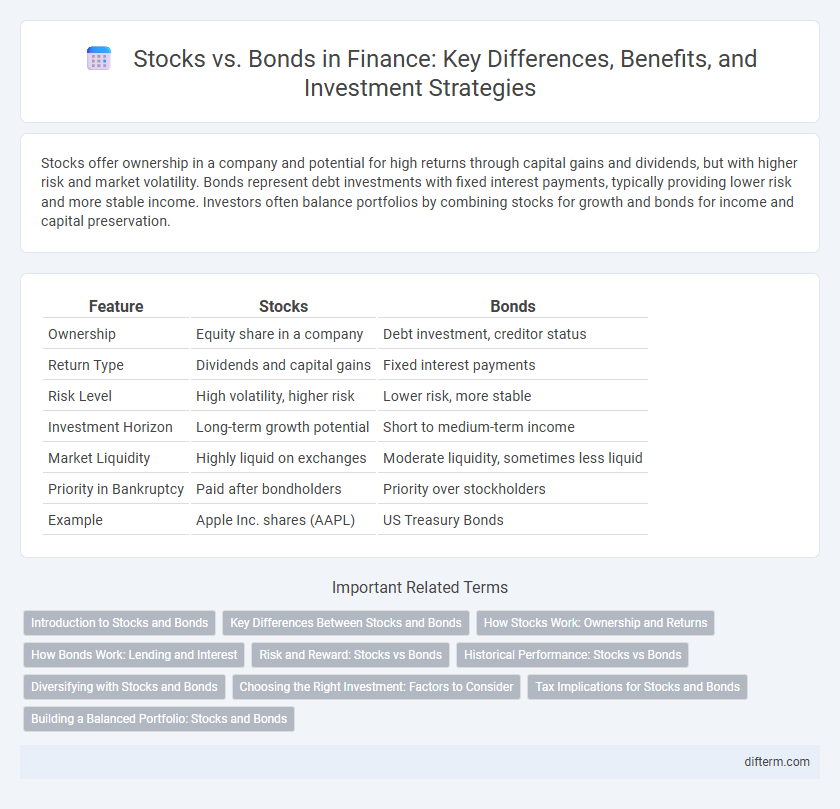

Table of Comparison

| Feature | Stocks | Bonds |

|---|---|---|

| Ownership | Equity share in a company | Debt investment, creditor status |

| Return Type | Dividends and capital gains | Fixed interest payments |

| Risk Level | High volatility, higher risk | Lower risk, more stable |

| Investment Horizon | Long-term growth potential | Short to medium-term income |

| Market Liquidity | Highly liquid on exchanges | Moderate liquidity, sometimes less liquid |

| Priority in Bankruptcy | Paid after bondholders | Priority over stockholders |

| Example | Apple Inc. shares (AAPL) | US Treasury Bonds |

Introduction to Stocks and Bonds

Stocks represent ownership shares in a corporation, offering investors potential dividends and capital gains linked to the company's performance. Bonds are debt securities issued by governments or corporations, providing fixed interest payments and principal repayment at maturity, typically considered lower risk than stocks. Understanding the fundamental differences between stocks and bonds is crucial for effective portfolio diversification and risk management.

Key Differences Between Stocks and Bonds

Stocks represent ownership shares in a company, offering potential for capital appreciation and dividends, while bonds are debt securities providing fixed interest income and principal repayment at maturity. Stocks carry higher risk due to market volatility and company performance, whereas bonds are generally considered safer with predictable returns. The liquidity and price fluctuations of stocks differ significantly from bonds, which often have set terms and lower price sensitivity to market changes.

How Stocks Work: Ownership and Returns

Stocks represent ownership shares in a corporation, granting investors partial control and voting rights proportional to their holdings. Returns from stocks primarily come through capital appreciation as share prices increase and dividends paid out from company profits. Unlike bonds, stocks carry higher risk due to market volatility but offer the potential for greater long-term growth and income.

How Bonds Work: Lending and Interest

Bonds function as debt instruments where investors lend money to an issuer, such as a corporation or government, in exchange for periodic interest payments called coupons. The principal amount is repaid at maturity, providing a fixed income stream and lower risk compared to stocks. Interest rates on bonds reflect credit risk, duration, and prevailing market conditions, influencing bond pricing and yield.

Risk and Reward: Stocks vs Bonds

Stocks typically offer higher potential returns compared to bonds but come with increased market volatility and risk of capital loss. Bonds generally provide lower but more stable income through fixed interest payments, reducing exposure to market fluctuations. Investors balance portfolios by combining stocks for growth potential and bonds for risk mitigation and steady cash flow.

Historical Performance: Stocks vs Bonds

Stocks have historically delivered higher average annual returns, approximately 10%, compared to bonds, which typically yield around 5% per year. Despite greater volatility and risk, stocks outperform bonds over the long term, benefiting from economic growth and corporate earnings. Bonds offer lower returns but provide stability and income, making them essential for risk management in diversified investment portfolios.

Diversifying with Stocks and Bonds

Diversifying with stocks and bonds balances growth potential and risk management by combining equity's higher returns with fixed-income stability. Stocks provide capital appreciation and dividend income, while bonds offer predictable interest payments and lower volatility. A well-blended portfolio of stocks and bonds enhances risk-adjusted returns and cushions against market fluctuations.

Choosing the Right Investment: Factors to Consider

Choosing the right investment between stocks and bonds depends on factors like risk tolerance, investment horizon, and income needs. Stocks typically offer higher growth potential but come with increased volatility, while bonds provide steadier income and lower risk. Evaluating market conditions, interest rates, and personal financial goals helps investors balance their portfolio for optimal returns and stability.

Tax Implications for Stocks and Bonds

Stocks typically generate taxable dividends and capital gains, subject to preferential tax rates on qualified dividends and long-term gains. Bonds often produce interest income taxed as ordinary income, which may result in higher tax liabilities compared to stocks. Municipal bonds offer tax-exempt interest at federal and sometimes state levels, providing favorable tax treatment for income-focused investors.

Building a Balanced Portfolio: Stocks and Bonds

Diversifying investments between stocks and bonds is essential for building a balanced portfolio that manages risk and maximizes returns. Stocks typically offer higher growth potential through capital appreciation, while bonds provide stability and consistent income via interest payments. Allocating assets strategically based on risk tolerance, investment goals, and market conditions enhances portfolio resilience and long-term financial growth.

Stocks vs Bonds Infographic

difterm.com

difterm.com