Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate, simplifying payments and improving financial management. Debt refinancing replaces an existing loan with a new one, often to secure better terms such as a lower interest rate or extended repayment period. Both strategies aim to reduce financial burden but differ in their approach to restructuring debt obligations.

Table of Comparison

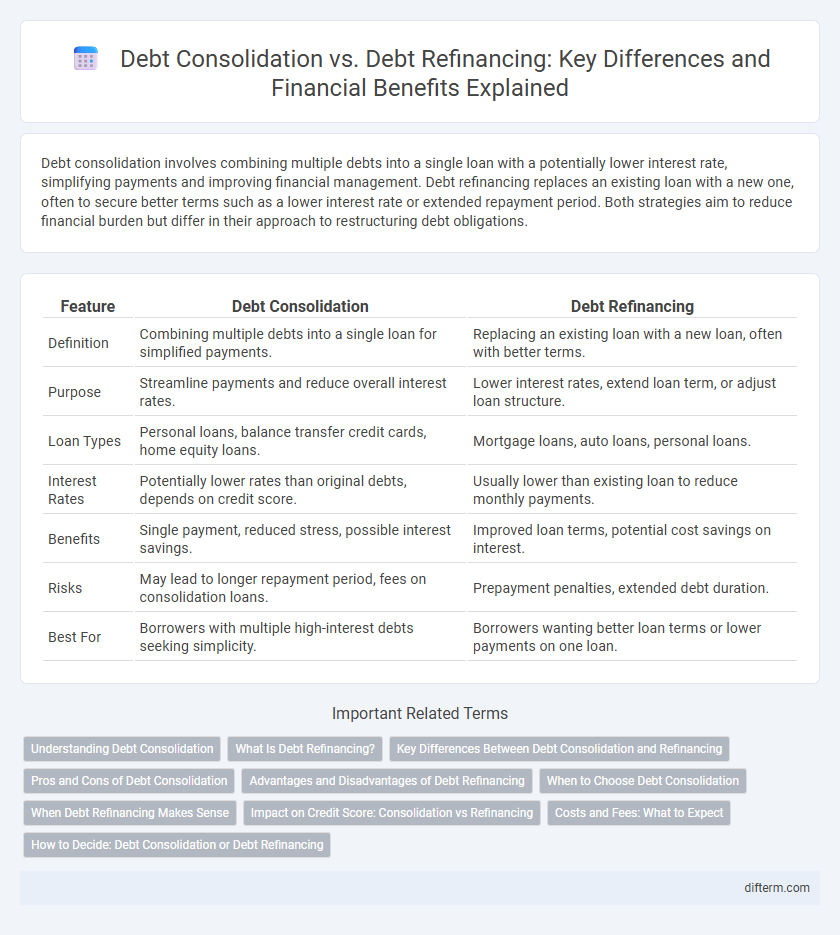

| Feature | Debt Consolidation | Debt Refinancing |

|---|---|---|

| Definition | Combining multiple debts into a single loan for simplified payments. | Replacing an existing loan with a new loan, often with better terms. |

| Purpose | Streamline payments and reduce overall interest rates. | Lower interest rates, extend loan term, or adjust loan structure. |

| Loan Types | Personal loans, balance transfer credit cards, home equity loans. | Mortgage loans, auto loans, personal loans. |

| Interest Rates | Potentially lower rates than original debts, depends on credit score. | Usually lower than existing loan to reduce monthly payments. |

| Benefits | Single payment, reduced stress, possible interest savings. | Improved loan terms, potential cost savings on interest. |

| Risks | May lead to longer repayment period, fees on consolidation loans. | Prepayment penalties, extended debt duration. |

| Best For | Borrowers with multiple high-interest debts seeking simplicity. | Borrowers wanting better loan terms or lower payments on one loan. |

Understanding Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a fixed interest rate, simplifying repayment and potentially lowering monthly payments. This strategy helps borrowers manage their finances more effectively by replacing several high-interest debts, such as credit cards and personal loans, with one consolidated loan. Understanding debt consolidation can improve credit scores and reduce financial stress by streamlining debt obligations and improving payment consistency.

