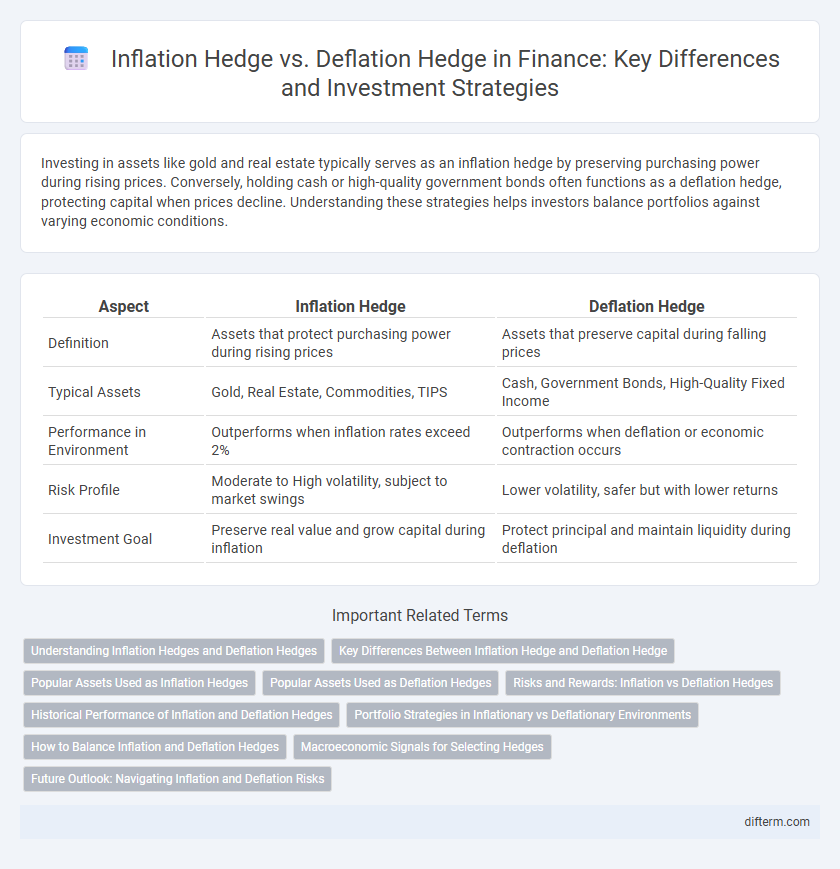

Investing in assets like gold and real estate typically serves as an inflation hedge by preserving purchasing power during rising prices. Conversely, holding cash or high-quality government bonds often functions as a deflation hedge, protecting capital when prices decline. Understanding these strategies helps investors balance portfolios against varying economic conditions.

Table of Comparison

| Aspect | Inflation Hedge | Deflation Hedge |

|---|---|---|

| Definition | Assets that protect purchasing power during rising prices | Assets that preserve capital during falling prices |

| Typical Assets | Gold, Real Estate, Commodities, TIPS | Cash, Government Bonds, High-Quality Fixed Income |

| Performance in Environment | Outperforms when inflation rates exceed 2% | Outperforms when deflation or economic contraction occurs |

| Risk Profile | Moderate to High volatility, subject to market swings | Lower volatility, safer but with lower returns |

| Investment Goal | Preserve real value and grow capital during inflation | Protect principal and maintain liquidity during deflation |

Understanding Inflation Hedges and Deflation Hedges

Inflation hedges such as gold, real estate, and Treasury Inflation-Protected Securities (TIPS) preserve purchasing power by rising in value during periods of increasing prices. Deflation hedges, including cash holdings, high-quality government bonds, and certain short-duration assets, protect portfolios when prices decline and economic activity slows. Recognizing these asset behaviors enables investors to balance risk and safeguard capital against varying economic conditions.

Key Differences Between Inflation Hedge and Deflation Hedge

An inflation hedge protects assets by maintaining purchasing power during rising prices, typically involving investments like gold, real estate, and inflation-indexed bonds. In contrast, a deflation hedge safeguards against falling prices and reduced economic activity, often favoring cash, high-quality bonds, and defensive stocks. The key difference lies in their response to economic cycles: inflation hedges thrive when prices increase, while deflation hedges provide stability during declining price environments.

