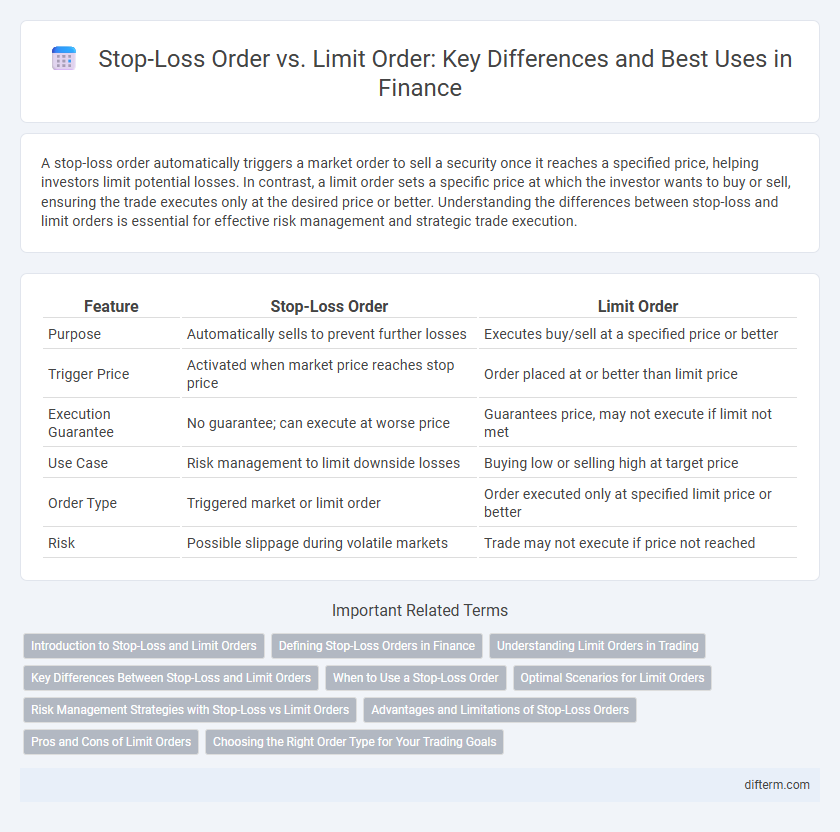

A stop-loss order automatically triggers a market order to sell a security once it reaches a specified price, helping investors limit potential losses. In contrast, a limit order sets a specific price at which the investor wants to buy or sell, ensuring the trade executes only at the desired price or better. Understanding the differences between stop-loss and limit orders is essential for effective risk management and strategic trade execution.

Table of Comparison

| Feature | Stop-Loss Order | Limit Order |

|---|---|---|

| Purpose | Automatically sells to prevent further losses | Executes buy/sell at a specified price or better |

| Trigger Price | Activated when market price reaches stop price | Order placed at or better than limit price |

| Execution Guarantee | No guarantee; can execute at worse price | Guarantees price, may not execute if limit not met |

| Use Case | Risk management to limit downside losses | Buying low or selling high at target price |

| Order Type | Triggered market or limit order | Order executed only at specified limit price or better |

| Risk | Possible slippage during volatile markets | Trade may not execute if price not reached |

Introduction to Stop-Loss and Limit Orders

Stop-loss orders automatically sell a security when its price drops to a specified level, helping investors limit potential losses and protect profits in volatile markets. Limit orders set a maximum purchase price or minimum sale price, allowing traders to control entry and exit points by only executing trades at desired price levels. Both order types are essential tools in risk management and strategic trading to optimize investment outcomes.

Defining Stop-Loss Orders in Finance

A stop-loss order in finance is a predetermined instruction to sell a security once its price falls to a specified level, designed to limit an investor's losses on a position. This order type automatically triggers a market order when the stop price is reached, ensuring prompt execution. By controlling downside risk, stop-loss orders help investors manage portfolio volatility and protect capital during market downturns.

Understanding Limit Orders in Trading

Limit orders are instructions set by traders to buy or sell securities at a specific price or better, ensuring control over the execution price and minimizing slippage. They are essential for managing entry and exit points, enabling investors to capitalize on favorable price movements while avoiding unexpected losses. Understanding limit orders improves trading strategy precision by setting predefined price limits in volatile markets.

Key Differences Between Stop-Loss and Limit Orders

Stop-loss orders activate a market order to sell or buy a security once it reaches a specific price, aiming to limit potential losses, while limit orders execute a trade only at a predetermined price or better, prioritizing price control over execution certainty. Stop-loss orders may trigger at prices below or above the target, causing slippage during volatile conditions, whereas limit orders ensure execution at the set price but risk non-execution if the market doesn't reach that level. Investors use stop-loss orders primarily for risk management to protect gains or prevent further losses, whereas limit orders focus on precise entry or exit points to capitalize on expected market movements.

When to Use a Stop-Loss Order

A stop-loss order is essential for risk management, automatically triggering a sale when a stock price falls to a predetermined level to limit potential losses. It is best used in volatile markets or when an investor cannot monitor the position continuously. Employing a stop-loss order helps protect capital by minimizing losses during sharp market downturns.

Optimal Scenarios for Limit Orders

Limit orders are optimal in volatile markets where precise entry or exit prices are crucial for maximizing gains or minimizing losses. They allow investors to set a specific price point, ensuring trades execute only at desired levels, thus protecting against unfavorable price fluctuations. This strategy is particularly effective for less liquid stocks or assets with wide bid-ask spreads, where controlling transaction costs and price execution is essential.

Risk Management Strategies with Stop-Loss vs Limit Orders

Stop-loss orders serve as crucial risk management tools by automatically selling assets when prices hit a predetermined level, limiting potential losses in volatile markets. Limit orders help manage risk by setting a maximum purchase price or minimum sale price, ensuring trades occur at favorable levels without unexpected price slippage. Combining stop-loss and limit orders allows investors to protect capital while optimizing entry and exit points for improved portfolio stability.

Advantages and Limitations of Stop-Loss Orders

Stop-loss orders help investors limit potential losses by automatically selling assets once a predetermined price is reached, providing risk management and emotional discipline during volatile markets. These orders offer the advantage of protecting portfolios from significant downturns without requiring constant monitoring, but they may trigger premature sales during short-term price fluctuations or market gaps. Investors must recognize that stop-loss orders do not guarantee execution at the stop price, especially in fast-moving or illiquid markets, which could result in selling at less favorable prices.

Pros and Cons of Limit Orders

Limit orders offer precise control over trade execution prices, allowing investors to buy or sell assets at a specified price or better, which helps manage risk and optimize profit margins. However, the main drawback is the possibility of missing out on trades if the market price never reaches the set limit, leading to missed opportunities in fast-moving markets. Limit orders are ideal for investors prioritizing price certainty over immediate execution, but they require careful monitoring and market analysis to set effective price targets.

Choosing the Right Order Type for Your Trading Goals

Stop-loss orders help minimize losses by automatically selling a security when its price falls to a specified level, making them ideal for risk-averse traders aiming to protect capital. Limit orders set the maximum or minimum price at which a trade can be executed, providing control over entry or exit prices and suitability for traders seeking specific price targets. Understanding your trading goals, risk tolerance, and market conditions is essential to selecting between stop-loss and limit orders for effective portfolio management.

Stop-Loss Order vs Limit Order Infographic

difterm.com

difterm.com