The discount window provides banks with short-term liquidity by allowing them to borrow directly from the central bank, typically at a higher interest rate, serving as a safety valve during financial stress. Open market operations involve the central bank buying or selling government securities in the open market to influence the money supply and interest rates, thereby managing economic stability. While the discount window targets individual institutions in need, open market operations broadly affect overall monetary conditions.

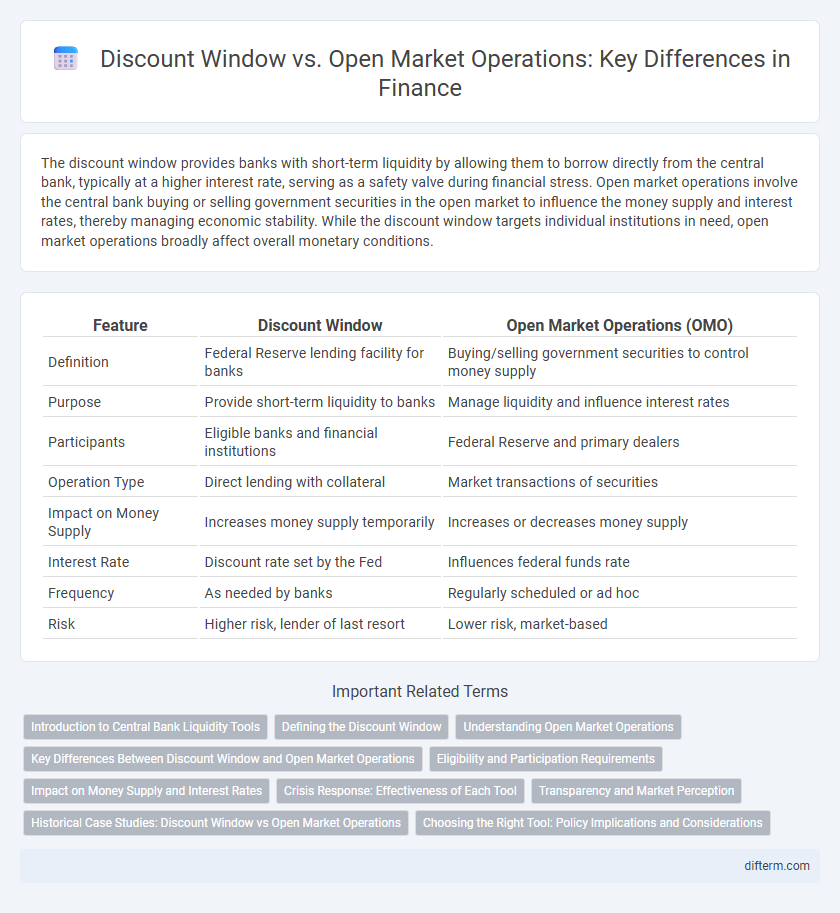

Table of Comparison

| Feature | Discount Window | Open Market Operations (OMO) |

|---|---|---|

| Definition | Federal Reserve lending facility for banks | Buying/selling government securities to control money supply |

| Purpose | Provide short-term liquidity to banks | Manage liquidity and influence interest rates |

| Participants | Eligible banks and financial institutions | Federal Reserve and primary dealers |

| Operation Type | Direct lending with collateral | Market transactions of securities |

| Impact on Money Supply | Increases money supply temporarily | Increases or decreases money supply |

| Interest Rate | Discount rate set by the Fed | Influences federal funds rate |

| Frequency | As needed by banks | Regularly scheduled or ad hoc |

| Risk | Higher risk, lender of last resort | Lower risk, market-based |

Introduction to Central Bank Liquidity Tools

Central bank liquidity tools include the discount window and open market operations, which serve distinct roles in managing short-term liquidity in the banking system. The discount window provides emergency funding directly to banks facing temporary liquidity shortages, typically at a penalty interest rate, ensuring stability. Open market operations involve the buying and selling of government securities to regulate money supply and influence interest rates, effectively controlling overall liquidity in the economy.

