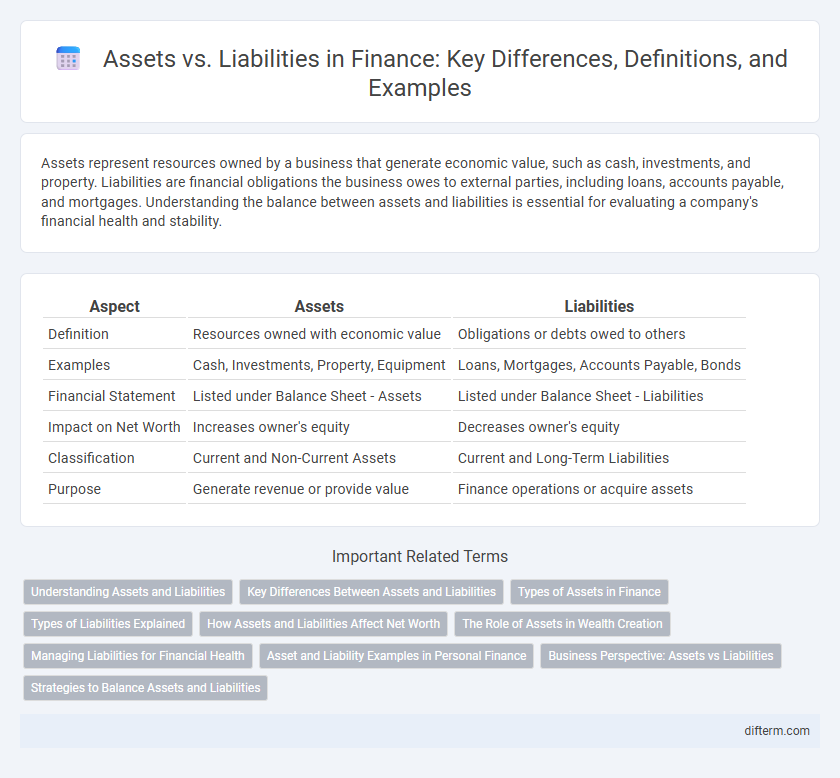

Assets represent resources owned by a business that generate economic value, such as cash, investments, and property. Liabilities are financial obligations the business owes to external parties, including loans, accounts payable, and mortgages. Understanding the balance between assets and liabilities is essential for evaluating a company's financial health and stability.

Table of Comparison

| Aspect | Assets | Liabilities |

|---|---|---|

| Definition | Resources owned with economic value | Obligations or debts owed to others |

| Examples | Cash, Investments, Property, Equipment | Loans, Mortgages, Accounts Payable, Bonds |

| Financial Statement | Listed under Balance Sheet - Assets | Listed under Balance Sheet - Liabilities |

| Impact on Net Worth | Increases owner's equity | Decreases owner's equity |

| Classification | Current and Non-Current Assets | Current and Long-Term Liabilities |

| Purpose | Generate revenue or provide value | Finance operations or acquire assets |

Understanding Assets and Liabilities

Assets represent valuable resources owned by a business or individual, including cash, investments, property, and accounts receivable, that generate economic benefits over time. Liabilities encompass financial obligations such as loans, mortgages, accounts payable, and other debts that must be settled in the future. Understanding the distinction between assets and liabilities is crucial for accurate financial analysis and effective balance sheet management.

Key Differences Between Assets and Liabilities

Assets represent resources owned by a business that provide future economic benefits, including cash, inventory, and property. Liabilities are financial obligations or debts owed to external parties, such as loans, accounts payable, and mortgages. The key difference lies in assets contributing to value creation and wealth accumulation, while liabilities reflect claims against the company's resources and require future settlement.

Types of Assets in Finance

Assets in finance are classified into current, fixed, and intangible assets. Current assets include cash, accounts receivable, and inventory, essential for day-to-day operations, while fixed assets cover property, plant, and equipment used for long-term business activities. Intangible assets, such as patents, trademarks, and goodwill, represent non-physical resources that contribute to a company's value and competitive advantage.

Types of Liabilities Explained

Current liabilities include obligations such as accounts payable, short-term loans, and accrued expenses due within one year, impacting a company's liquidity. Long-term liabilities encompass debts like bonds payable, mortgages, and lease obligations that extend beyond one year, affecting long-term financial stability. Understanding these liability types helps in assessing a firm's risk exposure and cash flow management.

How Assets and Liabilities Affect Net Worth

Assets increase net worth by adding value and providing resources that can generate income or be liquidated for cash, while liabilities decrease net worth by representing debts or obligations that reduce overall financial health. The calculation of net worth involves subtracting total liabilities from total assets, reflecting an individual's or company's true financial position. A higher ratio of assets to liabilities indicates stronger financial stability and greater wealth accumulation potential.

The Role of Assets in Wealth Creation

Assets play a crucial role in wealth creation by generating income and appreciating in value over time, thereby increasing net worth. Investments in assets such as real estate, stocks, and businesses provide passive income streams and capital gains that contribute to long-term financial growth. Building a diversified asset portfolio minimizes risks and maximizes the potential for sustainable wealth accumulation.

Managing Liabilities for Financial Health

Effective management of liabilities involves prioritizing debt reduction and optimizing payment schedules to enhance cash flow stability. Maintaining a balanced debt-to-asset ratio ensures long-term financial resilience and mitigates risks of default. Implementing strategic refinancing and leveraging low-interest opportunities can significantly improve overall financial health.

Asset and Liability Examples in Personal Finance

Assets in personal finance include cash, savings accounts, investments like stocks and bonds, real estate, and valuable personal property such as vehicles or jewelry. Liabilities consist of debts and financial obligations such as mortgages, credit card balances, student loans, and car loans. Understanding the distinction between assets and liabilities is crucial for managing net worth and achieving financial stability.

Business Perspective: Assets vs Liabilities

Assets represent valuable resources owned by a business that generate economic benefits, such as cash, inventory, property, and equipment. Liabilities are financial obligations the company owes, including loans, accounts payable, and mortgages, which must be settled over time. Understanding the balance between assets and liabilities is crucial for assessing a company's financial health, liquidity, and long-term solvency.

Strategies to Balance Assets and Liabilities

Implementing strategies to balance assets and liabilities involves maintaining an optimal debt-to-asset ratio to ensure financial stability and liquidity. Regular asset revaluation and liability restructuring can enhance cash flow management, minimizing financial risks and improving creditworthiness. Utilizing tools such as hedging and diversification further stabilizes the balance sheet by protecting against market volatility and interest rate fluctuations.

Assets vs Liabilities Infographic

difterm.com

difterm.com