Tax avoidance involves legally minimizing tax liability through careful planning and exploiting tax deductions, credits, and exemptions allowed by law. Tax evasion, by contrast, is the illegal practice of deliberately misrepresenting or concealing information to reduce tax owed, such as underreporting income or inflating expenses. Understanding the distinction is crucial for compliance and avoiding severe penalties from tax authorities.

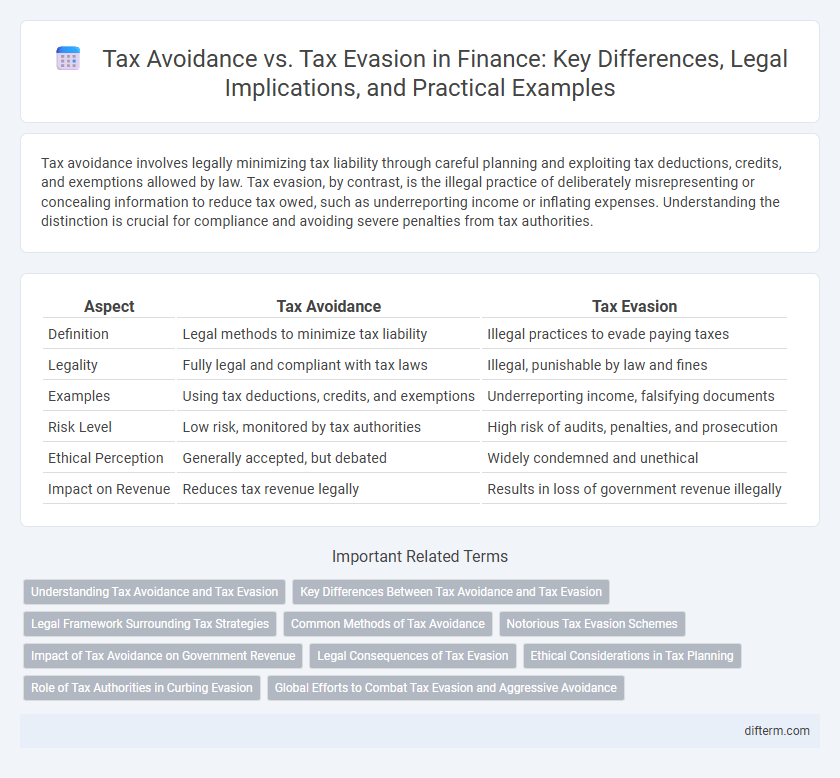

Table of Comparison

| Aspect | Tax Avoidance | Tax Evasion |

|---|---|---|

| Definition | Legal methods to minimize tax liability | Illegal practices to evade paying taxes |

| Legality | Fully legal and compliant with tax laws | Illegal, punishable by law and fines |

| Examples | Using tax deductions, credits, and exemptions | Underreporting income, falsifying documents |

| Risk Level | Low risk, monitored by tax authorities | High risk of audits, penalties, and prosecution |

| Ethical Perception | Generally accepted, but debated | Widely condemned and unethical |

| Impact on Revenue | Reduces tax revenue legally | Results in loss of government revenue illegally |

Understanding Tax Avoidance and Tax Evasion

Tax avoidance involves legally leveraging the tax code to minimize tax liability through methods like deductions, credits, and exemptions, while tax evasion constitutes the illegal act of deliberately misrepresenting income or falsifying information to reduce taxes owed. Understanding the distinction is crucial for compliance; tax avoidance aligns with regulatory frameworks and strategic planning, whereas tax evasion risks penalties, fines, and criminal charges. Accurate reporting and ethical financial management ensure businesses and individuals maintain transparency and avoid legal repercussions.

Key Differences Between Tax Avoidance and Tax Evasion

Tax avoidance involves legally exploiting the tax system to minimize tax liability through methods such as deductions, exemptions, and credits, whereas tax evasion is the illegal act of deliberately misreporting or concealing income to reduce tax payment. Key differences include legality, with tax avoidance being lawful and tax evasion constituting a criminal offense subject to penalties and prosecution. Tax avoidance strategies focus on compliance with tax laws, while tax evasion involves fraudulent behavior undermining regulatory frameworks.

Legal Framework Surrounding Tax Strategies

Tax avoidance involves legally exploiting the tax system to minimize tax liabilities through methods like deductions, credits, and exemptions authorized by tax laws. Tax evasion constitutes illegal practices such as underreporting income, inflating expenses, or hiding money offshore, violating regulations enforced by agencies like the IRS. The legal framework distinguishing these practices relies on compliance with statutes, judicial rulings, and regulatory guidelines determining acceptable tax planning versus criminal conduct.

Common Methods of Tax Avoidance

Common methods of tax avoidance include income deferral, where taxpayers delay income recognition to a later tax year, and tax deductions optimization, maximizing deductible expenses such as business costs or mortgage interest. Utilizing tax credits, like earned income or education credits, reduces tax liability legitimately. Offshore accounts and tax-efficient investments also play significant roles in minimizing taxable income within legal boundaries.

Notorious Tax Evasion Schemes

Notorious tax evasion schemes often involve offshore accounts, shell companies, and falsified documentation to conceal income from tax authorities. High-profile cases such as the Panama Papers and Paradise Papers leaks exposed global networks used by individuals and corporations to illegally evade taxes. These schemes undermine tax systems by creating significant revenue losses and prompting stricter regulations and enforcement measures worldwide.

Impact of Tax Avoidance on Government Revenue

Tax avoidance, through legal strategies to minimize taxable income, significantly reduces government revenue streams by shrinking the tax base. This decrease in funds limits public sector investments and social programs, adversely affecting economic development and public welfare. Persistent tax avoidance undermines fiscal stability, compelling governments to seek alternative revenue sources or increase tax rates for compliant taxpayers.

Legal Consequences of Tax Evasion

Tax evasion involves illegally underreporting income or inflating deductions, leading to criminal penalties including fines, asset seizure, and imprisonment. Authorities like the IRS rigorously investigate suspicious activities, increasing the likelihood of prosecution for tax evasion cases. Legal consequences extend beyond financial loss, severely damaging personal and corporate reputations.

Ethical Considerations in Tax Planning

Tax avoidance involves legally exploiting the tax system to minimize tax liabilities, while tax evasion constitutes illegal practices to evade taxes. Ethical considerations in tax planning emphasize transparency, compliance with tax laws, and corporate social responsibility to balance profit maximization with moral obligations. Businesses must weigh the reputational risks and legal consequences associated with aggressive tax avoidance strategies that might border on evasion.

Role of Tax Authorities in Curbing Evasion

Tax authorities play a critical role in curbing tax evasion through rigorous enforcement of tax laws, employing advanced data analytics to detect discrepancies and fraudulent activities. Regular audits, stringent penalties, and enhanced transparency measures help deter tax evasion by increasing the likelihood of detection and financial consequences. Collaboration with international agencies further strengthens efforts to identify cross-border tax evasion schemes and promote compliance.

Global Efforts to Combat Tax Evasion and Aggressive Avoidance

Global efforts to combat tax evasion and aggressive tax avoidance have intensified through enhanced regulatory frameworks like the OECD's Base Erosion and Profit Shifting (BEPS) Action Plan, which targets loopholes exploited by multinational corporations. Countries are increasingly adopting automatic exchange of information standards and implementing stricter anti-avoidance rules to ensure tax compliance and transparency across borders. Collaborative enforcement and increased penalties are critical in addressing illicit financial flows and safeguarding national tax revenues worldwide.

Tax avoidance vs Tax evasion Infographic

difterm.com

difterm.com