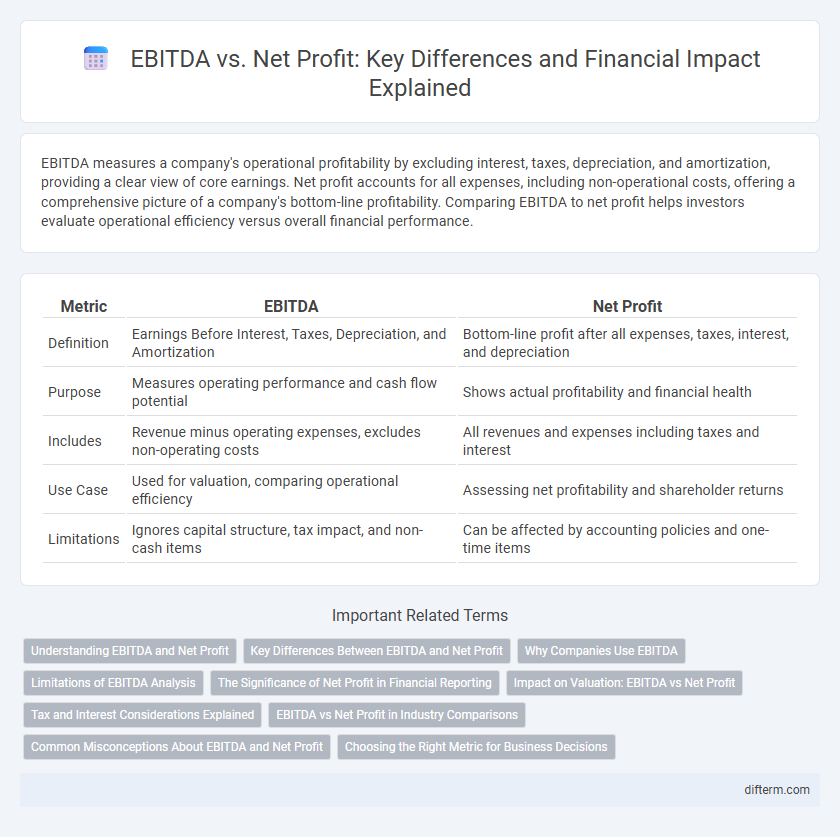

EBITDA measures a company's operational profitability by excluding interest, taxes, depreciation, and amortization, providing a clear view of core earnings. Net profit accounts for all expenses, including non-operational costs, offering a comprehensive picture of a company's bottom-line profitability. Comparing EBITDA to net profit helps investors evaluate operational efficiency versus overall financial performance.

Table of Comparison

| Metric | EBITDA | Net Profit |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Bottom-line profit after all expenses, taxes, interest, and depreciation |

| Purpose | Measures operating performance and cash flow potential | Shows actual profitability and financial health |

| Includes | Revenue minus operating expenses, excludes non-operating costs | All revenues and expenses including taxes and interest |

| Use Case | Used for valuation, comparing operational efficiency | Assessing net profitability and shareholder returns |

| Limitations | Ignores capital structure, tax impact, and non-cash items | Can be affected by accounting policies and one-time items |

Understanding EBITDA and Net Profit

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures a company's operational profitability by excluding non-operational expenses and non-cash charges, offering insight into cash flow generation. Net Profit, also known as net income or bottom line, reflects the company's total earnings after deducting all expenses, including interest, taxes, depreciation, and amortization, representing the ultimate measure of profitability. Comparing EBITDA and Net Profit helps investors evaluate operational efficiency alongside overall financial performance and profitability.

Key Differences Between EBITDA and Net Profit

EBITDA measures a company's operational profitability by excluding interest, taxes, depreciation, and amortization, providing insight into core business performance. Net profit, also known as the bottom line, accounts for all expenses including non-operational costs, taxes, and interest, reflecting the company's overall profitability. The key difference lies in EBITDA's focus on cash flow and operational efficiency, while net profit incorporates comprehensive financial factors affecting the final earnings.

Why Companies Use EBITDA

Companies use EBITDA to evaluate operational performance by excluding non-operational expenses such as taxes, depreciation, and amortization, providing a clearer view of core profitability. This metric allows investors and management to compare companies within the same industry without distortion from differing capital structures and tax environments. EBITDA serves as a key indicator for assessing cash flow potential and operational efficiency before financing and accounting decisions.

Limitations of EBITDA Analysis

EBITDA excludes key expenses such as interest, taxes, depreciation, and amortization, which can obscure a company's true profitability and cash flow situation. It may overstate financial health by ignoring capital expenditures and changes in working capital that affect long-term sustainability. Relying solely on EBITDA can lead to misleading conclusions, especially when comparing companies with different capital structures or tax environments.

The Significance of Net Profit in Financial Reporting

Net Profit represents the final earnings of a company after all expenses, taxes, and interest are deducted, providing a comprehensive measure of profitability. Unlike EBITDA, which excludes depreciation, amortization, and non-operating costs, Net Profit offers a complete view of financial performance critical for investors and stakeholders. Accurate Net Profit figures drive informed decision-making, regulatory compliance, and realistic assessments of a company's fiscal health.

Impact on Valuation: EBITDA vs Net Profit

EBITDA serves as a key indicator in valuation by reflecting a company's operational profitability before accounting for non-operating expenses, taxes, depreciation, and amortization, offering a clearer view of cash flow potential. Net Profit, however, incorporates all expenses and provides the bottom-line profitability, crucial for assessing the company's overall financial health and sustainable earnings. Valuation experts often prioritize EBITDA for comparative analysis and enterprise value multiples, while Net Profit is essential for equity valuation and understanding net earnings available to shareholders.

Tax and Interest Considerations Explained

EBITDA excludes interest and tax expenses, providing a clear view of a company's operating performance before financing and tax effects. Net profit accounts for all expenses, including interest payments on debt and tax obligations, reflecting the actual profitability available to shareholders. Understanding the distinction helps investors evaluate operational efficiency separately from the impact of capital structure and tax strategies.

EBITDA vs Net Profit in Industry Comparisons

EBITDA offers a clearer view of operational performance by excluding depreciation, amortization, interest, and taxes, making it ideal for comparing companies within the same industry regardless of capital structure or tax environments. Net Profit reflects the bottom-line profitability after all expenses, providing insight into a company's overall financial health but can vary significantly due to differing tax rates and financing strategies. In industry comparisons, EBITDA allows investors to assess core business efficiency, while Net Profit highlights the impact of financial and regulatory factors on final earnings.

Common Misconceptions About EBITDA and Net Profit

EBITDA often gets mistaken for a measure of actual profitability, but it excludes crucial expenses like interest, taxes, depreciation, and amortization that impact the net profit. Many assume EBITDA reflects cash flow, yet it overlooks capital expenditures and changes in working capital that affect a company's liquidity. Net profit provides a more comprehensive view of financial health by accounting for all costs, making it essential for evaluating true earnings performance.

Choosing the Right Metric for Business Decisions

EBITDA highlights operational profitability by excluding interest, taxes, depreciation, and amortization, making it ideal for evaluating core business performance and cash flow potential. Net profit reflects the company's overall profitability after all expenses, providing a comprehensive view crucial for assessing long-term financial health and shareholder value. Selecting between EBITDA and net profit depends on the specific business decision, such as operational efficiency analysis or investment valuation.

EBITDA vs Net Profit Infographic

difterm.com

difterm.com