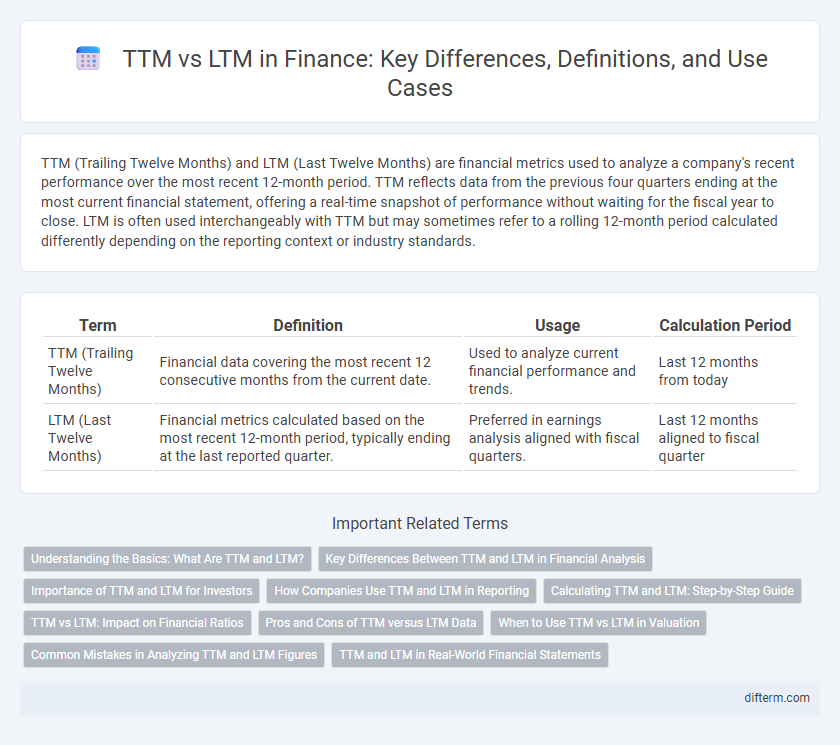

TTM (Trailing Twelve Months) and LTM (Last Twelve Months) are financial metrics used to analyze a company's recent performance over the most recent 12-month period. TTM reflects data from the previous four quarters ending at the most current financial statement, offering a real-time snapshot of performance without waiting for the fiscal year to close. LTM is often used interchangeably with TTM but may sometimes refer to a rolling 12-month period calculated differently depending on the reporting context or industry standards.

Table of Comparison

| Term | Definition | Usage | Calculation Period |

|---|---|---|---|

| TTM (Trailing Twelve Months) | Financial data covering the most recent 12 consecutive months from the current date. | Used to analyze current financial performance and trends. | Last 12 months from today |

| LTM (Last Twelve Months) | Financial metrics calculated based on the most recent 12-month period, typically ending at the last reported quarter. | Preferred in earnings analysis aligned with fiscal quarters. | Last 12 months aligned to fiscal quarter |

Understanding the Basics: What Are TTM and LTM?

TTM (Trailing Twelve Months) and LTM (Last Twelve Months) are financial metrics used to analyze a company's recent performance by summing up financial data from the most recent twelve-month period. These metrics provide a dynamic alternative to traditional fiscal year reports by including the latest available data, offering a more current view of revenue, earnings, or cash flow. Understanding TTM and LTM is critical for investors and analysts to evaluate trends, assess financial health, and make informed decisions based on the most up-to-date financial performance.

Key Differences Between TTM and LTM in Financial Analysis

TTM (Trailing Twelve Months) and LTM (Last Twelve Months) both measure financial performance over the most recent 12-month period but differ in calculation timing; TTM updates monthly or quarterly, while LTM is often aligned with fiscal year-end changes. TTM provides a rolling view that reflects the most current data, enhancing accuracy in trend analysis and valuation metrics like revenue growth or EBITDA margins. LTM typically serves for comparison against past fiscal years, offering a consistent timeframe for year-over-year performance assessments in financial modeling and investment decisions.

