Hard forks and soft forks are crucial concepts in blockchain technology impacting cryptocurrency networks. A hard fork creates a permanent divergence from the previous blockchain version, requiring all nodes to upgrade software, often leading to new coins or tokens. In contrast, a soft fork is backward-compatible, allowing non-upgraded nodes to still participate, typically used for minor protocol changes without splitting the network.

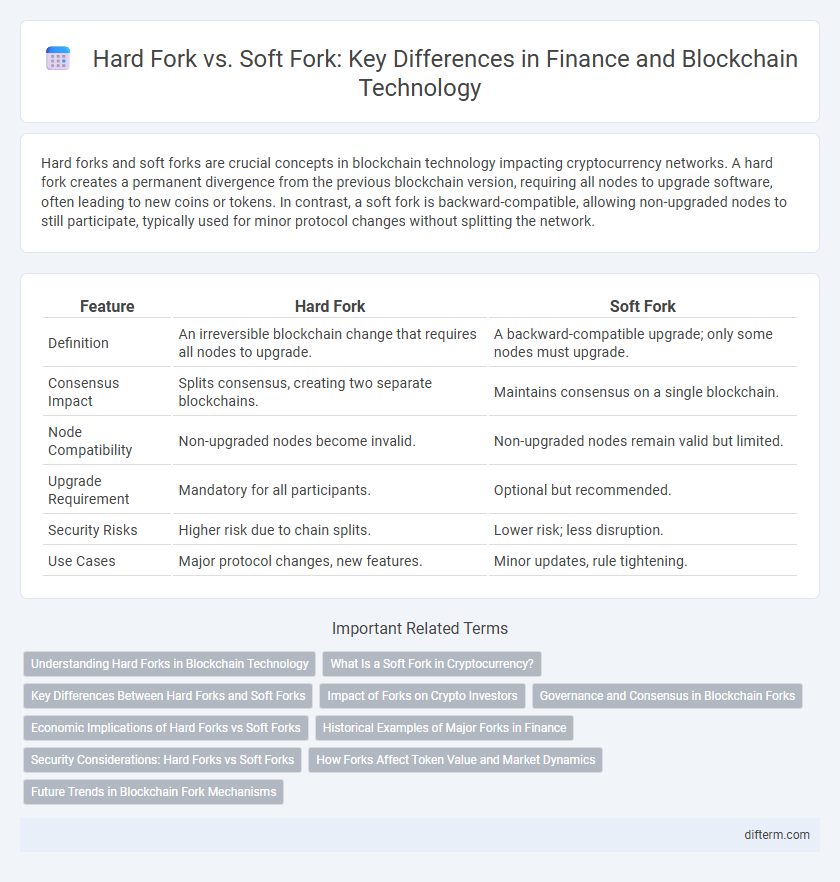

Table of Comparison

| Feature | Hard Fork | Soft Fork |

|---|---|---|

| Definition | An irreversible blockchain change that requires all nodes to upgrade. | A backward-compatible upgrade; only some nodes must upgrade. |

| Consensus Impact | Splits consensus, creating two separate blockchains. | Maintains consensus on a single blockchain. |

| Node Compatibility | Non-upgraded nodes become invalid. | Non-upgraded nodes remain valid but limited. |

| Upgrade Requirement | Mandatory for all participants. | Optional but recommended. |

| Security Risks | Higher risk due to chain splits. | Lower risk; less disruption. |

| Use Cases | Major protocol changes, new features. | Minor updates, rule tightening. |

Understanding Hard Forks in Blockchain Technology

Hard forks in blockchain technology represent a radical change to the protocol that creates divergence from the original chain, leading to two separate blockchains. This split occurs when nodes upgrade to a new version of software that is incompatible with the previous one, causing a permanent alteration in the network's rules. Unlike soft forks, hard forks require all participants to adopt the update to maintain consensus and avoid transaction invalidation.

