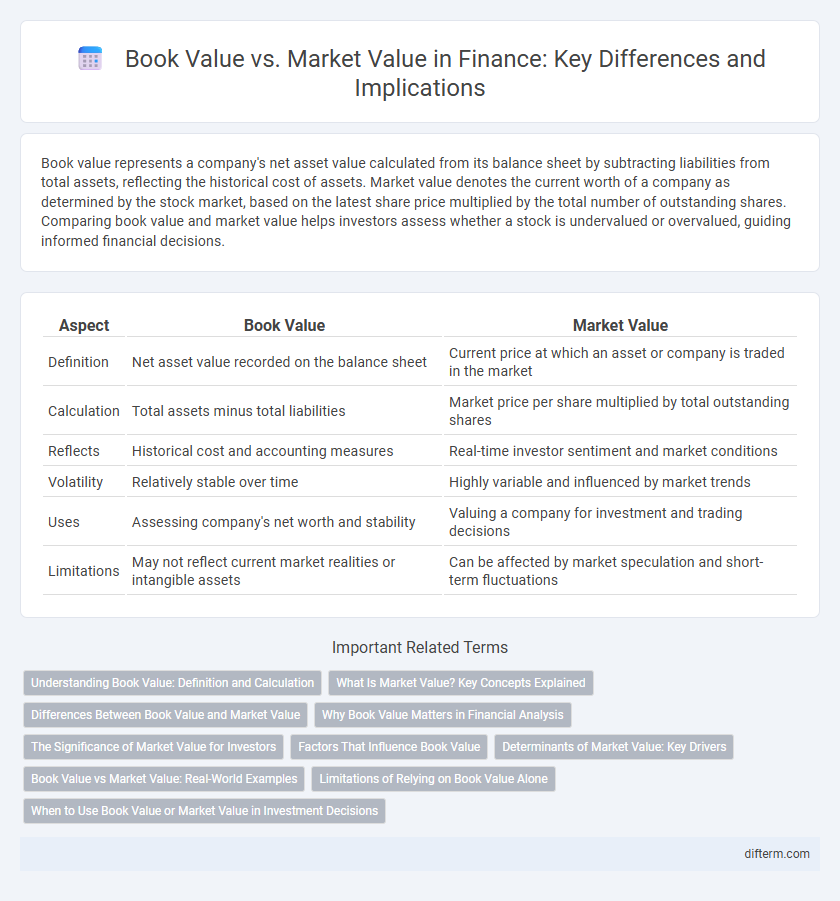

Book value represents a company's net asset value calculated from its balance sheet by subtracting liabilities from total assets, reflecting the historical cost of assets. Market value denotes the current worth of a company as determined by the stock market, based on the latest share price multiplied by the total number of outstanding shares. Comparing book value and market value helps investors assess whether a stock is undervalued or overvalued, guiding informed financial decisions.

Table of Comparison

| Aspect | Book Value | Market Value |

|---|---|---|

| Definition | Net asset value recorded on the balance sheet | Current price at which an asset or company is traded in the market |

| Calculation | Total assets minus total liabilities | Market price per share multiplied by total outstanding shares |

| Reflects | Historical cost and accounting measures | Real-time investor sentiment and market conditions |

| Volatility | Relatively stable over time | Highly variable and influenced by market trends |

| Uses | Assessing company's net worth and stability | Valuing a company for investment and trading decisions |

| Limitations | May not reflect current market realities or intangible assets | Can be affected by market speculation and short-term fluctuations |

Understanding Book Value: Definition and Calculation

Book value represents the net asset value of a company as recorded on its balance sheet, calculated by subtracting total liabilities from total assets. It reflects the historical cost of assets minus depreciation, providing a snapshot of the firm's intrinsic worth from an accounting perspective. Investors use book value to assess whether a stock is undervalued or overvalued compared to its market value, which fluctuates based on market perceptions and future growth potential.

What Is Market Value? Key Concepts Explained

Market value represents the current price at which an asset or company can be bought or sold in the open market, reflecting investor sentiment and supply-demand dynamics. Unlike book value, which is based on historical cost and accounting records, market value fluctuates with market conditions and future growth expectations. Key concepts include market capitalization for companies, which is calculated by multiplying the stock price by outstanding shares, providing a real-time valuation that investors use to assess a firm's market standing.

Differences Between Book Value and Market Value

Book value represents a company's net asset value calculated from its balance sheet by subtracting total liabilities from total assets, reflecting historical costs. Market value is determined by the current stock price multiplied by outstanding shares, capturing investor perception and future growth potential. The key difference lies in book value being static and based on past transactions, while market value is dynamic and influenced by market conditions and expectations.

Why Book Value Matters in Financial Analysis

Book value represents a company's net asset value based on its balance sheet, providing a tangible baseline for assessing financial health. Market value reflects the current stock price multiplied by outstanding shares, influenced by market sentiment and future growth expectations. Book value matters in financial analysis as it offers a conservative estimate of a company's worth, helps identify undervalued stocks, and serves as a key benchmark in valuation metrics like the price-to-book (P/B) ratio.

The Significance of Market Value for Investors

Market value reflects the current price at which an asset or company can be bought or sold in the marketplace, providing investors with real-time insight into the perceived worth based on supply and demand. Unlike book value, which is derived from historical accounting data, market value incorporates future growth prospects, risk factors, and investor sentiment, making it crucial for investment decision-making. Evaluating market value enables investors to identify undervalued or overvalued stocks, optimize portfolio allocation, and gauge potential returns relative to market conditions.

Factors That Influence Book Value

Book value is influenced by asset depreciation, amortization, and historical cost accounting methods, which reflect the original purchase price minus accumulated expenses. Changes in company investments, debt levels, and retained earnings also impact the book value recorded on the balance sheet. External factors like accounting policies and regulatory standards further shape how book value is calculated and reported.

Determinants of Market Value: Key Drivers

Market value is primarily influenced by company performance indicators such as earnings per share (EPS), revenue growth, and return on equity (ROE), which reflect the firm's ability to generate profits. Investor sentiment, market trends, and macroeconomic factors like interest rates and inflation also play critical roles in shaping market value. Furthermore, supply and demand dynamics in stock markets directly impact a company's market valuation, often causing deviations from its book value.

Book Value vs Market Value: Real-World Examples

Book value represents a company's net asset value calculated from its balance sheet, while market value reflects the current stock price multiplied by outstanding shares, showcasing investor perception. For example, technology firms like Apple often exhibit market values significantly higher than their book values due to strong brand equity and growth potential. Conversely, asset-heavy industries such as manufacturing may show market values close to or below book values when market confidence is low or assets depreciate.

Limitations of Relying on Book Value Alone

Book value often fails to reflect a company's true market worth due to outdated asset valuations and ignores intangible assets like brand equity or intellectual property. Market value incorporates investor sentiment, future growth potential, and current economic conditions, offering a more comprehensive assessment. Relying solely on book value can lead to undervaluation or misinterpretation of a firm's financial health in dynamic markets.

When to Use Book Value or Market Value in Investment Decisions

Book value is useful for assessing a company's intrinsic worth based on its historical financial data, making it a reliable metric during stable market conditions or for evaluating asset-heavy firms. Market value reflects current investor sentiment and market conditions, providing a real-time snapshot crucial for timing entry or exit points in volatile markets. Investors often compare both values to identify undervalued stocks by spotting discrepancies between a company's net asset value and its market capitalization.

Book Value vs Market Value Infographic

difterm.com

difterm.com