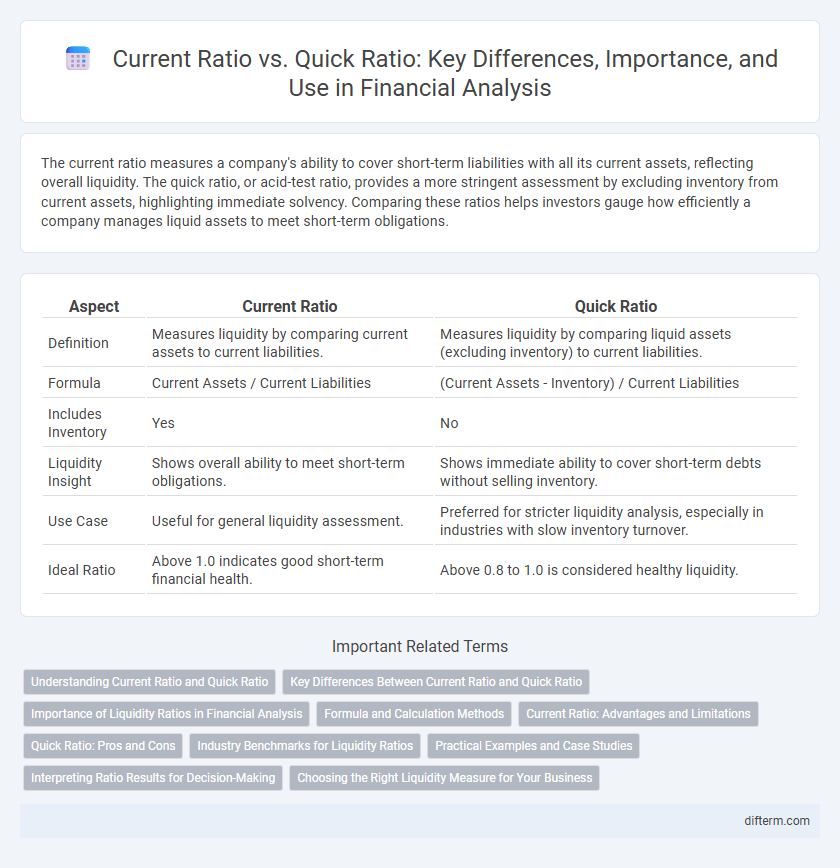

The current ratio measures a company's ability to cover short-term liabilities with all its current assets, reflecting overall liquidity. The quick ratio, or acid-test ratio, provides a more stringent assessment by excluding inventory from current assets, highlighting immediate solvency. Comparing these ratios helps investors gauge how efficiently a company manages liquid assets to meet short-term obligations.

Table of Comparison

| Aspect | Current Ratio | Quick Ratio |

|---|---|---|

| Definition | Measures liquidity by comparing current assets to current liabilities. | Measures liquidity by comparing liquid assets (excluding inventory) to current liabilities. |

| Formula | Current Assets / Current Liabilities | (Current Assets - Inventory) / Current Liabilities |

| Includes Inventory | Yes | No |

| Liquidity Insight | Shows overall ability to meet short-term obligations. | Shows immediate ability to cover short-term debts without selling inventory. |

| Use Case | Useful for general liquidity assessment. | Preferred for stricter liquidity analysis, especially in industries with slow inventory turnover. |

| Ideal Ratio | Above 1.0 indicates good short-term financial health. | Above 0.8 to 1.0 is considered healthy liquidity. |

Understanding Current Ratio and Quick Ratio

The Current Ratio measures a company's ability to cover its short-term liabilities with all its current assets, providing a broad view of liquidity. The Quick Ratio, also known as the acid-test ratio, refines this assessment by excluding inventory and other less liquid assets, focusing on the most liquid current assets like cash, marketable securities, and receivables. Both ratios are critical for evaluating financial health, but the Quick Ratio offers a more stringent test of a firm's immediate liquidity position.

Key Differences Between Current Ratio and Quick Ratio

The Current Ratio measures a company's ability to pay short-term liabilities with all current assets, including inventory, whereas the Quick Ratio excludes inventory to provide a stricter assessment of liquidity. Key differences include the Current Ratio's broader asset consideration, which may overstate liquidity, while the Quick Ratio focuses on liquid assets like cash, marketable securities, and receivables for immediate obligations. Financial analysts use the Quick Ratio to evaluate firms in industries with slow-moving inventory and the Current Ratio for a general assessment of short-term financial health.