What Is a Soft Fork in Cryptocurrency?

A soft fork in cryptocurrency is a backward-compatible upgrade to a blockchain protocol that allows non-upgraded nodes to continue validating transactions. It modifies rules in a way that tightens consensus without requiring all participants to update their software immediately. This upgrade can improve network security and functionality while maintaining compatibility with older versions.

Key Differences Between Hard Forks and Soft Forks

Hard forks result in a permanent split from the original blockchain, creating two separate chains that operate independently and often require users to upgrade to new software versions. Soft forks maintain compatibility with the existing blockchain by implementing backward-compatible protocol changes, allowing non-upgraded nodes to continue validating transactions. The key difference lies in network consensus and compatibility, with hard forks forcing a divergence and soft forks enabling seamless upgrades.

Impact of Forks on Crypto Investors

Hard forks create permanent splits in blockchain protocols, requiring investors to manage separate assets and navigate increased market volatility. Soft forks maintain backward compatibility, causing less disruption but still prompting software updates to avoid transaction validation issues. Investors must assess risks of value fluctuations, liquidity challenges, and potential replay attacks when forks occur.

Governance and Consensus in Blockchain Forks

Hard forks create permanent splits in a blockchain, requiring all nodes to upgrade to new protocols, which often leads to governance disputes as stakeholders must decide on divergent visions for the network. Soft forks maintain backward compatibility, allowing non-upgraded nodes to continue validating transactions, thus minimizing consensus disruption and preserving unified network governance. Effective governance ensures coordinated decision-making during forks, impacting consensus mechanisms and shaping the blockchain's future protocol evolution.

Economic Implications of Hard Forks vs Soft Forks

Hard forks often lead to the creation of new cryptocurrencies, resulting in market dilution and potential investor uncertainty, which can impact asset valuation and liquidity. Soft forks maintain backward compatibility, minimizing market disruption and preserving the economic stability of the original blockchain network. The choice between hard and soft forks influences transaction costs, network security incentives, and long-term investment strategies within decentralized finance ecosystems.

Historical Examples of Major Forks in Finance

Bitcoin's hard fork in 2017 led to the creation of Bitcoin Cash, addressing scalability issues by increasing block size. Ethereum experienced a notable hard fork in 2016 following the DAO hack, resulting in Ethereum Classic maintaining the original blockchain while Ethereum adopted the new chain. Soft forks, such as Bitcoin's Segregated Witness (SegWit) upgrade in 2017, improved transaction scalability and malleability without splitting the blockchain, reflecting key approaches to protocol evolution in finance.

Security Considerations: Hard Forks vs Soft Forks

Hard forks create divergent blockchain paths, increasing the risk of security vulnerabilities through network splits and potential double-spending attacks. Soft forks maintain backward compatibility, reducing security risks by ensuring all nodes and miners recognize the updated protocol without causing chain division. Security considerations favor soft forks for incremental protocol upgrades, while hard forks demand rigorous consensus and coordination to mitigate threats.

How Forks Affect Token Value and Market Dynamics

Hard forks create a permanent split in a blockchain, often resulting in the creation of a new token that can significantly impact the original token's market value and liquidity. Soft forks are backward-compatible upgrades that generally lead to less market disruption but can still influence investor confidence and token price stability. Both types of forks affect market dynamics by altering supply, investor sentiment, and network security, which are critical factors for token valuation in decentralized finance ecosystems.

Future Trends in Blockchain Fork Mechanisms

Future trends in blockchain fork mechanisms highlight an increasing preference for soft forks due to their backwards compatibility and reduced network disruption. Hard forks, while offering more significant protocol changes and opportunities for innovation, face challenges in community consensus and risk of chain splits. As decentralized finance (DeFi) ecosystems evolve, hybrid fork models combining benefits of both types are emerging to enhance scalability and governance flexibility.

Hard Fork vs Soft Fork Infographic

difterm.com

difterm.com