Asset-backed securities (ABS) are financial instruments backed by various types of loans such as auto loans, credit card debt, and student loans, while mortgage-backed securities (MBS) are specifically collateralized by residential or commercial mortgage loans. Both ABS and MBS offer investors periodic payments derived from the underlying asset pools, but MBS carry distinct prepayment risks due to borrower refinancing options. Understanding the differences in collateral types, risk profiles, and cash flow structures is crucial for optimizing investment strategies within fixed-income portfolios.

Table of Comparison

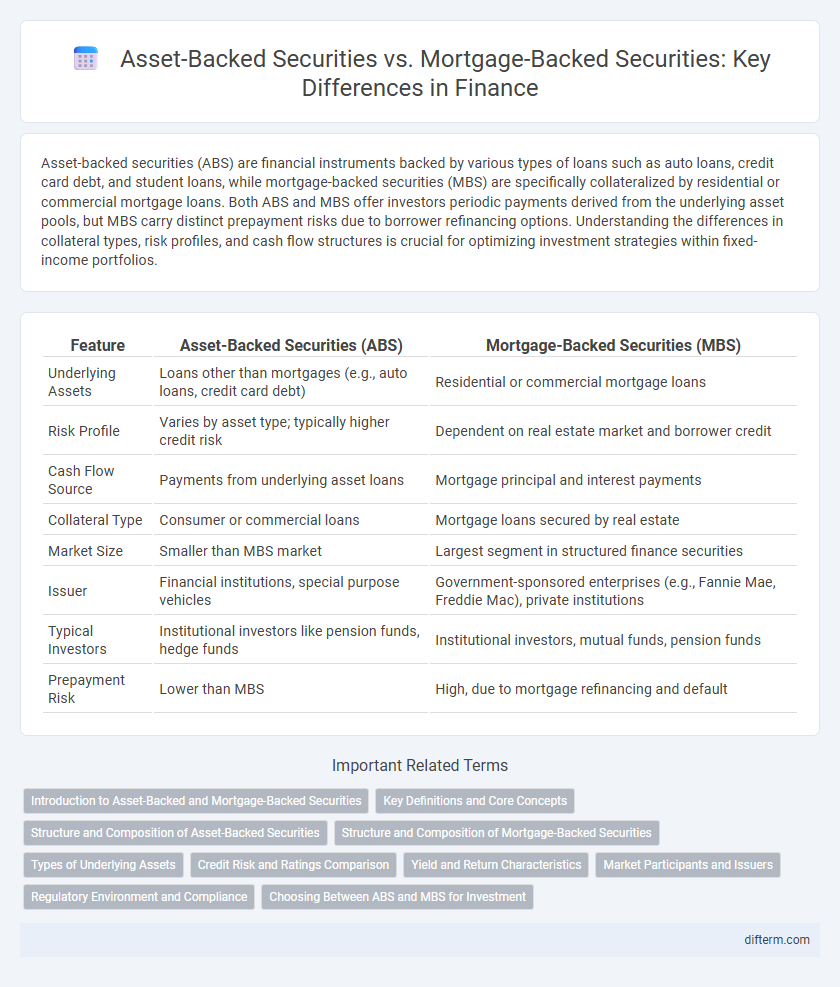

| Feature | Asset-Backed Securities (ABS) | Mortgage-Backed Securities (MBS) |

|---|---|---|

| Underlying Assets | Loans other than mortgages (e.g., auto loans, credit card debt) | Residential or commercial mortgage loans |

| Risk Profile | Varies by asset type; typically higher credit risk | Dependent on real estate market and borrower credit |

| Cash Flow Source | Payments from underlying asset loans | Mortgage principal and interest payments |

| Collateral Type | Consumer or commercial loans | Mortgage loans secured by real estate |

| Market Size | Smaller than MBS market | Largest segment in structured finance securities |

| Issuer | Financial institutions, special purpose vehicles | Government-sponsored enterprises (e.g., Fannie Mae, Freddie Mac), private institutions |

| Typical Investors | Institutional investors like pension funds, hedge funds | Institutional investors, mutual funds, pension funds |

| Prepayment Risk | Lower than MBS | High, due to mortgage refinancing and default |

Introduction to Asset-Backed and Mortgage-Backed Securities

Asset-backed securities (ABS) are financial instruments backed by pools of diverse asset types such as auto loans, credit card receivables, and student loans, providing investors with cash flow derived from underlying asset payments. Mortgage-backed securities (MBS) specifically derive cash flows from pooled residential or commercial mortgage loans, offering exposure to real estate debt markets. Both ABS and MBS enable lenders to transfer risks and enhance liquidity, playing crucial roles in structured finance and capital market activities.

