Stock splits increase the number of outstanding shares by issuing more shares to current shareholders, effectively lowering the stock price and improving liquidity without changing the company's market capitalization. Reverse splits consolidate existing shares into fewer, higher-priced shares, often used to meet minimum price requirements for stock exchanges or to enhance the stock's perceived value. Understanding the impact on share price, market perception, and shareholder equity is crucial when evaluating stock splits versus reverse splits in financial strategies.

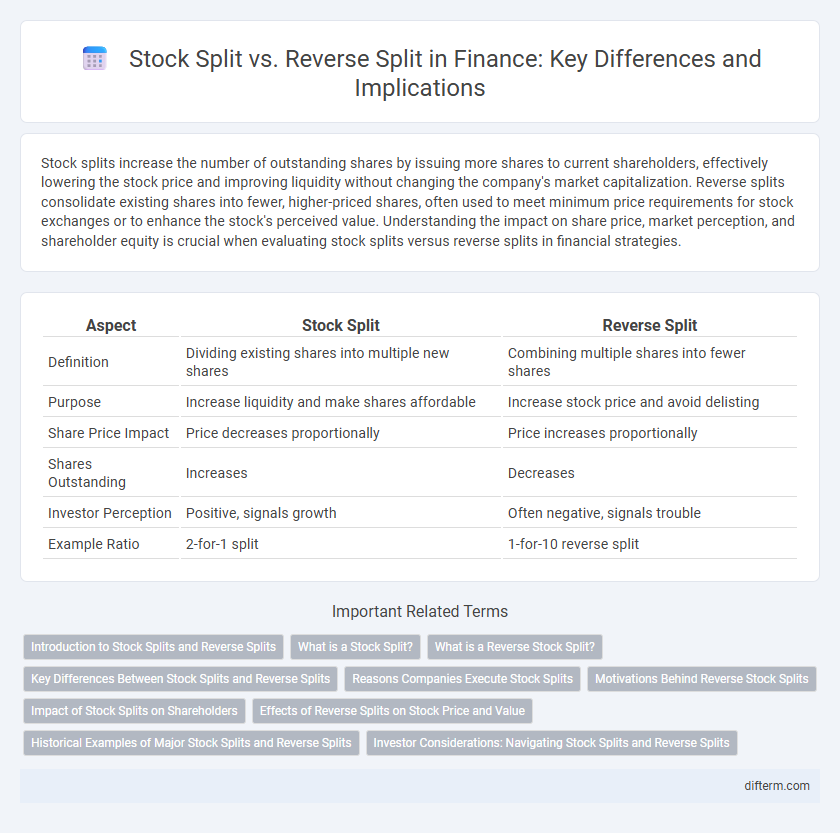

Table of Comparison

| Aspect | Stock Split | Reverse Split |

|---|---|---|

| Definition | Dividing existing shares into multiple new shares | Combining multiple shares into fewer shares |

| Purpose | Increase liquidity and make shares affordable | Increase stock price and avoid delisting |

| Share Price Impact | Price decreases proportionally | Price increases proportionally |

| Shares Outstanding | Increases | Decreases |

| Investor Perception | Positive, signals growth | Often negative, signals trouble |

| Example Ratio | 2-for-1 split | 1-for-10 reverse split |

Introduction to Stock Splits and Reverse Splits

Stock splits increase the number of outstanding shares by dividing existing shares, reducing the stock price to improve liquidity and accessibility for investors. Reverse splits consolidate shares, decreasing the number of outstanding shares while increasing the stock price to meet exchange listing requirements or boost market perception. Both strategies adjust share structure without altering the company's overall market capitalization.

What is a Stock Split?

A stock split increases the number of outstanding shares by issuing more shares to existing shareholders, effectively lowering the stock price without changing the company's market capitalization. It improves stock liquidity and accessibility for individual investors by reducing the per-share price. Common ratios for stock splits include 2-for-1 and 3-for-2, amplifying the total shares outstanding while maintaining shareholder value.

What is a Reverse Stock Split?

A reverse stock split consolidates a company's existing shares into fewer, proportionally more valuable shares, increasing the stock price per share without changing the company's overall market capitalization. This strategy is often used to meet minimum price requirements for stock exchanges or to improve the stock's market perception. Unlike a regular stock split, which increases the number of shares and reduces the price per share, a reverse stock split reduces the share count and raises the stock price.

Key Differences Between Stock Splits and Reverse Splits

Stock splits increase the number of shares outstanding by issuing more shares to existing shareholders, effectively reducing the stock price per share without changing the company's market capitalization. Reverse splits consolidate existing shares into fewer shares, raising the stock price per share and often meeting exchange listing requirements or appealing to institutional investors. Stock splits signal growth and investor confidence, whereas reverse splits can indicate financial trouble or strategic repositioning to avoid delisting.

Reasons Companies Execute Stock Splits

Companies execute stock splits to increase share liquidity and make shares more affordable to retail investors, enhancing marketability and attracting broader investment. A stock split boosts the number of outstanding shares while proportionally reducing the stock price, maintaining overall market capitalization. In contrast, reverse splits are employed to consolidate shares, increase stock price, and meet minimum exchange listing requirements or improve the company's perceived market value.

Motivations Behind Reverse Stock Splits

Reverse stock splits are primarily motivated by a company's need to increase its stock price to meet minimum listing requirements on major exchanges such as the NYSE or NASDAQ. This action helps avoid delisting and maintain investor confidence by projecting financial stability and enhancing the stock's perceived value. Corporations may also initiate reverse splits to reduce the number of outstanding shares, enabling more attractive share price multiples for institutional investors.

Impact of Stock Splits on Shareholders

Stock splits increase the number of outstanding shares while reducing the share price proportionally, enhancing liquidity and making shares more accessible to retail investors without altering the company's market capitalization. Reverse splits consolidate shares to boost the per-share price, often used to meet exchange listing requirements, but may signal financial distress and lead to shareholder dilution concerns. Both actions impact shareholder perceptions and trading dynamics, influencing market behavior and investment strategies.

Effects of Reverse Splits on Stock Price and Value

Reverse stock splits reduce the number of outstanding shares to increase the stock price proportionally, aiming to meet exchange listing requirements or attract institutional investors. Although the stock price rises, the market capitalization and shareholder value remain largely unchanged since the reduction in share quantity offsets the price increase. This strategic move can also signal financial distress, often leading to negative market perception despite the adjusted price.

Historical Examples of Major Stock Splits and Reverse Splits

Apple's 7-for-1 stock split in 2014 dramatically increased its share liquidity and attracted retail investors, driving market enthusiasm. In contrast, Citigroup executed a reverse stock split in 2011 to consolidate shares and maintain compliance with exchange listing requirements amid financial distress. These historical examples highlight how stock splits can boost accessibility while reverse splits often signal efforts to stabilize stock price and investor confidence.

Investor Considerations: Navigating Stock Splits and Reverse Splits

Investors should evaluate how stock splits increase share liquidity and accessibility by lowering the per-share price, often attracting retail interest and enhancing marketability. Reverse splits consolidate shares to boost the stock price, which can help maintain exchange listing requirements but may signal financial distress, affecting investor perception. Carefully assessing the company's motivations and market conditions is crucial for investors to navigate the potential risks and opportunities associated with stock splits and reverse splits.

Stock split vs Reverse split Infographic

difterm.com

difterm.com