Leveraged Buyouts (LBO) involve acquiring a company using significant amounts of borrowed money, often to purchase controlling interest, while Management Buyouts (MBO) occur when a company's existing management team acquires the business. LBOs typically attract private equity firms seeking financial returns through operational improvements and debt repayment, whereas MBOs emphasize continuity by allowing managers to take ownership and drive strategic growth. Both methods leverage debt financing but differ in buyer identity and post-transaction management dynamics.

Table of Comparison

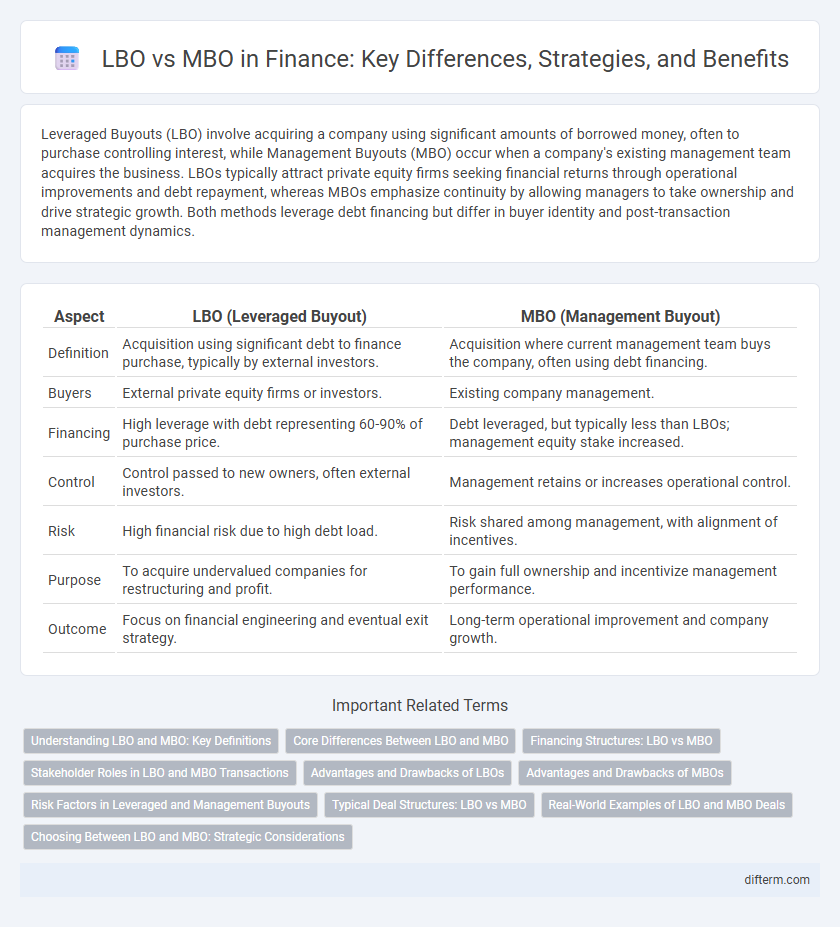

| Aspect | LBO (Leveraged Buyout) | MBO (Management Buyout) |

|---|---|---|

| Definition | Acquisition using significant debt to finance purchase, typically by external investors. | Acquisition where current management team buys the company, often using debt financing. |

| Buyers | External private equity firms or investors. | Existing company management. |

| Financing | High leverage with debt representing 60-90% of purchase price. | Debt leveraged, but typically less than LBOs; management equity stake increased. |

| Control | Control passed to new owners, often external investors. | Management retains or increases operational control. |

| Risk | High financial risk due to high debt load. | Risk shared among management, with alignment of incentives. |

| Purpose | To acquire undervalued companies for restructuring and profit. | To gain full ownership and incentivize management performance. |

| Outcome | Focus on financial engineering and eventual exit strategy. | Long-term operational improvement and company growth. |

Understanding LBO and MBO: Key Definitions

A Leveraged Buyout (LBO) involves acquiring a company primarily using borrowed funds secured against the target's assets, often executed by external investors such as private equity firms. A Management Buyout (MBO) occurs when a company's existing management team acquires a significant portion or all of the business, frequently supported by external financing yet driven by internal leadership. Both LBOs and MBOs utilize leverage to maximize returns but differ in the buyer's identity and motivations behind the transaction.

