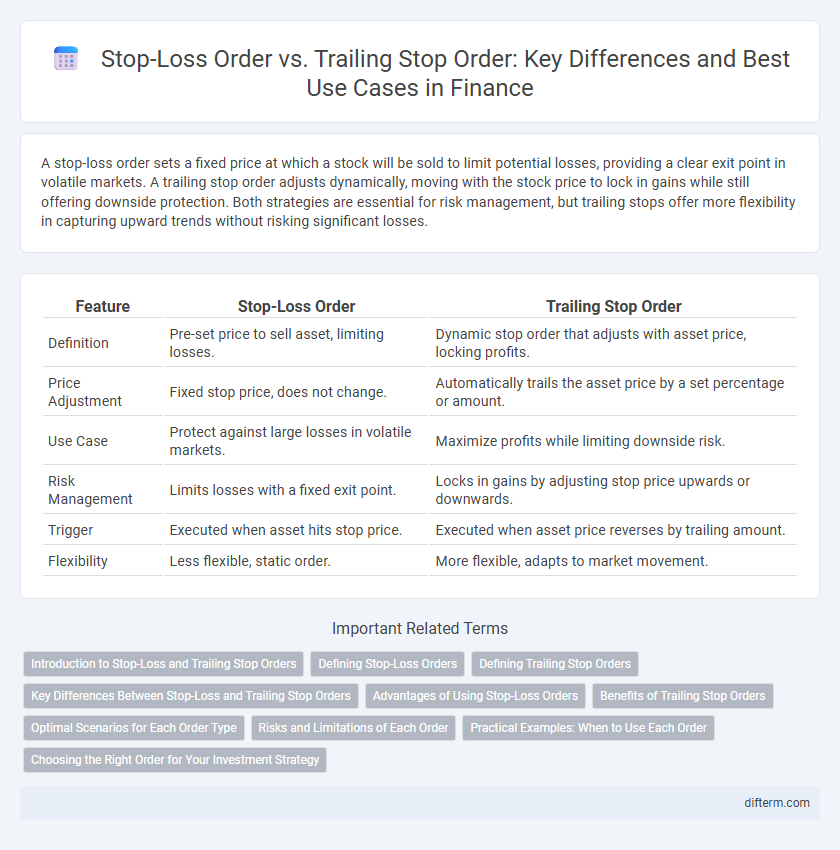

A stop-loss order sets a fixed price at which a stock will be sold to limit potential losses, providing a clear exit point in volatile markets. A trailing stop order adjusts dynamically, moving with the stock price to lock in gains while still offering downside protection. Both strategies are essential for risk management, but trailing stops offer more flexibility in capturing upward trends without risking significant losses.

Table of Comparison

| Feature | Stop-Loss Order | Trailing Stop Order |

|---|---|---|

| Definition | Pre-set price to sell asset, limiting losses. | Dynamic stop order that adjusts with asset price, locking profits. |

| Price Adjustment | Fixed stop price, does not change. | Automatically trails the asset price by a set percentage or amount. |

| Use Case | Protect against large losses in volatile markets. | Maximize profits while limiting downside risk. |

| Risk Management | Limits losses with a fixed exit point. | Locks in gains by adjusting stop price upwards or downwards. |

| Trigger | Executed when asset hits stop price. | Executed when asset price reverses by trailing amount. |

| Flexibility | Less flexible, static order. | More flexible, adapts to market movement. |

Introduction to Stop-Loss and Trailing Stop Orders

Stop-loss orders are designed to limit an investor's loss by automatically selling a security once it reaches a predetermined price, ensuring downside protection in volatile markets. Trailing stop orders adjust dynamically, setting the stop price at a fixed percentage or dollar amount below the market price, allowing for profit retention while safeguarding against reversals. Both tools serve as risk management strategies that automate exit points based on market conditions, enhancing portfolio control and minimizing emotional decision-making.

Defining Stop-Loss Orders

Stop-loss orders automatically sell a security when its price falls to a predetermined level, limiting potential losses. Investors use stop-loss orders to manage risk by setting a price threshold that triggers an immediate sale once reached. This order type helps protect portfolios from significant declines without requiring constant market monitoring.

Defining Trailing Stop Orders

A trailing stop order is a dynamic risk management tool that automatically adjusts the stop price at a fixed percentage or dollar amount below (for long positions) or above (for short positions) the market price. Unlike a traditional stop-loss order, which remains static once set, the trailing stop locks in profits by moving with favorable price fluctuations while limiting losses when the price reverses. This method allows traders to protect gains while providing flexibility to capture upward momentum in volatile markets.

Key Differences Between Stop-Loss and Trailing Stop Orders

Stop-loss orders automatically sell a security when it reaches a specified price to limit potential losses, providing a fixed exit point. Trailing stop orders adjust dynamically, moving the stop price according to the security's highest price reached, which allows investors to lock in profits while still protecting against downside risk. The key difference lies in the trailing stop's ability to capture gains by following favorable price movements, whereas stop-loss orders remain static.

Advantages of Using Stop-Loss Orders

Stop-loss orders provide investors with a clear exit strategy by automatically selling a security once it reaches a predetermined price, limiting potential losses and protecting capital in volatile markets. These orders help maintain disciplined trading by removing emotional decision-making and enabling efficient risk management. Their simplicity and reliability make stop-loss orders an essential tool for minimizing downside risk in both short-term trading and long-term investment portfolios.

Benefits of Trailing Stop Orders

Trailing stop orders offer dynamic protection by automatically adjusting the stop price as the security's price moves favorably, which helps lock in profits while limiting losses. They provide greater flexibility compared to fixed stop-loss orders, enabling investors to capitalize on upward trends without constantly monitoring the market. This automatic adjustment reduces emotional decision-making and enhances risk management strategies in volatile markets.

Optimal Scenarios for Each Order Type

Stop-loss orders are optimal for investors seeking to limit potential losses by setting a fixed exit price, especially in volatile markets where precise risk control is crucial. Trailing stop orders are ideal for capturing upward price movements by automatically adjusting the stop price as the asset's value increases, maximizing gains while protecting profits. Traders aiming to balance risk management with profit preservation often use trailing stops during trending markets and stop-loss orders in uncertain or sideways markets.

Risks and Limitations of Each Order

Stop-loss orders can trigger a sale at a predetermined price, but they may execute at a lower price during market gaps or high volatility, leading to unexpected losses. Trailing stop orders adjust with market movement, yet sudden price drops can still trigger a sale below the trailing threshold, potentially resulting in premature exits. Both order types lack guaranteed execution prices and may be less effective in highly volatile or illiquid markets, requiring careful consideration of risk tolerance.

Practical Examples: When to Use Each Order

A stop-loss order is ideal for limiting losses on a stock that has dropped below a specific price, such as selling shares if a stock falls to $50 to prevent further loss. A trailing stop order is useful when locking in profits while allowing for potential gains, for example, setting a trailing stop 5% below a rising stock price that moves from $100 to $120, automatically adjusting the stop price upwards. Traders use stop-loss orders to ensure exit points in volatile markets and trailing stops to maximize gains in trending markets without manually adjusting orders.

Choosing the Right Order for Your Investment Strategy

Selecting the right order type depends on your risk tolerance and market outlook. A stop-loss order sets a fixed exit price to limit losses, ideal for conservative investors seeking predefined risk management. Trailing stop orders adjust dynamically with market movements, offering flexibility to lock in profits while allowing for potential upside in trending markets.

Stop-Loss Order vs Trailing Stop Order Infographic

difterm.com

difterm.com