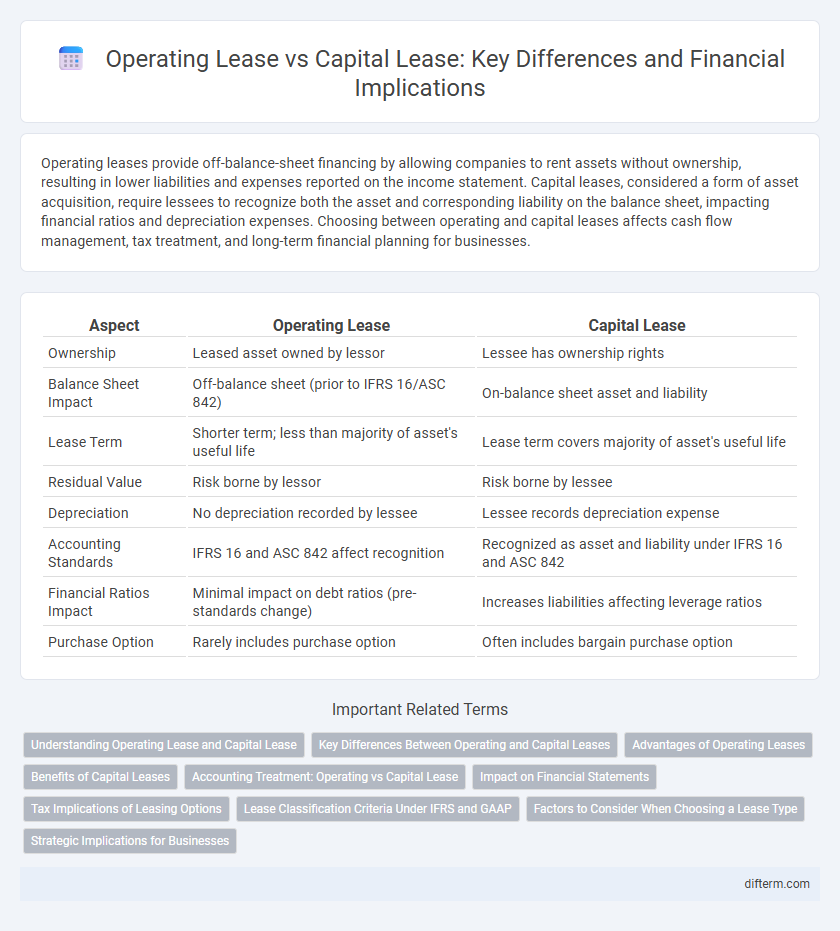

Operating leases provide off-balance-sheet financing by allowing companies to rent assets without ownership, resulting in lower liabilities and expenses reported on the income statement. Capital leases, considered a form of asset acquisition, require lessees to recognize both the asset and corresponding liability on the balance sheet, impacting financial ratios and depreciation expenses. Choosing between operating and capital leases affects cash flow management, tax treatment, and long-term financial planning for businesses.

Table of Comparison

| Aspect | Operating Lease | Capital Lease |

|---|---|---|

| Ownership | Leased asset owned by lessor | Lessee has ownership rights |

| Balance Sheet Impact | Off-balance sheet (prior to IFRS 16/ASC 842) | On-balance sheet asset and liability |

| Lease Term | Shorter term; less than majority of asset's useful life | Lease term covers majority of asset's useful life |

| Residual Value | Risk borne by lessor | Risk borne by lessee |

| Depreciation | No depreciation recorded by lessee | Lessee records depreciation expense |

| Accounting Standards | IFRS 16 and ASC 842 affect recognition | Recognized as asset and liability under IFRS 16 and ASC 842 |

| Financial Ratios Impact | Minimal impact on debt ratios (pre-standards change) | Increases liabilities affecting leverage ratios |

| Purchase Option | Rarely includes purchase option | Often includes bargain purchase option |

Understanding Operating Lease and Capital Lease

Operating leases represent rental agreements where the lessee uses an asset without owning it, allowing for off-balance-sheet treatment under certain accounting standards. Capital leases, also known as finance leases, entail the lessee assuming ownership risks and rewards, requiring asset capitalization and liability recognition on the balance sheet. The fundamental distinction lies in asset ownership transfer and the resulting financial statement impact, influencing lease classification and reporting in compliance with accounting principles like ASC 842 or IFRS 16.

