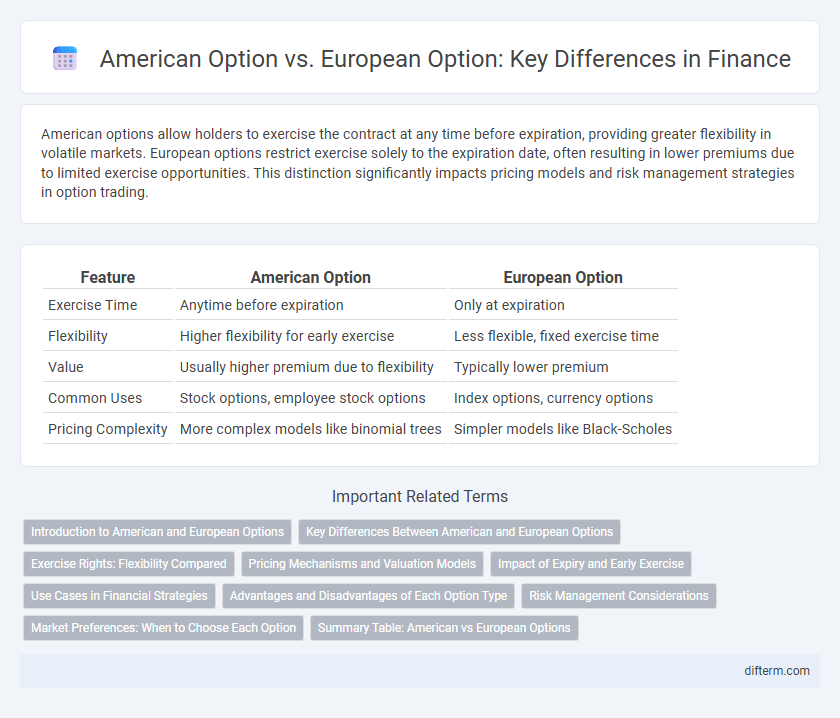

American options allow holders to exercise the contract at any time before expiration, providing greater flexibility in volatile markets. European options restrict exercise solely to the expiration date, often resulting in lower premiums due to limited exercise opportunities. This distinction significantly impacts pricing models and risk management strategies in option trading.

Table of Comparison

| Feature | American Option | European Option |

|---|---|---|

| Exercise Time | Anytime before expiration | Only at expiration |

| Flexibility | Higher flexibility for early exercise | Less flexible, fixed exercise time |

| Value | Usually higher premium due to flexibility | Typically lower premium |

| Common Uses | Stock options, employee stock options | Index options, currency options |

| Pricing Complexity | More complex models like binomial trees | Simpler models like Black-Scholes |

Introduction to American and European Options

American options provide the holder the right to exercise the option at any time before or on the expiration date, offering greater flexibility and potential strategic advantages in volatile markets. European options restrict exercise to the expiration date only, often resulting in simpler valuation models and lower premiums due to reduced flexibility. These fundamental differences influence pricing, risk management, and optimal exercise strategies in financial derivatives trading.

Key Differences Between American and European Options

American options offer the flexibility to exercise the contract at any point up to and including the expiration date, providing greater strategic opportunities and higher premium costs. European options restrict exercise solely to the expiration date, resulting in potentially lower premiums but reduced flexibility for the holder. This fundamental difference impacts pricing models, risk management strategies, and suitability for various investment goals in derivative trading.

Exercise Rights: Flexibility Compared

American options provide holders the flexibility to exercise the option at any time before or on the expiration date, enabling strategic responses to market fluctuations. European options restrict exercise rights solely to the expiration date, limiting early execution opportunities. This fundamental difference significantly impacts hedging strategies, pricing models, and risk management decisions within options trading.

Pricing Mechanisms and Valuation Models

American options allow early exercise, giving them higher flexibility and generally higher value compared to European options, which can only be exercised at maturity. Pricing American options typically involves numerical methods like the Binomial Tree or Finite Difference models to account for the early exercise feature, whereas European options are often priced using closed-form solutions such as the Black-Scholes-Merton model. The inclusion of early exercise opportunities requires more complex valuation techniques for American options, influencing their premium and risk management strategies.

Impact of Expiry and Early Exercise

American options allow holders to exercise the option at any time before or at expiry, providing greater flexibility and potentially higher value in volatile markets. European options restrict exercise to the expiration date only, limiting early exercise opportunities and influencing pricing models to focus on terminal payoff. The impact of expiry timing significantly affects hedging strategies and risk management, with American options often commanding higher premiums due to early exercise rights.

Use Cases in Financial Strategies

American options provide flexibility for early exercise, making them suitable for hedging strategies that require timely reaction to market movements or dividend payouts. European options, exercisable only at maturity, are often preferred in portfolio diversification and speculative strategies where cost efficiency and long-term planning are prioritized. In volatility trading and risk management, combining both option types enhances strategic control over timing and payoff structures.

Advantages and Disadvantages of Each Option Type

American options offer the advantage of flexibility, allowing holders to exercise the option anytime before expiration, which can be beneficial in volatile markets or when dividends are expected. However, this flexibility typically results in higher premiums compared to European options, which can only be exercised at maturity, simplifying pricing models and reducing the risk of early exercise. European options tend to have lower premiums and less complexity but lack the strategic exercise opportunities that can potentially increase profitability in American options.

Risk Management Considerations

American options offer greater flexibility in exercise timing compared to European options, allowing holders to hedge positions more effectively against market volatility. This early exercise feature introduces additional complexity in risk management models, requiring dynamic adjustment of delta and gamma hedging strategies. European options, exercisable only at maturity, simplify risk assessment but limit tactical responses to adverse price movements prior to expiration.

Market Preferences: When to Choose Each Option

American options are preferred in volatile markets due to their flexibility of early exercise, allowing investors to capitalize on favorable price movements anytime before expiration. European options, typically chosen for hedging strategies and structured products, offer lower premiums because they can only be exercised at maturity, making them cost-effective for long-term investors. Market participants select American options when anticipating significant short-term price swings, whereas European options suit those prioritizing predictable payoff schedules and reduced upfront costs.

Summary Table: American vs European Options

American options allow holders to exercise the option at any time before expiration, offering greater flexibility and potentially higher strategic value in volatile markets. European options restrict exercise to the expiration date only, typically resulting in simpler pricing models and lower premiums. The key differences lie in exercise rights, pricing complexity, and applicability, where American options are often preferred for equities while European options are common in index and currency derivatives.

American Option vs European Option Infographic

difterm.com

difterm.com