The settlement date is the day when the actual transfer of securities and payment occurs, while the trade date is when the transaction is executed or agreed upon. In finance, understanding the distinction between these dates is crucial for accurate portfolio valuation and cash flow management. Settlement delays can impact liquidity and risk, making clear differentiation essential in financial decision-making.

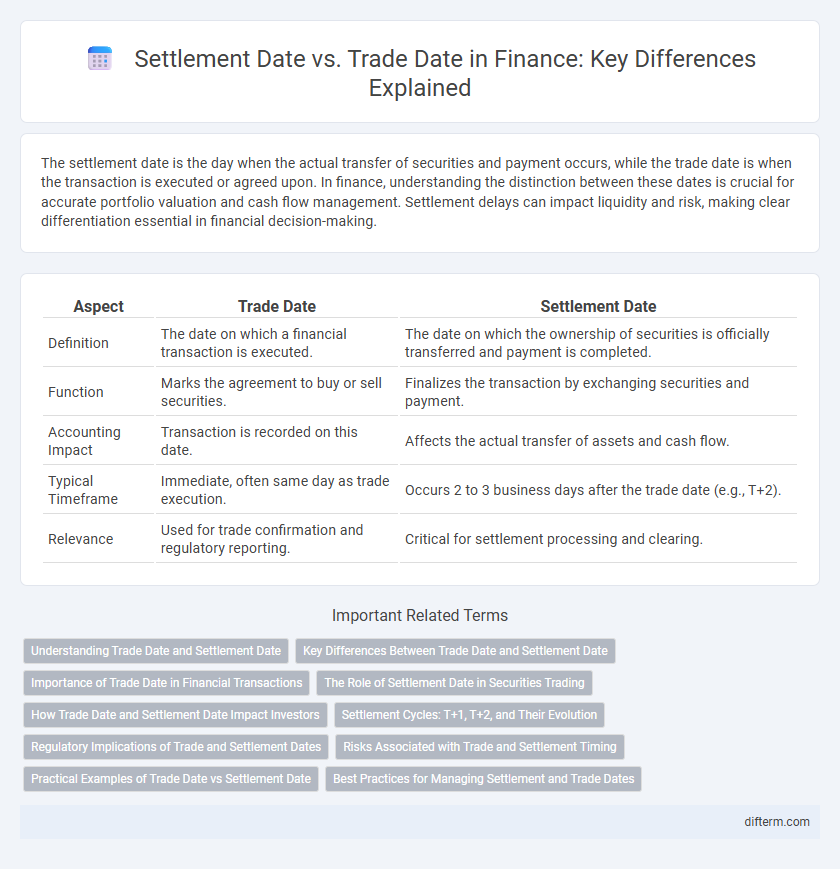

Table of Comparison

| Aspect | Trade Date | Settlement Date |

|---|---|---|

| Definition | The date on which a financial transaction is executed. | The date on which the ownership of securities is officially transferred and payment is completed. |

| Function | Marks the agreement to buy or sell securities. | Finalizes the transaction by exchanging securities and payment. |

| Accounting Impact | Transaction is recorded on this date. | Affects the actual transfer of assets and cash flow. |

| Typical Timeframe | Immediate, often same day as trade execution. | Occurs 2 to 3 business days after the trade date (e.g., T+2). |

| Relevance | Used for trade confirmation and regulatory reporting. | Critical for settlement processing and clearing. |

Understanding Trade Date and Settlement Date

The trade date is the day when a financial transaction is executed, marking the agreement to buy or sell assets, whereas the settlement date is when the actual transfer of securities and funds occurs, completing the transaction. Understanding the difference is crucial for managing cash flow, risk, and compliance in investment portfolios, as settlement dates typically lag trade dates by two business days (T+2) in most markets. Accurate tracking of both dates ensures proper accounting, regulatory reporting, and minimizes settlement risk in securities trading.