What Is Debt Refinancing?

Debt refinancing involves replacing an existing loan with a new one, typically with better terms such as a lower interest rate, extended repayment period, or reduced monthly payments. This financial strategy helps borrowers manage debt more efficiently by reducing overall interest costs or improving cash flow. Compared to debt consolidation, refinancing targets individual loans rather than combining multiple debts into a single payment.

Key Differences Between Debt Consolidation and Refinancing

Debt consolidation combines multiple debts into a single loan with a fixed interest rate, simplifying payments and potentially lowering monthly expenses, while refinancing replaces an existing loan with a new one that ideally offers better terms such as lower interest rates or extended repayment periods. Debt consolidation is mainly used for managing unsecured debts like credit cards, whereas refinancing typically applies to a specific loan, such as a mortgage or auto loan. Understanding the purpose, types of debts involved, and financial goals are crucial for choosing between debt consolidation and refinancing strategies.

Pros and Cons of Debt Consolidation

Debt consolidation simplifies multiple debts into a single payment, often lowering monthly payments and interest rates, which can improve financial management and reduce stress. However, it may extend the repayment period, potentially increasing the total interest paid over time, and might require collateral, posing a risk to assets. Choosing debt consolidation involves weighing immediate cash flow benefits against long-term financial costs and personal risk tolerance.

Advantages and Disadvantages of Debt Refinancing

Debt refinancing offers the advantage of securing a lower interest rate, which can reduce monthly payments and overall loan costs. However, it may involve fees such as closing costs or prepayment penalties that could offset immediate savings. The main disadvantage is the potential for extending the loan term, potentially increasing total interest paid over time despite lower rates.

When to Choose Debt Consolidation

Debt consolidation is ideal when managing multiple high-interest debts, as it combines them into a single loan with a potentially lower overall interest rate, simplifying monthly payments and reducing financial stress. It works best for borrowers struggling with credit card balances or personal loans who seek predictable payments and improved debt management. Choosing debt consolidation is advantageous when the goal is to improve cash flow and avoid the complexities of multiple creditor relationships.

When Debt Refinancing Makes Sense

Debt refinancing makes sense when interest rates have dropped significantly since the original loan was taken, allowing borrowers to reduce their monthly payments and overall interest costs. It is also beneficial for those seeking to extend the loan term to improve cash flow without accumulating more debt. Refinancing can provide access to better loan terms or convert variable-rate debt into fixed-rate debt, stabilizing repayment amounts.

Impact on Credit Score: Consolidation vs Refinancing

Debt consolidation can temporarily lower your credit score due to the hard inquiry and opening of a new account but may improve it over time by reducing credit utilization and simplifying payments. Debt refinancing often involves replacing existing loans with new ones at better interest rates, which may cause a minor score dip initially but can enhance your credit profile through improved payment history and reduced debt-to-income ratio. Both strategies impact credit scores differently based on loan types, payment behaviors, and credit utilization adjustments.

Costs and Fees: What to Expect

Debt consolidation typically involves a single loan with a fixed interest rate, which can lower overall monthly payments and simplify management, but may come with origination fees ranging from 1% to 5% of the loan amount. Debt refinancing often offers lower interest rates and customized terms, but borrowers should anticipate potential prepayment penalties, closing costs, and appraisal fees that can total 2% to 6% of the refinanced amount. Understanding these costs and fees is crucial for making an informed choice between consolidating multiple debts or refinancing individual loans to optimize financial savings.

How to Decide: Debt Consolidation or Debt Refinancing

Choosing between debt consolidation and debt refinancing depends on the structure of your existing debt and your financial goals. Debt consolidation involves combining multiple debts into a single loan with one monthly payment, which simplifies management but may extend repayment terms. Debt refinancing replaces an existing loan with a new one, potentially lowering interest rates and monthly payments, ideal for individuals seeking better loan terms rather than just simplifying payments.

Debt Consolidation vs Debt Refinancing Infographic

difterm.com

difterm.com