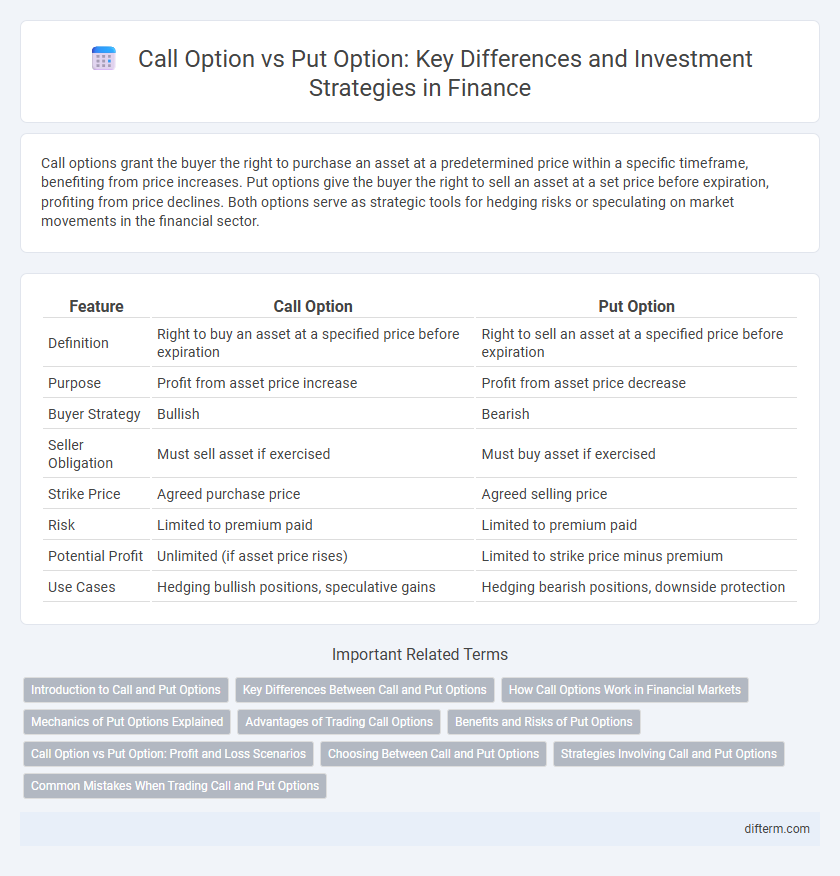

Call options grant the buyer the right to purchase an asset at a predetermined price within a specific timeframe, benefiting from price increases. Put options give the buyer the right to sell an asset at a set price before expiration, profiting from price declines. Both options serve as strategic tools for hedging risks or speculating on market movements in the financial sector.

Table of Comparison

| Feature | Call Option | Put Option |

|---|---|---|

| Definition | Right to buy an asset at a specified price before expiration | Right to sell an asset at a specified price before expiration |

| Purpose | Profit from asset price increase | Profit from asset price decrease |

| Buyer Strategy | Bullish | Bearish |

| Seller Obligation | Must sell asset if exercised | Must buy asset if exercised |

| Strike Price | Agreed purchase price | Agreed selling price |

| Risk | Limited to premium paid | Limited to premium paid |

| Potential Profit | Unlimited (if asset price rises) | Limited to strike price minus premium |

| Use Cases | Hedging bullish positions, speculative gains | Hedging bearish positions, downside protection |

Introduction to Call and Put Options

Call options grant the buyer the right to purchase an underlying asset at a predetermined strike price before or on the expiration date, enabling profit from asset price increases. Put options provide the buyer the right to sell the underlying asset at a specified strike price within a set timeframe, offering protection against price declines. Both call and put options are fundamental derivatives in options trading, used for hedging, speculation, and income generation strategies.

Key Differences Between Call and Put Options

Call options grant the holder the right to buy an underlying asset at a predetermined strike price before expiration, offering profit potential when asset prices rise. Put options provide the right to sell the underlying asset at the strike price, benefiting investors during price declines. Key differences include directional market bets, with calls anticipating bullish trends and puts serving as protective or speculative tools against downturns.

How Call Options Work in Financial Markets

Call options grant investors the right, but not the obligation, to purchase an underlying asset at a predetermined strike price before the option's expiration date, enabling profit from asset price appreciation. These derivatives are widely used for hedging and speculative strategies in stock, forex, and commodities markets, providing leverage with limited downside risk. Market participants analyze volatility, time decay, and underlying asset trends to optimize call option positions and maximize returns.

Mechanics of Put Options Explained

Put options give the holder the right to sell an underlying asset at a predetermined strike price before or on the expiration date, providing a hedge against declining market prices. When the market price falls below the strike price, the put option increases in value, allowing the holder to sell assets at a higher price than the current market value. This mechanism effectively limits downside risk and can be used for portfolio protection or speculative purposes.

Advantages of Trading Call Options

Call options offer significant advantages in finance by enabling traders to leverage potential price increases with limited capital risk. They provide the opportunity for substantial returns if the underlying asset's price rises above the strike price before expiration. Moreover, call options allow for strategic flexibility, including hedging existing positions or speculating on bullish market trends without owning the actual asset.

Benefits and Risks of Put Options

Put options provide investors with the ability to hedge against potential declines in the price of an underlying asset, offering downside protection and allowing for profits when market prices fall. The risk associated with put options is limited to the premium paid, making them a less risky alternative compared to short selling, but they can expire worthless if the underlying asset's price does not drop below the strike price. Put options also enhance portfolio diversification by enabling strategic defensive positions during market volatility.

Call Option vs Put Option: Profit and Loss Scenarios

Call options generate profit when the underlying asset's price exceeds the strike price plus the premium paid, resulting in potentially unlimited upside. Put options yield profits when the asset's price falls below the strike price minus the premium, offering limited loss but capped gain. Understanding these profit and loss scenarios is essential for strategic option trading and risk management in financial markets.

Choosing Between Call and Put Options

Choosing between call and put options depends on market outlook and investment goals; call options benefit investors expecting asset prices to rise, offering leveraged gains with limited risk. Put options serve as protection or profit tools in declining markets by allowing the sale of underlying assets at predetermined prices, effectively managing downside risk. Evaluating volatility, time horizon, and risk tolerance is essential for selecting the appropriate option strategy in financial portfolios.

Strategies Involving Call and Put Options

Call and put options are essential tools for implementing bullish and bearish strategies in financial markets. Investors use call options to capitalize on anticipated price increases by purchasing the right to buy an asset at a predetermined strike price, while put options provide the right to sell, serving as a hedge against declining asset values. Complex strategies such as straddles, strangles, and spreads combine calls and puts to manage risk, enhance returns, and capitalize on volatility in underlying securities.

Common Mistakes When Trading Call and Put Options

A common mistake when trading call and put options is misunderstanding the impact of time decay on option premiums, often leading to unexpected losses as expiration approaches. Traders frequently misprice options by neglecting implied volatility fluctuations, which can drastically affect option values and profitability. Another error is failing to implement proper risk management strategies, such as setting stop-loss orders or position sizing, resulting in disproportionate exposure to market movements.

Call Option vs Put Option Infographic

difterm.com

difterm.com