Core Differences Between LBO and MBO

LBO (Leveraged Buyout) involves acquiring a company primarily through borrowed funds, often by external investors, whereas MBO (Management Buyout) occurs when a company's existing management team acquires the business using a mix of personal equity and debt. The core difference lies in the acquirers: LBOs typically feature external private equity firms targeting operational efficiencies, while MBOs emphasize continuity with insider management maintaining strategic control. Financial structuring in LBOs leans heavily on debt for value maximization, whereas MBOs focus on aligning management incentives with long-term company performance.

Financing Structures: LBO vs MBO

Leveraged Buyouts (LBOs) primarily rely on significant amounts of debt financing secured against the target company's assets, aiming to maximize returns through financial leverage. Management Buyouts (MBOs) involve the incumbent management team using a mix of equity contributions and debt financing, often with seller financing or private equity support, to acquire ownership stakes. The financing structure in LBOs typically emphasizes external debt providers and syndicated loans, whereas MBOs focus more on internal management equity stakes combined with tailored debt packages.

Stakeholder Roles in LBO and MBO Transactions

In Leveraged Buyouts (LBOs), private equity firms act as primary acquirers, providing substantial debt financing and strategic management to optimize company value, while existing management often transitions to a less dominant operational role. Management Buyouts (MBOs) feature current executives as principal buyers, leveraging personal equity and external debt to secure ownership, fostering alignment between management incentives and company performance. Stakeholders in LBOs focus on maximizing return on investment through operational restructuring, whereas MBO stakeholders prioritize continuity and control, ensuring smoother transitions and sustained business growth.

Advantages and Drawbacks of LBOs

Leveraged Buyouts (LBOs) enable significant acquisition financing by using high debt levels, allowing buyers to maximize equity returns and maintain control over the target company. However, the substantial leverage increases financial risk and can strain cash flows, potentially jeopardizing operational stability if earnings falter. LBOs also impose strict covenants and repayment obligations, which may limit strategic flexibility and lead to asset sales under pressure.

Advantages and Drawbacks of MBOs

Management Buyouts (MBOs) offer the advantage of aligning management's interests with company performance, fostering enhanced operational efficiency and strategic focus. However, MBOs carry the risk of high financial leverage, potentially leading to liquidity constraints and increased vulnerability to market fluctuations. Despite these drawbacks, MBOs can create significant value when management has in-depth knowledge of the business and sufficient incentives to drive growth.

Risk Factors in Leveraged and Management Buyouts

Leveraged Buyouts (LBOs) carry significant financial risk due to high debt levels, which can strain cash flows and increase default probability during economic downturns. Management Buyouts (MBOs) present unique operational risks as existing management may lack necessary expertise to handle new ownership responsibilities and debt servicing. Both structures require thorough due diligence to assess market volatility, interest rate fluctuations, and potential conflicts of interest impacting deal success.

Typical Deal Structures: LBO vs MBO

In finance, typical deal structures for Leveraged Buyouts (LBOs) involve acquiring a company primarily through debt financing, leveraging the target's assets as collateral to maximize returns. Management Buyouts (MBOs) differ by having the existing management team acquire the company, often combining personal equity with external debt to maintain operational control. LBOs typically center on financial sponsors seeking high returns, whereas MBOs prioritize continuity and strategic control by company insiders.

Real-World Examples of LBO and MBO Deals

The 2007 buyout of Dell Inc. by Michael Dell and Silver Lake Partners exemplifies a prominent Management Buyout (MBO), where existing executives took control to restructure operations and enhance value. Kohlberg Kravis Roberts' (KKR) 2006 acquisition of TXU Energy illustrates a classic Leveraged Buyout (LBO), leveraging substantial debt to finance the $45 billion transaction. These deals highlight strategic execution differences, with MBOs driven by insider management visions and LBOs frequently involving external private equity firms employing financial leverage for value creation.

Choosing Between LBO and MBO: Strategic Considerations

Evaluating the choice between Leveraged Buyout (LBO) and Management Buyout (MBO) requires analyzing the alignment of financial risk and operational control goals. LBOs often emphasize maximizing external debt leverage for value creation, while MBOs prioritize continuity and insider expertise through management-led acquisition. Strategic considerations include assessing management's capability to run the company post-buyout, debt capacity, and the desired level of autonomy in decision-making.

LBO vs MBO Infographic

difterm.com

difterm.com