Hard inquiries occur when a lender reviews your credit report as part of a loan or credit application, potentially impacting your credit score. Soft inquiries, on the other hand, happen during background checks or when you check your own credit, and they do not affect your score. Understanding the difference between hard and soft inquiries helps you manage credit applications strategically and maintain a healthy credit profile.

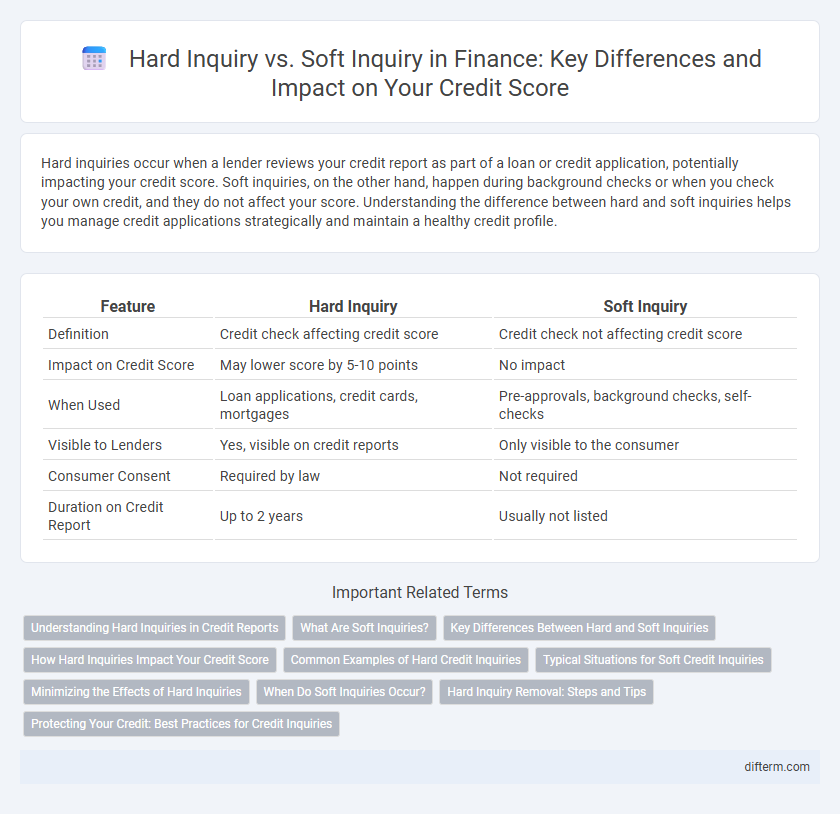

Table of Comparison

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Definition | Credit check affecting credit score | Credit check not affecting credit score |

| Impact on Credit Score | May lower score by 5-10 points | No impact |

| When Used | Loan applications, credit cards, mortgages | Pre-approvals, background checks, self-checks |

| Visible to Lenders | Yes, visible on credit reports | Only visible to the consumer |

| Consumer Consent | Required by law | Not required |

| Duration on Credit Report | Up to 2 years | Usually not listed |

Understanding Hard Inquiries in Credit Reports

Hard inquiries occur when a lender or creditor reviews your credit report as part of a formal application process, such as applying for a mortgage, auto loan, or credit card. These inquiries can impact your credit score by slightly lowering it, typically for up to 12 months, as multiple hard inquiries within a short period may signal increased credit risk. Monitoring hard inquiries on your credit report is essential for maintaining an accurate credit profile and improving your chances of loan approval.

What Are Soft Inquiries?

Soft inquiries refer to credit checks that do not impact an individual's credit score and occur when a person or company reviews a credit report for purposes unrelated to lending decisions. Common examples include employer background checks, pre-approved credit card offers, and personal credit reviews conducted by consumers themselves. Unlike hard inquiries, soft inquiries remain invisible to lenders and creditors evaluating a credit application.

Key Differences Between Hard and Soft Inquiries

Hard inquiries occur when a lender reviews your credit report as part of a loan or credit application, impacting your credit score and staying on your report for up to two years. Soft inquiries, used for pre-approval offers or background checks, do not affect your credit score and are only visible to you. The key differences lie in their effect on credit scores and visibility to other lenders.

How Hard Inquiries Impact Your Credit Score

Hard inquiries occur when lenders review your credit report to make lending decisions, causing a temporary dip in your credit score typically ranging from 5 to 10 points. Multiple hard inquiries within a short period, such as when rate shopping for a mortgage or auto loan, are usually treated as a single inquiry to minimize impact. These inquiries remain on your credit report for up to two years but generally affect your score for only about 12 months.

Common Examples of Hard Credit Inquiries

Hard credit inquiries commonly occur when applying for a mortgage, auto loan, or credit card, as lenders review credit reports to assess borrower risk. These inquiries can also happen during requests for personal loans or when landlords screen potential tenants. Such hard pulls typically stay on credit reports for up to two years and may impact credit scores.

Typical Situations for Soft Credit Inquiries

Soft credit inquiries commonly occur when individuals check their own credit reports, apply for pre-approved credit offers, or undergo background checks for employment purposes. These inquiries do not affect credit scores and are primarily used for informational or non-lending decisions. Financial institutions often use soft pulls during account reviews or customer retention efforts to assess creditworthiness without impacting the borrower's credit profile.

Minimizing the Effects of Hard Inquiries

Minimizing the effects of hard inquiries on your credit score involves strategically limiting credit applications within a short timeframe, as multiple inquiries can significantly lower your credit rating. Monitoring your credit reports regularly can help identify unauthorized hard inquiries and prompt timely disputes to prevent unnecessary damage. Maintaining a stable credit profile by managing existing accounts responsibly reduces the need for frequent credit checks and preserves your creditworthiness.

When Do Soft Inquiries Occur?

Soft inquiries occur during routine financial activities such as checking your own credit score, pre-approved credit offers, and background checks by employers or landlords. These inquiries do not affect your credit score and are typically visible only to you on your credit report. Financial institutions use soft inquiries to assess creditworthiness without requiring explicit permission or impacting the applicant's credit history.

Hard Inquiry Removal: Steps and Tips

Hard inquiry removal starts by obtaining a copy of your credit report from major bureaus like Experian, Equifax, and TransUnion to identify unauthorized or inaccurate hard inquiries. Dispute any wrongful entries directly with the credit bureau by submitting a formal request along with supporting documentation to prove the inquiry was not authorized. Following up regularly and leveraging the Fair Credit Reporting Act (FCRA) can expedite the removal process, improving your credit score effectively.

Protecting Your Credit: Best Practices for Credit Inquiries

Hard inquiries occur when lenders review your credit report for loan approvals, potentially lowering your credit score by a few points, while soft inquiries, such as personal credit checks or pre-approved offers, do not impact your score. To protect your credit, limit hard inquiries by applying for credit sparingly and monitoring your credit reports regularly for unauthorized checks. Utilizing credit monitoring services and maintaining a strong credit history can help minimize the negative effects of hard inquiries on your overall credit health.

Hard Inquiry vs Soft Inquiry Infographic

difterm.com

difterm.com