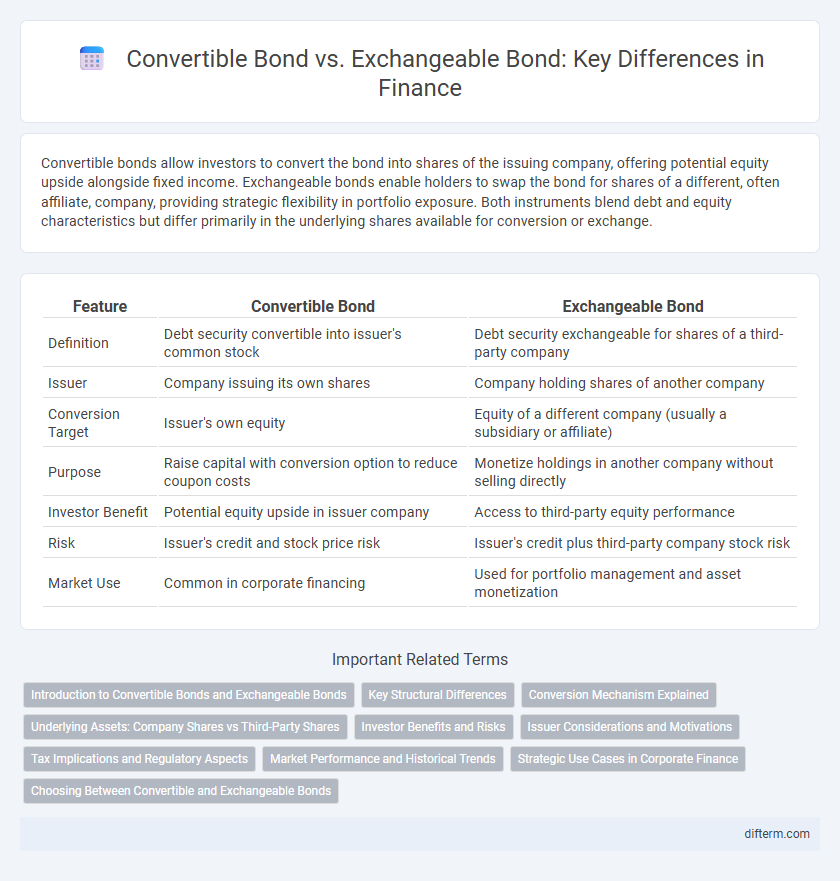

Convertible bonds allow investors to convert the bond into shares of the issuing company, offering potential equity upside alongside fixed income. Exchangeable bonds enable holders to swap the bond for shares of a different, often affiliate, company, providing strategic flexibility in portfolio exposure. Both instruments blend debt and equity characteristics but differ primarily in the underlying shares available for conversion or exchange.

Table of Comparison

| Feature | Convertible Bond | Exchangeable Bond |

|---|---|---|

| Definition | Debt security convertible into issuer's common stock | Debt security exchangeable for shares of a third-party company |

| Issuer | Company issuing its own shares | Company holding shares of another company |

| Conversion Target | Issuer's own equity | Equity of a different company (usually a subsidiary or affiliate) |

| Purpose | Raise capital with conversion option to reduce coupon costs | Monetize holdings in another company without selling directly |

| Investor Benefit | Potential equity upside in issuer company | Access to third-party equity performance |

| Risk | Issuer's credit and stock price risk | Issuer's credit plus third-party company stock risk |

| Market Use | Common in corporate financing | Used for portfolio management and asset monetization |

Introduction to Convertible Bonds and Exchangeable Bonds

Convertible bonds are debt securities that can be converted into a predetermined number of the issuer's equity shares, offering investors potential upside through equity conversion while providing fixed income returns. Exchangeable bonds, unlike convertible bonds, allow holders to exchange bonds for shares of a company other than the issuer, typically a subsidiary or an affiliate, enabling portfolio diversification. Both instruments blend debt and equity features, serving as strategic financing tools for issuers and offering investors flexible exit options.

Key Structural Differences

Convertible bonds grant holders the right to convert the bond into shares of the issuing company, enabling direct equity participation and potential upside from share price appreciation. Exchangeable bonds allow bondholders to exchange the bond for shares of a different company, often a subsidiary or affiliate, providing diversification benefits. Key structural differences include the underlying equity involved, with convertible bonds tied to the issuer's stock, while exchangeable bonds are linked to third-party company shares, impacting risk profiles and conversion incentives.

