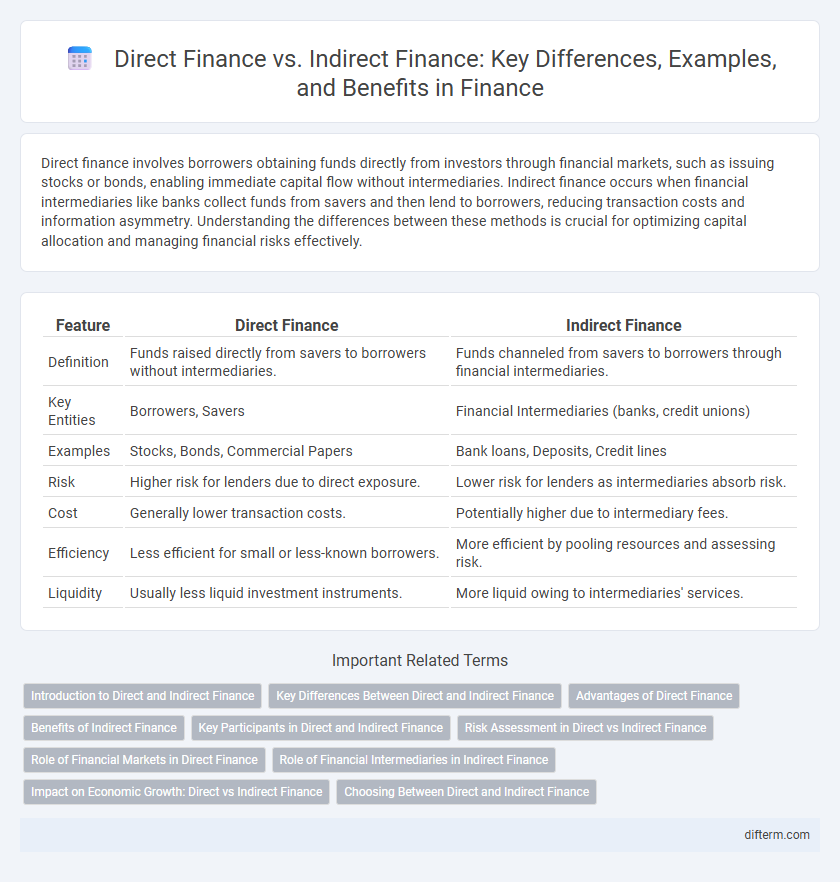

Direct finance involves borrowers obtaining funds directly from investors through financial markets, such as issuing stocks or bonds, enabling immediate capital flow without intermediaries. Indirect finance occurs when financial intermediaries like banks collect funds from savers and then lend to borrowers, reducing transaction costs and information asymmetry. Understanding the differences between these methods is crucial for optimizing capital allocation and managing financial risks effectively.

Table of Comparison

| Feature | Direct Finance | Indirect Finance |

|---|---|---|

| Definition | Funds raised directly from savers to borrowers without intermediaries. | Funds channeled from savers to borrowers through financial intermediaries. |

| Key Entities | Borrowers, Savers | Financial Intermediaries (banks, credit unions) |

| Examples | Stocks, Bonds, Commercial Papers | Bank loans, Deposits, Credit lines |

| Risk | Higher risk for lenders due to direct exposure. | Lower risk for lenders as intermediaries absorb risk. |

| Cost | Generally lower transaction costs. | Potentially higher due to intermediary fees. |

| Efficiency | Less efficient for small or less-known borrowers. | More efficient by pooling resources and assessing risk. |

| Liquidity | Usually less liquid investment instruments. | More liquid owing to intermediaries' services. |

Introduction to Direct and Indirect Finance

Direct finance involves borrowers obtaining funds directly from savers through financial markets by issuing securities like stocks and bonds, facilitating efficient capital allocation without intermediaries. Indirect finance occurs when financial intermediaries such as banks, credit unions, or mutual funds bridge savers and borrowers, transforming liabilities and absorbing credit risk. Understanding the distinctions between direct and indirect finance is essential for assessing financial system structure, market efficiency, and risk distribution.