Key Differences Between Operating and Capital Leases

Operating leases do not transfer ownership rights or risks to the lessee and are treated as rental expenses, while capital leases transfer ownership risks and are recorded as assets and liabilities on the balance sheet. Operating leases typically have shorter terms and do not affect the lessee's debt ratios, whereas capital leases have longer terms, often matching the asset's useful life and impact financial leverage. The accounting treatment differs, with operating leases expensed on the income statement, whereas capital leases require depreciation and interest expense recognition.

Advantages of Operating Leases

Operating leases offer significant advantages by preserving a company's capital and improving cash flow, as lease payments are treated as operating expenses rather than debt, keeping liabilities off the balance sheet. This flexibility allows businesses to upgrade assets more frequently without the risks of ownership, reducing maintenance costs and obsolescence concerns. Operating leases also provide favorable tax treatment since lease payments are fully deductible, enhancing financial ratios and investor perception.

Benefits of Capital Leases

Capital leases provide businesses with the advantage of asset ownership, allowing them to record the asset on the balance sheet and benefit from depreciation tax deductions. They enhance financial transparency by reflecting long-term liabilities, which can improve creditworthiness and investor confidence. Capital leases also offer greater control over the leased asset, enabling customization and extended use beyond typical operating lease terms.

Accounting Treatment: Operating vs Capital Lease

Operating leases are recorded as rental expenses on the income statement and do not appear on the balance sheet, preserving a company's debt-to-equity ratio. Capital leases, classified as finance leases under ASC 842 and IFRS 16, require recognizing both an asset and a liability on the balance sheet, reflecting ownership-like benefits and obligations. This accounting treatment impacts financial ratios, asset management, and tax implications significantly for businesses evaluating lease classification.

Impact on Financial Statements

Operating leases keep lease expenses off the balance sheet, recorded as rental expenses on the income statement, resulting in lower liabilities and assets. Capital leases, treated as asset acquisitions, increase both assets and liabilities on the balance sheet, reflecting depreciation and interest expenses on the income statement. This distinction affects financial ratios such as debt-to-equity and return on assets, influencing stakeholders' assessment of a company's leverage and profitability.

Tax Implications of Leasing Options

Operating leases typically allow businesses to deduct lease payments as operating expenses, providing immediate tax benefits without affecting the balance sheet. Capital leases, classified as asset acquisitions, require depreciation and interest expense deductions, potentially resulting in a higher tax shield over time. The choice between operating and capital leases significantly impacts taxable income, cash flow, and financial ratios, influencing strategic tax planning decisions.

Lease Classification Criteria Under IFRS and GAAP

Lease classification under IFRS (IFRS 16) and GAAP (ASC 842) hinges on distinct criteria emphasizing transfer of ownership, lease term, and present value of lease payments. IFRS adopts a single model treating most leases as finance leases, identifying operating leases if the lease does not transfer substantially all risks and rewards of ownership. GAAP maintains a dual model requiring leases to meet specific criteria such as ownership transfer, bargain purchase option, lease term being major part of asset's economic life, or present value of lease payments equaling substantially all asset's fair value to classify as capital leases.

Factors to Consider When Choosing a Lease Type

When choosing between an operating lease and a capital lease, businesses must evaluate the lease term relative to the asset's useful life, as capital leases often extend over most or all of the asset's lifespan. Consider the impact on financial statements, since capital leases are capitalized as assets and liabilities, affecting debt ratios, while operating leases typically remain off-balance-sheet expenses. Tax implications, such as depreciation benefits and interest deductions available with capital leases, also play a crucial role in determining the most cost-effective and strategically aligned lease type.

Strategic Implications for Businesses

Operating leases enhance financial flexibility by keeping liabilities off the balance sheet, improving key ratios such as return on assets and debt-to-equity, which appeals to investors and lenders. Capital leases, recorded as assets and liabilities, provide long-term control over the leased asset, allowing businesses to benefit from depreciation and interest deductions, impacting tax strategy and cash flow management. Choosing between operating and capital leases influences strategic decisions related to asset management, financial reporting transparency, and capital allocation priorities.

Operating lease vs Capital lease Infographic

difterm.com

difterm.com