Importance of Liquidity Ratios in Financial Analysis

Liquidity ratios, such as the Current Ratio and Quick Ratio, play a critical role in financial analysis by measuring a company's ability to meet short-term obligations without raising external capital. The Current Ratio evaluates overall short-term liquidity by comparing current assets to current liabilities, while the Quick Ratio offers a more stringent assessment by excluding inventory from assets. These ratios provide vital insights into operational efficiency and financial stability, guiding investors and creditors in risk assessment and decision-making.

Formula and Calculation Methods

The Current Ratio is calculated by dividing current assets by current liabilities, providing a measure of a company's ability to cover short-term obligations with its total current assets. The Quick Ratio, also known as the Acid-Test Ratio, refines this by excluding inventory and prepaid expenses from current assets, focusing on the most liquid assets such as cash, marketable securities, and receivables before dividing by current liabilities. These formulas offer insights into liquidity, with the Current Ratio giving a broader view and the Quick Ratio providing a more conservative assessment of immediate financial health.

Current Ratio: Advantages and Limitations

The Current Ratio measures a company's ability to cover short-term liabilities with its short-term assets, offering a broad overview of liquidity and financial health. Its advantages include simplicity, ease of calculation, and usefulness for assessing overall working capital management. However, limitations arise from its inclusion of inventory and prepaid expenses, which may not be easily convertible to cash, potentially overstating liquidity strength.

Quick Ratio: Pros and Cons

The Quick Ratio, also known as the acid-test ratio, provides a stringent measure of a company's short-term liquidity by excluding inventory from current assets, focusing on cash, marketable securities, and receivables. It offers a more accurate assessment of immediate financial health compared to the Current Ratio, especially for businesses with slow-moving inventory. However, the Quick Ratio may underestimate liquidity in firms where inventory is easily converted to cash, and it doesn't account for the timing of receivables collection, potentially misrepresenting actual cash availability.

Industry Benchmarks for Liquidity Ratios

The current ratio and quick ratio serve as key liquidity indicators, with industry benchmarks varying significantly across sectors; for example, retail typically shows a current ratio around 1.5 to 2.0 and a quick ratio near 1.0, reflecting higher inventory levels, whereas technology firms often have ratios closer to 1.0 and 0.8 due to their asset composition. Comparing these ratios against industry-specific benchmarks provides a clearer assessment of a company's short-term financial health and operational efficiency. Firms far below or above these standard ratios may signal potential liquidity issues or inefficient asset management relative to peers.

Practical Examples and Case Studies

A manufacturing company with $200,000 in current assets and $120,000 in current liabilities has a current ratio of 1.67, indicating sufficient short-term liquidity. However, its quick ratio drops to 0.9 after excluding $50,000 in inventory, revealing potential challenges in covering immediate liabilities without relying on inventory sales. Case studies demonstrate that businesses with quick ratios below 1 often face cash flow constraints despite seemingly healthy current ratios, emphasizing the importance of analyzing both metrics for accurate liquidity assessment.

Interpreting Ratio Results for Decision-Making

The current ratio measures a company's ability to cover short-term liabilities with its total current assets, providing a broad view of liquidity, while the quick ratio excludes inventory, offering a more stringent assessment of immediate solvency. Interpreting these ratios together helps investors and managers gauge financial health, identifying potential liquidity risks that could impact operational stability or debt repayment capacity. A current ratio significantly higher than the quick ratio may signal over-reliance on inventory, affecting decisions related to working capital management and short-term financing strategies.

Choosing the Right Liquidity Measure for Your Business

Choosing the right liquidity measure depends on the nature of your business assets and liabilities; the Current Ratio includes all current assets, offering a broad view of short-term financial health, while the Quick Ratio excludes inventory, providing a more conservative assessment of immediate liquidity. Companies with slow-moving inventory or those in industries with less liquid assets often benefit from relying on the Quick Ratio to ensure they can meet short-term obligations without selling stock. Evaluating both ratios together can provide a comprehensive understanding of your business's ability to pay off current liabilities quickly and effectively.

Current Ratio vs Quick Ratio Infographic

difterm.com

difterm.com