Key Definitions and Core Concepts

Asset-Backed Securities (ABS) are financial instruments backed by a pool of underlying assets such as auto loans, credit card receivables, or student loans, while Mortgage-Backed Securities (MBS) specifically consist of pools of residential or commercial mortgage loans. Both ABS and MBS provide investors with periodic payments derived from the cash flows of the underlying assets, but MBS carry distinct prepayment risks due to mortgage refinancing and principal repayments. Understanding the securitization process, which transforms illiquid assets into tradable securities, is essential for evaluating the credit risk, yield, and liquidity profiles of ABS and MBS.

Structure and Composition of Asset-Backed Securities

Asset-backed securities (ABS) are structured financial instruments backed by pools of diversified assets such as auto loans, credit card receivables, or student loans, unlike mortgage-backed securities (MBS) which are specifically backed by residential or commercial mortgage loans. ABS typically feature multiple tranches with varying risk levels, offering different cash flow priorities and credit enhancements to attract a broader range of investors. The underlying collateral's diversity in ABS provides a different risk profile and liquidity compared to the more homogenous mortgage pools in MBS.

Structure and Composition of Mortgage-Backed Securities

Mortgage-Backed Securities (MBS) are structured financial instruments backed by pools of residential or commercial mortgage loans, where the cash flows from mortgage payments are passed through to investors. The composition of MBS includes various types such as pass-through securities, collateralized mortgage obligations (CMOs), and stripped MBS, each offering distinct risk and return profiles based on the underlying mortgage pool characteristics. These securities are often grouped by loan type, credit quality, and maturity, impacting their prepayment risk and market valuation compared to other asset-backed securities.

Types of Underlying Assets

Asset-Backed Securities (ABS) are backed by a diverse range of underlying assets such as auto loans, credit card receivables, student loans, and leases, offering varied risk profiles and cash flow characteristics. Mortgage-Backed Securities (MBS) are specifically secured by residential or commercial mortgage loans, primarily focusing on home and property financing. The differentiation in underlying assets directly affects the credit risk, yield expectations, and market liquidity of ABS and MBS instruments.

Credit Risk and Ratings Comparison

Asset-Backed Securities (ABS) typically pool various types of loans such as auto loans or credit card receivables, resulting in diverse credit risk profiles compared to Mortgage-Backed Securities (MBS), which specifically consist of home mortgage loans. Credit ratings for ABS generally reflect the underlying asset quality and cash flow stability, often receiving higher ratings due to shorter maturities and more predictable payments, whereas MBS ratings heavily depend on housing market conditions and borrower creditworthiness. Both ABS and MBS ratings are assigned by agencies like Moody's, S&P, and Fitch, but MBS can exhibit greater sensitivity to economic downturns and borrower default risk, impacting their credit risk assessment more significantly.

Yield and Return Characteristics

Asset-Backed Securities (ABS) typically offer higher yields than Mortgage-Backed Securities (MBS) due to their exposure to diverse asset pools such as auto loans, credit card receivables, and student loans, which carry varying risk profiles. Mortgage-Backed Securities generally provide more stable cash flows and lower yields, reflecting the relatively lower default risk associated with residential mortgage collateral and government or agency guarantees. Yield and return characteristics in ABS and MBS depend heavily on credit quality, prepayment risk, and underlying asset performance, with ABS often exhibiting greater volatility and potential for higher returns.

Market Participants and Issuers

Institutional investors, such as pension funds and insurance companies, dominate the market for asset-backed securities (ABS) due to their diversified collateral pools including auto loans, credit card receivables, and student loans. Mortgage-backed securities (MBS) primarily attract banks, government agencies like Ginnie Mae, Fannie Mae, and Freddie Mac, and investment firms focused on residential or commercial real estate loans. Issuers of ABS are typically financial institutions and corporations securitizing consumer debt, while MBS issuers often include government-sponsored enterprises and mortgage lenders packaging home loan mortgages for liquidity and risk distribution.

Regulatory Environment and Compliance

Asset-backed securities (ABS) and mortgage-backed securities (MBS) are subject to distinct regulatory frameworks designed to ensure transparency and protect investors. ABS issuers primarily comply with the Securities Act of 1933 and are regulated by the Securities and Exchange Commission (SEC), demanding strict disclosure and reporting requirements. MBS are regulated by both the SEC and the Federal Housing Finance Agency (FHFA), with additional oversight related to mortgage originators' adherence to the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA).

Choosing Between ABS and MBS for Investment

Choosing between Asset-Backed Securities (ABS) and Mortgage-Backed Securities (MBS) depends on risk tolerance, cash flow characteristics, and underlying collateral quality. ABS typically offer diversification benefits with exposure to consumer loans, auto loans, or credit card debt, while MBS are closely tied to real estate market dynamics and interest rate sensitivity. Investors seeking stable income with moderate risk may favor MBS, whereas those pursuing higher yields and sector diversification might prefer ABS.

Asset-Backed Securities vs Mortgage-Backed Securities Infographic

difterm.com

difterm.com