Angel investors typically provide early-stage funding to startups, offering capital in exchange for equity often during the company's initial development phase. Seed investors contribute funds specifically aimed at product development and market research, usually following the angel investment round. Understanding the distinction between these investors helps startups tailor their fundraising strategies and equity negotiations effectively.

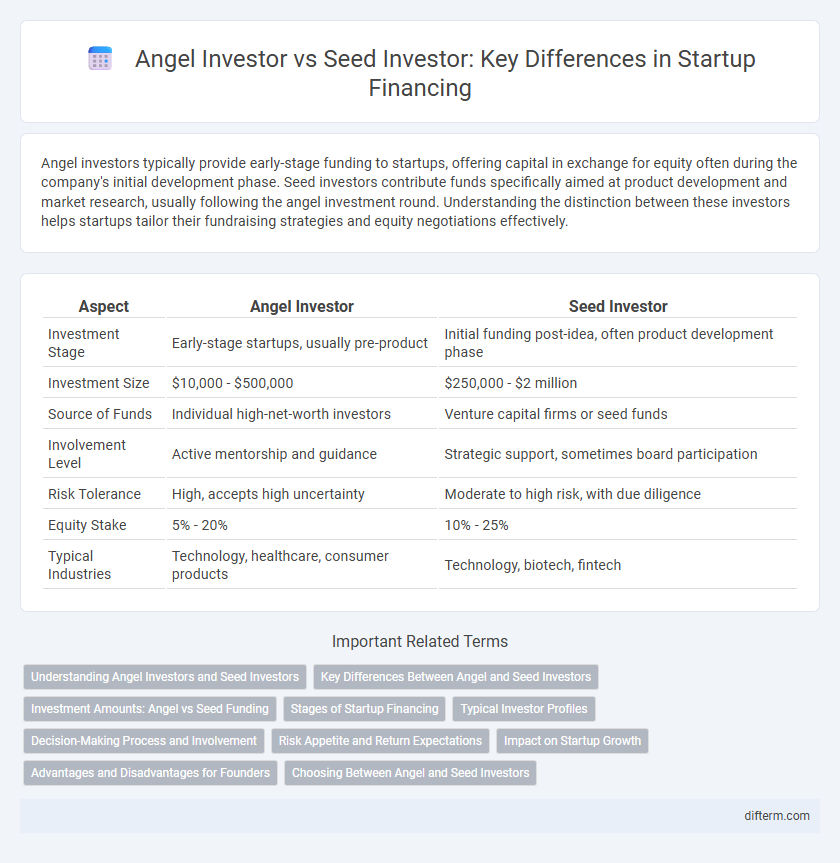

Table of Comparison

| Aspect | Angel Investor | Seed Investor |

|---|---|---|

| Investment Stage | Early-stage startups, usually pre-product | Initial funding post-idea, often product development phase |

| Investment Size | $10,000 - $500,000 | $250,000 - $2 million |

| Source of Funds | Individual high-net-worth investors | Venture capital firms or seed funds |

| Involvement Level | Active mentorship and guidance | Strategic support, sometimes board participation |

| Risk Tolerance | High, accepts high uncertainty | Moderate to high risk, with due diligence |

| Equity Stake | 5% - 20% | 10% - 25% |

| Typical Industries | Technology, healthcare, consumer products | Technology, biotech, fintech |

Understanding Angel Investors and Seed Investors

Angel investors are high-net-worth individuals who provide early-stage capital to startups in exchange for equity, often bringing valuable industry expertise and mentorship. Seed investors typically represent funds or institutions that offer structured financial backing during a startup's initial development phase to accelerate product validation and market entry. Understanding the distinct roles and investment amounts--angel investments usually ranging from $25,000 to $100,000, while seed rounds can exceed $1 million--helps entrepreneurs tailor their funding strategies effectively.

Key Differences Between Angel and Seed Investors

Angel investors typically provide early-stage funding using personal funds, often investing amounts ranging from $25,000 to $100,000, focusing on startups in their nascent phase. Seed investors usually operate through organized funds or venture capital firms, investing larger sums between $100,000 and $2 million to support product development and market entry. Angel investors tend to offer mentorship and strategic advice due to their hands-on involvement, while seed investors emphasize scalable business models and potential for significant returns.

Investment Amounts: Angel vs Seed Funding

Angel investors typically invest between $25,000 and $100,000 in early-stage startups, providing critical initial capital for product development and market testing. Seed funding rounds generally range from $100,000 to $2 million, often led by seed venture capital firms or super angels who seek higher investment stakes and accelerated growth potential. The distinction in investment amounts reflects differing risk tolerance and involvement levels, with angel funding serving as the earliest boost, while seed funding propels startups toward scalable operations.

Stages of Startup Financing

Angel investors typically provide early-stage funding during the seed or pre-seed phases, offering capital to startups in exchange for equity or convertible debt. Seed investors focus on the initial development stage, helping startups with product development, market research, and early operational costs to validate their business model. Both play crucial roles in the startup financing lifecycle, enabling companies to progress from concept to market entry.

Typical Investor Profiles

Angel investors are typically high-net-worth individuals who invest their personal funds in early-stage startups, offering not only capital but also mentorship and industry connections. Seed investors often include institutional funds or venture capital firms specializing in seed-stage financing, focusing on scalable startups with high growth potential. Angel investors usually take smaller equity stakes with a hands-on approach, while seed investors seek larger positions and may require formal governance rights.

Decision-Making Process and Involvement

Angel investors typically make decisions based on personal judgment, industry experience, and potential for high returns, often investing their own capital with a hands-on approach in early-stage startups. Seed investors, usually part of organized seed funds or venture capital, rely on structured due diligence, market analysis, and scalable business models, providing strategic guidance and resources beyond funding. Both play crucial roles in startup growth, but angels tend to be more involved in mentoring, while seed investors focus on scaling and formal governance.

Risk Appetite and Return Expectations

Angel investors typically exhibit a higher risk appetite, investing personal funds in early-stage startups with uncertain prospects, aiming for substantial long-term returns. Seed investors, often institutional or professional entities, balance risk with a focus on scalable business models and clearer growth potential, seeking quicker exits and moderate to high returns. Both investor types prioritize innovative startups but differ fundamentally in their tolerance for risk and expectations on investment timelines and returns.

Impact on Startup Growth

Angel investors provide early-stage startups with crucial capital and mentorship, often enabling foundational development and market entry. Seed investors typically offer larger funding rounds that support product refinement, team expansion, and initial scaling efforts. Both investor types significantly influence startup growth trajectories by reducing financial barriers and accelerating business milestones.

Advantages and Disadvantages for Founders

Angel investors provide early-stage startups with flexible funding and valuable mentorship but may require significant equity and influence in company decisions. Seed investors typically offer larger capital amounts with structured terms, which can accelerate growth but may impose stricter performance expectations and dilute founder control. Founders benefit from angel investors' personalized support but face limited funding scale, while seed investors enable faster scaling at the potential cost of reduced autonomy.

Choosing Between Angel and Seed Investors

Choosing between angel investors and seed investors depends on the startup's funding needs, growth stage, and desired level of involvement. Angel investors typically provide early-stage capital and mentorship with smaller check sizes, ideal for nascent startups seeking personalized support. Seed investors usually offer larger funding rounds focused on scaling operations and product development, often coming from venture capital funds or specialized seed investment firms.

Angel Investor vs Seed Investor Infographic

difterm.com

difterm.com