Key Differences Between Trade Date and Settlement Date

The trade date represents the day when a financial transaction is executed, while the settlement date is when the actual transfer of securities and funds is completed. Key differences include timing, as the trade date occurs at the agreement of the trade, and the settlement date follows after a specified period, typically T+2 for stocks. Settlement date impacts the ownership transfer and payment finalization, which is critical for regulatory compliance and accurate record-keeping in financial markets.

Importance of Trade Date in Financial Transactions

The trade date is crucial in financial transactions as it determines the official day when the agreement to buy or sell an asset is made, impacting the pricing and contractual obligations. This date affects the calculation of gains, losses, and interest, making it essential for accurate financial reporting and compliance with regulatory requirements. Unlike the settlement date, which marks the transfer of ownership, the trade date anchors the transaction within a specific accounting period.

The Role of Settlement Date in Securities Trading

The settlement date in securities trading is the day when the actual transfer of funds and securities between buyer and seller occurs, finalizing the transaction initiated on the trade date. This date determines the legal ownership of the security and affects the calculation of dividends, interest, and tax obligations. Efficient processing of settlement dates reduces counterparty risk and ensures market liquidity and integrity.

How Trade Date and Settlement Date Impact Investors

The trade date marks when a transaction is executed, determining the price and contract terms affecting an investor's portfolio valuation and tax obligations. The settlement date, occurring days later, finalizes the transfer of securities and funds, impacting cash flow management and the timing of asset ownership rights. Understanding the distinction between these dates enables investors to strategically plan tax implications and liquidity needs.

Settlement Cycles: T+1, T+2, and Their Evolution

Settlement cycles such as T+1 and T+2 define the time between the trade date and the settlement date, with T+2 currently being the standard in many global markets to reduce counterparty risk and improve liquidity. The shift from T+3 to T+2 in recent years reflects advancements in technology and regulatory pressures aimed at enhancing market efficiency and reducing systemic risk. Emerging discussions on adopting T+1 settlement cycles indicate a trend toward faster transaction finality, benefiting investors and clearinghouses by minimizing exposure and capital requirements.

Regulatory Implications of Trade and Settlement Dates

Regulatory frameworks such as the SEC and MiFID II impose strict requirements on the reporting and accuracy of trade and settlement dates to ensure market transparency and mitigate settlement risk. Accurate differentiation between trade date, the date a transaction is executed, and settlement date, when ownership is transferred, is critical for compliance with rules on trade reporting, position limits, and capital adequacy. Failure to adhere to these requirements can result in regulatory sanctions, financial penalties, and increased scrutiny from oversight bodies.

Risks Associated with Trade and Settlement Timing

Settlement date and trade date discrepancies expose investors to several risks, including market risk, where price fluctuations between these dates can impact the trade's value. Counterparty risk arises if one party defaults before settlement occurs, causing potential financial loss or settlement failure. Liquidity risk is also present, as delays in settlement may affect cash flow management and the timely availability of funds.

Practical Examples of Trade Date vs Settlement Date

Trade date refers to the exact day a financial transaction, such as buying or selling stocks, occurs, while the settlement date is when the trade is officially completed and ownership is transferred. For example, if an investor buys shares on March 1 (trade date), the funds and stock delivery typically finalize on March 3 (settlement date) under a T+2 settlement cycle. Understanding this timing impacts cash flow management, dividend eligibility, and accurate portfolio valuations in trading activities.

Best Practices for Managing Settlement and Trade Dates

Accurately distinguishing between the settlement date and trade date is essential for effective financial transaction management, ensuring compliance with regulatory requirements and optimizing cash flow. Best practices include implementing robust systems to track and reconcile these dates, minimizing settlement risk and operational errors. Maintaining clear communication with counterparties and custodians facilitates timely settlements, reducing potential delays and financial penalties.

Settlement Date vs Trade Date Infographic

difterm.com

difterm.com