Defining the Discount Window

The discount window is a facility provided by central banks allowing financial institutions to borrow short-term funds to meet liquidity needs, typically at a preset discount rate. It serves as a lender of last resort to ensure stability in the banking system during periods of financial stress. Unlike open market operations, which involve buying or selling government securities to influence money supply, the discount window provides direct credit access to banks.

Understanding Open Market Operations

Open Market Operations (OMO) involve the central bank buying or selling government securities in the open market to regulate money supply and interest rates. This mechanism ensures liquidity control by influencing short-term interest rates, thereby stabilizing the financial system. OMO is a primary monetary policy tool, distinct from the discount window which provides direct lending to banks during liquidity shortages.

Key Differences Between Discount Window and Open Market Operations

The discount window provides short-term emergency liquidity to banks at a preset interest rate, typically higher than market rates, serving as a lender of last resort to maintain financial stability. Open market operations involve the buying and selling of government securities by the central bank to regulate money supply and control inflation, directly influencing short-term interest rates and overall economic activity. Key differences include the discount window's role as a backup funding source for individual banks versus open market operations' function in implementing monetary policy at a systemic level.

Eligibility and Participation Requirements

Discount window access is typically reserved for depository institutions meeting specific regulatory criteria, requiring borrower institutions to have collateral and demonstrate creditworthiness. Open market operations involve a broader range of primary dealers and financial institutions authorized by the central bank, with less stringent individual eligibility conditions. Participation in the discount window generally involves higher scrutiny and direct loan agreements, while open market operations occur through buying and selling government securities to influence liquidity.

Impact on Money Supply and Interest Rates

The discount window provides short-term liquidity to banks at the discount rate, often signaling higher borrowing costs and causing a moderate increase in money supply due to targeted lending. Open market operations, involving the purchase or sale of government securities, directly influence the reserves of commercial banks, leading to more significant and immediate changes in money supply and fluctuations in short-term interest rates. Central banks commonly use open market operations for precise control over monetary policy, while the discount window serves as a backup source of funds during liquidity shortages.

Crisis Response: Effectiveness of Each Tool

The discount window provides immediate liquidity to banks facing short-term funding stress, making it a crucial tool in crisis response to prevent sudden bank failures. Open market operations, by contrast, influence broader market conditions by adjusting the overall money supply and interest rates, stabilizing the financial system more gradually. Historical data from the 2008 financial crisis shows that while discount window usage surged during acute liquidity crunches, open market operations effectively supported systemic stability over the medium term.

Transparency and Market Perception

The discount window offers direct liquidity to banks but often carries a stigma, leading to less transparency and potential negative market perception regarding a bank's health. Open market operations are conducted more transparently through publicized asset purchases and sales, enhancing market confidence and reducing speculation. Consequently, open market operations are preferred for signaling monetary policy intentions without the adverse stigma attached to discount window borrowing.

Historical Case Studies: Discount Window vs Open Market Operations

Historical case studies reveal that the discount window provided emergency liquidity during the 2008 financial crisis, acting as a lender of last resort for banks facing short-term funding issues. In contrast, open market operations have historically been used for routine monetary policy adjustments, influencing short-term interest rates and liquidity on a broader scale. Analysis of these cases highlights the discount window's role in crisis stabilization, while open market operations maintain ongoing market equilibrium.

Choosing the Right Tool: Policy Implications and Considerations

Choosing between the discount window and open market operations hinges on the central bank's immediate liquidity needs and signaling goals. The discount window is tailored for emergency, short-term lending to financial institutions facing temporary liquidity shortages, emphasizing stabilizing confidence. In contrast, open market operations, involving buying or selling government securities, offer broader control over money supply and interest rates, directly influencing economic conditions and policy transmission.

discount window vs open market operations Infographic

difterm.com

difterm.com