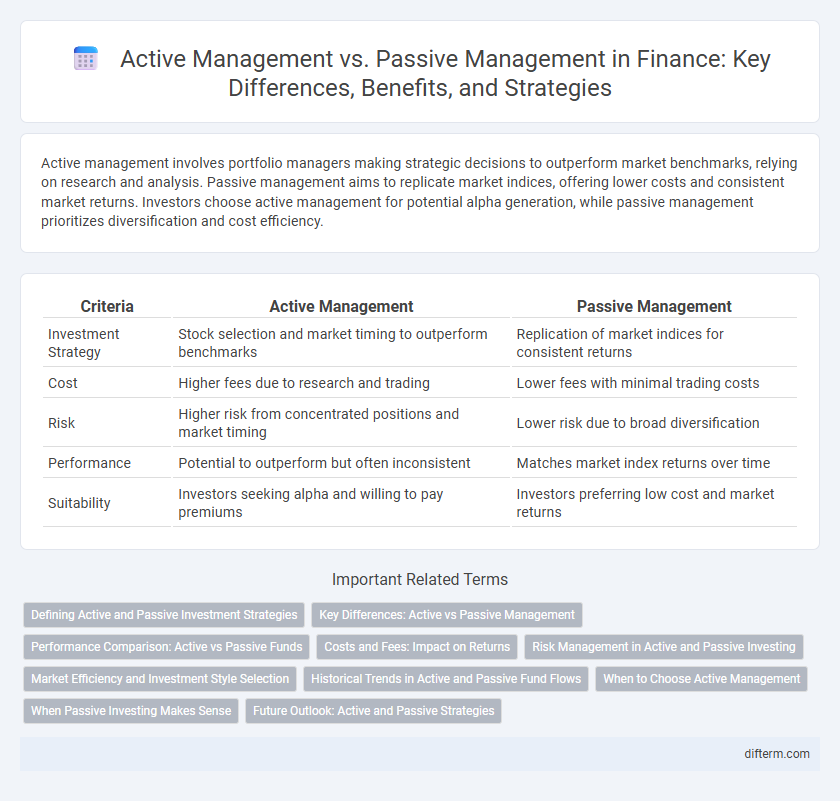

Active management involves portfolio managers making strategic decisions to outperform market benchmarks, relying on research and analysis. Passive management aims to replicate market indices, offering lower costs and consistent market returns. Investors choose active management for potential alpha generation, while passive management prioritizes diversification and cost efficiency.

Table of Comparison

| Criteria | Active Management | Passive Management |

|---|---|---|

| Investment Strategy | Stock selection and market timing to outperform benchmarks | Replication of market indices for consistent returns |

| Cost | Higher fees due to research and trading | Lower fees with minimal trading costs |

| Risk | Higher risk from concentrated positions and market timing | Lower risk due to broad diversification |

| Performance | Potential to outperform but often inconsistent | Matches market index returns over time |

| Suitability | Investors seeking alpha and willing to pay premiums | Investors preferring low cost and market returns |

Defining Active and Passive Investment Strategies

Active investment strategies involve portfolio managers making specific investments with the goal of outperforming a benchmark index through research, market forecasting, and stock selection. Passive investment strategies aim to replicate the performance of a market index by holding a diversified portfolio that mirrors the index composition, minimizing trading frequency and management costs. Understanding these definitions helps investors choose between attempting to beat the market or matching its average returns efficiently.

Key Differences: Active vs Passive Management

Active management involves continuous portfolio adjustments by fund managers aiming to outperform benchmarks through stock selection and market timing, whereas passive management replicates index performance by holding a fixed portfolio aligned with market indices. Active funds typically incur higher fees due to research and trading costs, while passive funds offer lower expenses and reduced turnover, enhancing tax efficiency. Performance variability is greater in active management, with potential for above-market returns but also higher risk, whereas passive management delivers consistent market-matching returns with less risk and volatility.

Performance Comparison: Active vs Passive Funds

Active management seeks to outperform market benchmarks by leveraging expert stock selection and market timing, often resulting in higher fees and variable performance. Passive management aims to replicate the performance of a specific index, typically offering lower costs and more consistent returns aligned with market averages. Studies show that over long-term periods, a majority of active funds underperform their passive counterparts after accounting for fees and expenses.

Costs and Fees: Impact on Returns

Active management typically incurs higher costs and fees due to frequent trading and portfolio supervision, which can erode net returns over time. Passive management strategies, such as index funds, generally have lower expense ratios, enabling investors to retain a greater portion of market gains. Studies indicate that the fee differential significantly affects long-term investment performance, with lower-cost passive funds often outperforming actively managed counterparts after fees.

Risk Management in Active and Passive Investing

Active management employs continuous risk assessment and tactical adjustments to mitigate market volatility and capitalize on short-term opportunities, enhancing portfolio resilience. Passive management minimizes risk through broad market exposure and diversification, reducing the impact of individual asset fluctuations and lowering costs. Both strategies address risk differently: active management relies on skilled decision-making to adapt, while passive management leverages market efficiency for stable, long-term growth.

Market Efficiency and Investment Style Selection

Active management relies on the assumption of market inefficiencies to outperform benchmarks through security selection and market timing, while passive management assumes markets are efficient, aiming to replicate index performance at lower costs. Investment style selection in active management involves analyzing factors such as growth versus value stocks and market capitalization, leveraging detailed research to capitalize on mispricings. Conversely, passive strategies prioritize broad market exposure and diversification, minimizing transaction costs and tracking error in efficient markets.

Historical Trends in Active and Passive Fund Flows

Historical trends in fund flows reveal a significant shift from active to passive management, with passive funds experiencing consistent inflows due to lower fees and broad market exposure. Despite periodic rebounds in active management driven by market volatility or sector-specific opportunities, passive investment strategies have dominated growth in assets under management since the early 2000s. Data from Morningstar shows that passive funds captured over 60% of total equity fund inflows by 2023, underscoring investor preference for cost-efficient, index-linked products.

When to Choose Active Management

Active management is ideal in inefficient markets where skilled managers can exploit mispriced securities to generate alpha. It is preferable during periods of high volatility or economic uncertainty when market inefficiencies increase. Investors seeking to outperform benchmarks and willing to accept higher fees should consider active management.

When Passive Investing Makes Sense

Passive investing makes sense when market efficiency is high, reducing opportunities for active managers to consistently outperform benchmarks. It is ideal for investors seeking low-cost, diversified exposure with minimal trading and tax implications. This approach suits long-term horizons where market fluctuations are less likely to impact overall returns.

Future Outlook: Active and Passive Strategies

Active management will likely evolve with advances in artificial intelligence and big data analytics, enabling fund managers to uncover unique investment opportunities and enhance risk management. Passive management is expected to maintain its popularity due to low fees and consistent market returns, driving continued growth in index fund and ETF assets worldwide. The future of investment strategies suggests a hybrid approach could emerge, combining the precision of passive indexing with selective active management to optimize portfolio performance.

Active Management vs Passive Management Infographic

difterm.com

difterm.com