Popular Assets Used as Inflation Hedges

Gold, real estate, and Treasury Inflation-Protected Securities (TIPS) are popular assets used as inflation hedges due to their ability to preserve purchasing power during rising price levels. Commodities and equities in sectors like energy and consumer staples also tend to perform well as they often pass increased costs to consumers. These assets contrast with deflation hedges such as high-quality bonds and cash, which maintain value in falling price environments.

Popular Assets Used as Deflation Hedges

Popular assets used as deflation hedges include government bonds, cash, and high-quality fixed-income securities due to their ability to preserve capital during falling price environments. Investors often prefer Treasury bonds and money market funds because they provide stable returns and liquidity when economic activity contracts and asset prices decline. These assets contrast with inflation hedges like commodities and real estate, as they perform well when purchasing power increases and credit risk diminishes.

Risks and Rewards: Inflation vs Deflation Hedges

Inflation hedges like gold, real estate, and inflation-linked bonds protect purchasing power as rising prices erode currency value, but they carry risks such as market volatility and liquidity constraints. Deflation hedges, including high-quality government bonds and cash, preserve capital during falling price environments, yet they may offer low returns and face reinvestment risk if deflation persists. Balancing inflation and deflation hedges involves assessing economic indicators, inflation expectations, and interest rate trends to optimize portfolio resilience against unpredictable price dynamics.

Historical Performance of Inflation and Deflation Hedges

Gold and real estate assets historically serve as strong inflation hedges, with gold maintaining purchasing power during high inflation periods and real estate providing rental income growth aligned with rising prices. Conversely, government bonds and cash hold value better during deflation, as falling prices and interest rates increase bond prices and preserve liquidity. Understanding these historical performance trends helps investors balance portfolios against varying economic conditions.

Portfolio Strategies in Inflationary vs Deflationary Environments

Portfolio strategies in inflationary environments emphasize assets like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS) to preserve purchasing power and generate positive real returns. In contrast, deflationary environments prioritize cash, high-quality government bonds, and dividend-paying stocks, as these assets tend to maintain value or appreciate when prices decline. Balancing inflation hedge and deflation hedge components within a diversified portfolio mitigates risks associated with economic cycles and protects capital across varying monetary conditions.

How to Balance Inflation and Deflation Hedges

Balancing inflation and deflation hedges requires diversifying investments across assets that perform well under different economic conditions, such as commodities and real estate for inflation protection, and high-quality bonds or cash equivalents for deflation scenarios. Employing dynamic asset allocation strategies based on economic indicators like Consumer Price Index (CPI) trends and interest rate movements enhances portfolio resilience. Risk management tools including options and futures contracts can further optimize the hedge balance by mitigating exposure to unexpected inflation or deflation shocks.

Macroeconomic Signals for Selecting Hedges

Macroeconomic signals such as rising Consumer Price Index (CPI) and expanding money supply typically indicate inflationary pressures, suggesting investments in assets like commodities or Treasury Inflation-Protected Securities (TIPS) as effective inflation hedges. Conversely, deflationary environments characterized by falling producer prices, reduced demand, and contracting GDP growth favor defensive assets such as government bonds and cash equivalents to preserve capital. Monitoring leading indicators like Purchasing Managers' Index (PMI) and unemployment rates helps investors optimize hedge selection by anticipating shifts between inflation and deflation dynamics.

Future Outlook: Navigating Inflation and Deflation Risks

Inflation hedges like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS) safeguard purchasing power during rising price levels, while deflation hedges such as high-quality government bonds and cash preserve capital amid falling prices. Investors must monitor central bank policies, supply chain dynamics, and global economic indicators to adjust strategies for potential inflationary or deflationary environments. Diversification across asset classes with inflation and deflation hedging characteristics enhances portfolio resilience against uncertain future economic conditions.

Inflation hedge vs Deflation hedge Infographic

difterm.com

difterm.com