Key Differences Between Direct and Indirect Finance

Direct finance involves borrowers obtaining funds directly from lenders through financial markets by issuing securities such as bonds or stocks, enabling efficient capital allocation without intermediaries. Indirect finance includes financial intermediaries like banks or mutual funds that collect savings and lend to borrowers, reducing transaction costs and mitigating information asymmetry. Key differences include the presence of intermediaries, the risk-bearing entities, and the level of transparency in information flow between parties.

Advantages of Direct Finance

Direct finance enables borrowers and lenders to interact without intermediaries, reducing transaction costs and increasing efficiency in capital allocation. It allows for customized financial agreements that better meet the specific needs of both parties, enhancing flexibility and control over funds. Transparent negotiation processes in direct finance improve risk assessment and foster stronger trust between investors and borrowers.

Benefits of Indirect Finance

Indirect finance offers enhanced risk diversification by pooling funds through financial intermediaries such as banks and mutual funds, reducing exposure for individual investors. It provides increased liquidity and accessibility, enabling smaller investors to participate in financial markets without the need for significant capital. Furthermore, intermediaries perform critical functions like credit assessment and monitoring, lowering transaction costs and information asymmetry compared to direct finance.

Key Participants in Direct and Indirect Finance

Key participants in direct finance include borrowers issuing securities and lenders or investors purchasing these instruments without intermediaries. Indirect finance involves financial intermediaries such as banks, credit unions, and mutual funds that channel funds from savers to borrowers, managing risks and maturity mismatches. Both forms rely on these entities to facilitate efficient capital allocation and liquidity in financial markets.

Risk Assessment in Direct vs Indirect Finance

Risk assessment in direct finance involves evaluating the creditworthiness of borrowers and analyzing market conditions to mitigate default risk, as funds flow directly from investors to entities. Indirect finance shifts this risk assessment to financial intermediaries like banks, which manage credit risk through diversification, collateral evaluation, and regulatory oversight. The differing risk management approaches impact liquidity, exposure levels, and the overall stability of financial markets.

Role of Financial Markets in Direct Finance

Financial markets play a crucial role in direct finance by facilitating the efficient allocation of capital between savers and borrowers through instruments such as stocks and bonds. They provide transparency, liquidity, and price discovery, enabling businesses to obtain funds directly from investors without intermediaries. This direct interaction reduces transaction costs and enhances market efficiency, promoting economic growth by mobilizing resources effectively.

Role of Financial Intermediaries in Indirect Finance

Financial intermediaries such as banks, credit unions, and investment funds play a crucial role in indirect finance by channeling funds from savers to borrowers, reducing information asymmetry and transaction costs. These institutions assess credit risk, provide liquidity, and offer diversification, facilitating efficient capital allocation in the economy. By transforming short-term deposits into long-term loans, financial intermediaries sustain economic growth and stability.

Impact on Economic Growth: Direct vs Indirect Finance

Direct finance channels capital from savers to borrowers without intermediaries, accelerating economic growth by enhancing resource allocation efficiency and reducing transaction costs. Indirect finance relies on financial intermediaries like banks, which mobilize savings and manage risks but may introduce frictions that slow capital flow and dampen growth. Empirical studies show economies with well-developed direct finance systems exhibit higher investment rates and productivity gains compared to those dependent primarily on indirect finance.

Choosing Between Direct and Indirect Finance

Choosing between direct and indirect finance depends on factors such as cost, control, and risk tolerance. Direct finance often involves issuing securities directly to investors, reducing intermediary fees but requiring greater regulatory compliance and market knowledge. Indirect finance leverages financial intermediaries like banks, providing convenience and risk-sharing while potentially increasing costs through interest margins and fees.

direct finance vs indirect finance Infographic

difterm.com

difterm.com