Importance of TTM and LTM for Investors

TTM (Trailing Twelve Months) and LTM (Last Twelve Months) provide investors with the most recent and comprehensive financial performance data, crucial for accurate valuation and trend analysis. These metrics eliminate seasonality distortions and offer a dynamic view of a company's earnings, cash flow, and revenue growth. TTM and LTM help investors make informed decisions by reflecting real-time business health and facilitating reliable comparisons across different time periods.

How Companies Use TTM and LTM in Reporting

Companies use TTM (Trailing Twelve Months) and LTM (Last Twelve Months) metrics to provide a more current and comprehensive view of financial performance by analyzing data from the most recent 12-month period, regardless of the fiscal year-end. TTM and LTM figures help investors and analysts assess trends, forecast future earnings, and evaluate company health by smoothing out seasonal fluctuations. These measures are essential for comparing performance across quarters or fiscal years, ensuring consistency in financial reporting and decision-making.

Calculating TTM and LTM: Step-by-Step Guide

Calculating TTM (Trailing Twelve Months) involves summing the financial data from the most recent four quarters to capture the latest annual performance, ensuring an up-to-date financial snapshot. For LTM (Last Twelve Months), aggregate the financial metrics from the last 12 months, which may include partial fiscal quarters, providing a more current evaluation than standard annual reports. Both TTM and LTM calculations require accurate quarterly financial statements and careful date alignment to deliver precise, real-time insights for investment analysis and financial planning.

TTM vs LTM: Impact on Financial Ratios

TTM (Trailing Twelve Months) and LTM (Last Twelve Months) both measure financial performance over the most recent 12-month period but differ slightly in calculation timing, impacting financial ratios' accuracy. TTM captures data updated continuously through the most recent quarter, offering a more current reflection of earnings, while LTM often refers to the last 12 months ending on a specific fiscal date, potentially missing the latest financial shifts. This timing nuance affects ratios like P/E, ROE, and EBITDA margin, where TTM provides a more real-time view, enhancing the precision of trend analysis and investment decisions.

Pros and Cons of TTM versus LTM Data

TTM (Trailing Twelve Months) data provides a real-time snapshot of a company's financial performance by capturing the most recent 12-month period, which is especially useful for identifying current trends and seasonality. LTM (Last Twelve Months) data, while similar, may rely on calendar-based or fiscal year data, potentially missing mid-year fluctuations or recent developments. TTM offers greater responsiveness to recent changes but can be more volatile, whereas LTM provides stability with standardized reporting periods but might lag in reflecting the latest performance shifts.

When to Use TTM vs LTM in Valuation

TTM (Trailing Twelve Months) provides the most current financial performance by analyzing data from the past 12 months, making it ideal for businesses with recent volatility or rapid changes. LTM (Last Twelve Months) may be preferred when a company's fiscal year-end differs from the calendar year, allowing valuation experts to align performance metrics with financial reporting periods. For accurate valuation, use TTM for up-to-date earnings and cash flow assessment, while LTM offers consistency when comparing companies with differing fiscal year-ends.

Common Mistakes in Analyzing TTM and LTM Figures

Common mistakes in analyzing TTM (Trailing Twelve Months) and LTM (Last Twelve Months) figures include confusing the two terms, as TTM refers to the most recently completed 12 months while LTM can be a rolling measure that includes the latest data available. Investors often overlook the impact of seasonality and one-time events on TTM and LTM calculations, leading to misleading conclusions. Another error is failing to adjust for changes in accounting policies or business structure, which can distort comparability over time.

TTM and LTM in Real-World Financial Statements

Trailing Twelve Months (TTM) and Last Twelve Months (LTM) both represent a 12-month period but differ in alignment with fiscal calendars; TTM often trails the most recent quarterly report date, while LTM aligns with the last completed fiscal year. In real-world financial statements, TTM provides the most up-to-date performance metrics by capturing recent financial activity, making it crucial for timely investment analysis. LTM figures are frequently used for year-over-year comparisons and budgeting since they correspond with official fiscal reporting periods.

TTM vs LTM Infographic

difterm.com

difterm.com