Credit unions offer personalized service and typically lower fees as member-owned institutions, while commercial banks provide a broader range of financial products with advanced technology and nationwide access. Credit unions prioritize community and member benefits, making them ideal for localized banking needs. Commercial banks excel in convenience and scalability, serving both individual customers and large businesses.

Table of Comparison

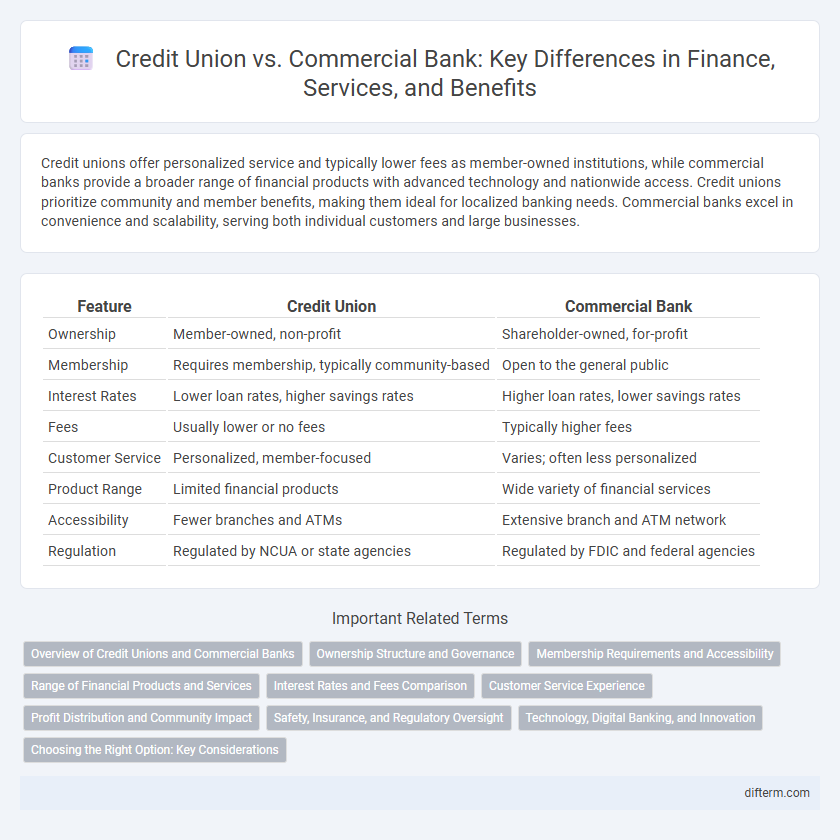

| Feature | Credit Union | Commercial Bank |

|---|---|---|

| Ownership | Member-owned, non-profit | Shareholder-owned, for-profit |

| Membership | Requires membership, typically community-based | Open to the general public |

| Interest Rates | Lower loan rates, higher savings rates | Higher loan rates, lower savings rates |

| Fees | Usually lower or no fees | Typically higher fees |

| Customer Service | Personalized, member-focused | Varies; often less personalized |

| Product Range | Limited financial products | Wide variety of financial services |

| Accessibility | Fewer branches and ATMs | Extensive branch and ATM network |

| Regulation | Regulated by NCUA or state agencies | Regulated by FDIC and federal agencies |

Overview of Credit Unions and Commercial Banks

Credit unions are member-owned financial cooperatives that offer personalized banking services with typically lower fees and higher interest rates on savings compared to commercial banks. Commercial banks are for-profit institutions providing a wide range of financial products to the general public, prioritizing shareholder returns and extensive branch networks. Both institutions are regulated but differ in their ownership, purpose, and customer focus within the financial sector.

Ownership Structure and Governance

Credit unions operate as member-owned cooperatives where each member has an equal vote in governance, promoting a democratic structure that prioritizes member benefits over profits. Commercial banks are investor-owned institutions governed by a board of directors accountable to shareholders, focusing primarily on maximizing shareholder value. This fundamental difference influences decision-making processes, with credit unions emphasizing community needs and commercial banks prioritizing financial returns.

Membership Requirements and Accessibility

Credit unions require membership based on specific eligibility criteria such as employment, geographic location, or association membership, limiting access to select groups. Commercial banks offer open accessibility without membership restrictions, allowing anyone to open an account regardless of background. This fundamental difference influences customer reach, with credit unions fostering a community-based approach and commercial banks prioritizing broad market availability.

Range of Financial Products and Services

Credit unions typically offer a more limited range of financial products and services, focusing on savings accounts, personal loans, and mortgages tailored to their member base. Commercial banks provide a broader spectrum, including business loans, investment services, credit cards, and advanced online banking platforms. The diversity in offerings from commercial banks often caters to a wider audience, whereas credit unions prioritize personalized service and member benefits.

Interest Rates and Fees Comparison

Credit unions typically offer lower interest rates on loans and higher rates on savings accounts compared to commercial banks, resulting from their not-for-profit structure. Fees charged by credit unions are generally lower and less varied, with many waiving common fees such as maintenance and overdrafts, unlike many commercial banks that impose higher fees to maximize shareholder profits. Consumers seeking cost-effective borrowing and saving options often benefit from the reduced rates and fees associated with credit union membership.

Customer Service Experience

Credit unions prioritize personalized customer service by offering member-focused support and lower fees, creating a more community-centered experience than commercial banks. Commercial banks typically provide faster, technology-driven services with extensive ATM networks but may lack the individualized attention found in credit unions. Customer satisfaction often hinges on the choice between credit unions' tailored engagement and commercial banks' convenience and scalability.

Profit Distribution and Community Impact

Credit unions distribute profits directly back to their members through lower fees and higher savings rates, enhancing individual financial well-being and fostering local economic growth. Commercial banks prioritize shareholder returns, often reinvesting profits into expanding services and infrastructure, which can lead to broader market influence but less direct benefit to local communities. This fundamental difference shapes the community impact, with credit unions typically supporting localized financial empowerment, while commercial banks drive large-scale economic development.

Safety, Insurance, and Regulatory Oversight

Credit unions are regulated by the National Credit Union Administration (NCUA), offering members federal insurance coverage up to $250,000 through the National Credit Union Share Insurance Fund (NCUSIF), ensuring deposit safety. Commercial banks fall under the supervision of agencies like the Federal Deposit Insurance Corporation (FDIC), which similarly insures deposits up to $250,000 per depositor, per bank, providing robust consumer protection. Both institutions adhere to stringent regulatory oversight aimed at maintaining financial stability and safeguarding depositor assets.

Technology, Digital Banking, and Innovation

Credit unions often leverage innovative technology to enhance member-centric digital banking experiences, offering personalized mobile apps and streamlined online services tailored to community needs. Commercial banks typically invest heavily in advanced fintech solutions, implementing AI-driven tools, blockchain for secure transactions, and expansive digital platforms to support a broad customer base. Both institutions prioritize technology integration, but commercial banks tend to lead in large-scale digital innovation while credit unions focus on user-friendly, community-focused tech enhancements.

Choosing the Right Option: Key Considerations

Credit unions typically offer lower interest rates and personalized service due to their not-for-profit structure, making them ideal for individuals seeking cost-effective loans and community-focused banking. Commercial banks provide a wider range of financial products, advanced technology, and greater accessibility through extensive branch networks, which suits customers prioritizing convenience and diverse services. Assessing factors such as fee structures, loan requirements, customer service quality, and digital banking capabilities helps determine the best choice between credit unions and commercial banks.

Credit union vs commercial bank Infographic

difterm.com

difterm.com