Conversion Mechanism Explained

Convertible bonds allow holders to convert their bonds directly into a predetermined number of the issuing company's shares, providing potential equity participation and upside in the company's stock performance. Exchangeable bonds, by contrast, give investors the option to exchange the bond for shares of a different company, typically a subsidiary or another related entity, offering diversification without diluting the issuer's equity. The conversion mechanism in convertible bonds is usually tied to a fixed conversion ratio and conversion price, whereas exchangeable bonds' terms depend on the underlying share valuation of the external entity.

Underlying Assets: Company Shares vs Third-Party Shares

Convertible bonds grant holders the option to convert their bonds into company shares, directly linking the debt instrument's value to the issuing company's equity performance. Exchangeable bonds, in contrast, allow investors to exchange bonds for shares of a third-party company, which can offer diversification benefits and reduce exposure to the issuer's operational risks. The distinction in underlying assets significantly affects risk profiles, valuation methods, and potential returns for investors in convertible versus exchangeable bonds.

Investor Benefits and Risks

Convertible bonds offer investors the benefit of equity upside potential by allowing conversion into the issuer's common stock, providing downside protection through fixed interest payments. Exchangeable bonds enable investors to exchange bonds for shares of a third party's stock, often offering diversification benefits but may carry higher issuer-specific risk. Both instruments expose investors to market volatility and credit risk, with convertible bonds generally exhibiting higher sensitivity to the issuing company's stock performance.

Issuer Considerations and Motivations

Issuers choose convertible bonds to raise capital while offering investors equity upside through conversion rights, which can lower interest costs and reduce immediate cash outflows. Exchangeable bonds enable issuers to monetize existing equity holdings in subsidiaries or affiliates without issuing new shares, facilitating portfolio management and asset restructuring. Both instruments serve strategic financing goals, with convertible bonds promoting equity-linked growth and exchangeable bonds focusing on balance sheet optimization.

Tax Implications and Regulatory Aspects

Convertible bonds often present unique tax implications as interest payments may be treated differently compared to exchangeable bonds, where the tax treatment typically depends on the underlying asset's jurisdiction and classification. Regulatory aspects for convertible bonds are generally more stringent due to their hybrid nature of debt and equity, requiring compliance with securities laws and disclosure standards, while exchangeable bonds primarily adhere to regulations pertaining to asset-specific transactions and cross-border trading controls. Investors must carefully analyze tax consequences and regulatory frameworks within their jurisdiction to optimize returns and ensure legal compliance for both bond types.

Market Performance and Historical Trends

Convertible bonds historically exhibit higher market performance volatility due to their direct equity conversion feature, allowing investors to benefit from rising stock prices. Exchangeable bonds, backed by a holding company's shares, typically demonstrate more stable returns with lower correlation to the issuer's stock price fluctuations. Market trends indicate convertible bonds surge during bullish equity markets, while exchangeable bonds provide consistent income in sideways or declining markets.

Strategic Use Cases in Corporate Finance

Convertible bonds provide companies with strategic flexibility by enabling debt to be converted into equity, reducing immediate cash outflows while potentially diluting ownership when equity prices rise. Exchangeable bonds offer targeted asset management by allowing bondholders to exchange debt for shares of related but separate entities, facilitating portfolio restructuring without issuing new equity. Both instruments optimize capital structure by balancing debt and equity, supporting mergers, acquisitions, or spin-offs within corporate finance strategies.

Choosing Between Convertible and Exchangeable Bonds

Choosing between convertible bonds and exchangeable bonds depends on the issuer's asset composition and investor preferences. Convertible bonds allow conversion into the issuer's own equity, providing potential upside tied to the company's stock performance, while exchangeable bonds grant conversion into shares of a different company or subsidiary, often enabling portfolio diversification or exposure to strategic assets. Investors prioritize convertible bonds for direct equity participation and capital appreciation, whereas exchangeable bonds appeal to those seeking specific equity exposure without direct investment in the issuer.

Convertible Bond vs Exchangeable Bond Infographic

difterm.com

difterm.com